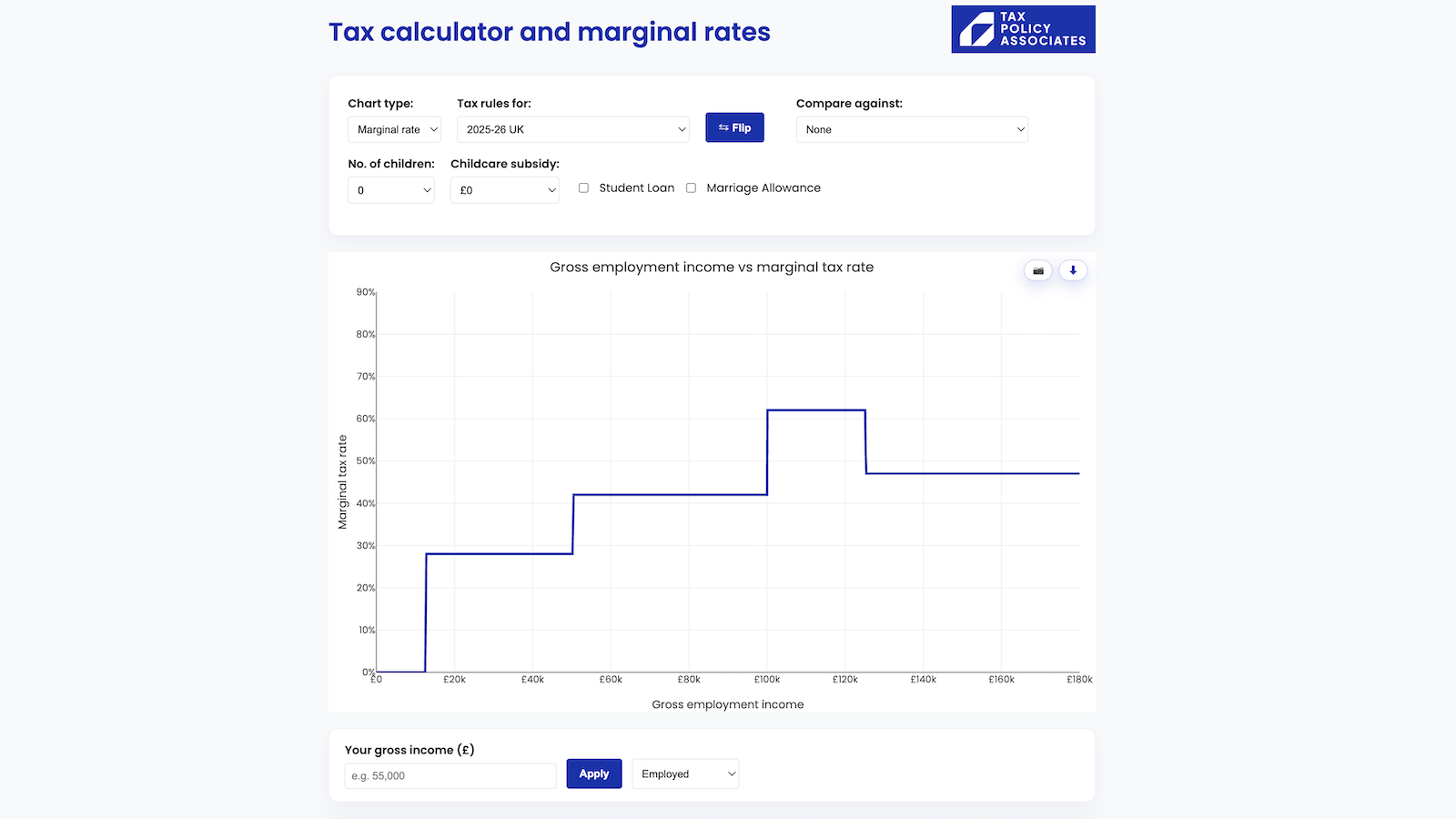

This online calculator calculates your tax on employment, self-employed or partnership income, and shows how it changes under a variety of Budget proposals. It charts the marginal and effective tax rate at all income levels, and shows where you fall on that chart.

Now updated for the actual Budget, with rates for 2026/27 rates and 2027/28 (assuming the only changes are those announced in the Budget to property, savings and dividend rates).

The charts show that teachers, doctors and others earning fairly ordinary salaries can face marginal tax rates of more than 60%, and sometimes approaching 80%. We believe it’s inequitable and holds back growth. Rachel Reeves should commit to ending these anomalies.

This Government was elected on a platform of kickstarting economic growth. It has a large majority, and probably four years until the next election. It’s a rare chance for real pro-growth tax reform. That’s all the more necessary if we are going to see tax rises.

It’s important to note: the point of the tax calculator is not that UK tax rates are currently too high. Overall they are not; they’re low by international standards, and the average worker pays less tax on income than their equivalents in other countries. But there are earning levels at which there are anomalously high rates, and that is damaging.

The tax calculator

You can view the calculator full screen here.

A quick guide:

When it starts up, the chart shows the current UK tax marginal rates at each income point. You can enter your income and see your tax result1, and your position on the chart. You can use the “tax rules” dropdown to select:

- The 2023/24 rates.

- The Scottish current or 2023/24 rates.

- The IFS suggestion to increase income tax by 1p (it’s one of several options, not a proposal as such).

- The Resolution Foundation proposal to “switch” 2p from employee national insurance to income tax

- The Green Party proposal to abolish the national insurance upper earnings limit.

- The proposal to charge employer national insurance on partnership/LLP profits.

- The suggestion that income tax rates will be maintained, but thresholds will be cut (for which we are using figures calculated by Julian Jessop).

The app will then chart the marginal rate at each income point or (if you change the top left dropdown) give you a chart of effective rate at each income point, or net income vs gross income.

You can select a scenario in the “compare against” dropdown, and that scenario will be added to the chart (dashed red line).

The options

You can select options that demonstrate some of the features in our tax system that create anomalously high marginal tax rates:

- You can choose whether you’re employed, self-employed, retired, a contractor paid under “IR35“, or a member of a partnership/LLP.

- Once you increase “number of children” above zero, you see the effect of child benefit.2 This increases the income of anyone with children under 16 (or under 20 if in approved education or training) but, once their income (or that of a cohabiting partner) hits £60k, the “high income child benefit charge” (HICBC) starts to claw child benefit back. It’s completely gone by £80k. That creates a very high marginal tax rate at £60k – 58% for someone with three children, and 67% if they also have a student loan.

- If you add “childcare subsidy” you can model the impact of the tax-free childcare scheme and the various Government free childcare hours schemes in England, Wales and Scotland.3 These schemes are generous – potentially worth £20k in some cases, and we classify that as increasing your income (and therefore reducing your effective tax rate). However the schemes are completely withdrawn if income exceeds £100k (with the exception of the Scottish scheme4). That creates the very odd effect that someone using the schemes becomes worse off if their income exceeds £100k – a marginal tax rate well in excess of 100%.5

- The “student loan” option applies the standard 9% student loan repayment rate (or you can select other rates in the dropdown).6

- The “marriage allowance” option deals with the small element of personal allowance sharing between married couples.

- And anyone earning £100k sees their tax-free personal allowance reduced, by £1 for every £2 of income above £100k. This isn’t an option – it happens automatically. It means the marginal rate at £100k is 62%, falling back to the “correct” amount of 47% once the personal allowance is completely gone at £125,140.

What the marginal rates mean

The “marginal tax rate” is the percentage of tax you’ll pay on the next pound you earn.7 is withdrawn results in nonsensical marginal rates It’s therefore critical because it impacts your incentive to earn that pound. It’s obvious that if 100% is taxed you’ll have a lower incentive than if 0% is taxed; and the.same is true for 70% vs 40%. We’ve written a fuller explanation of the precise meaning of “marginal tax rate”, and why it’s so important.

If you turn on all the “options” you’ll see a series of very high marginal rates across the UK, over 70% in some cases. The rates are even higher in Scotland (the red dashed line):

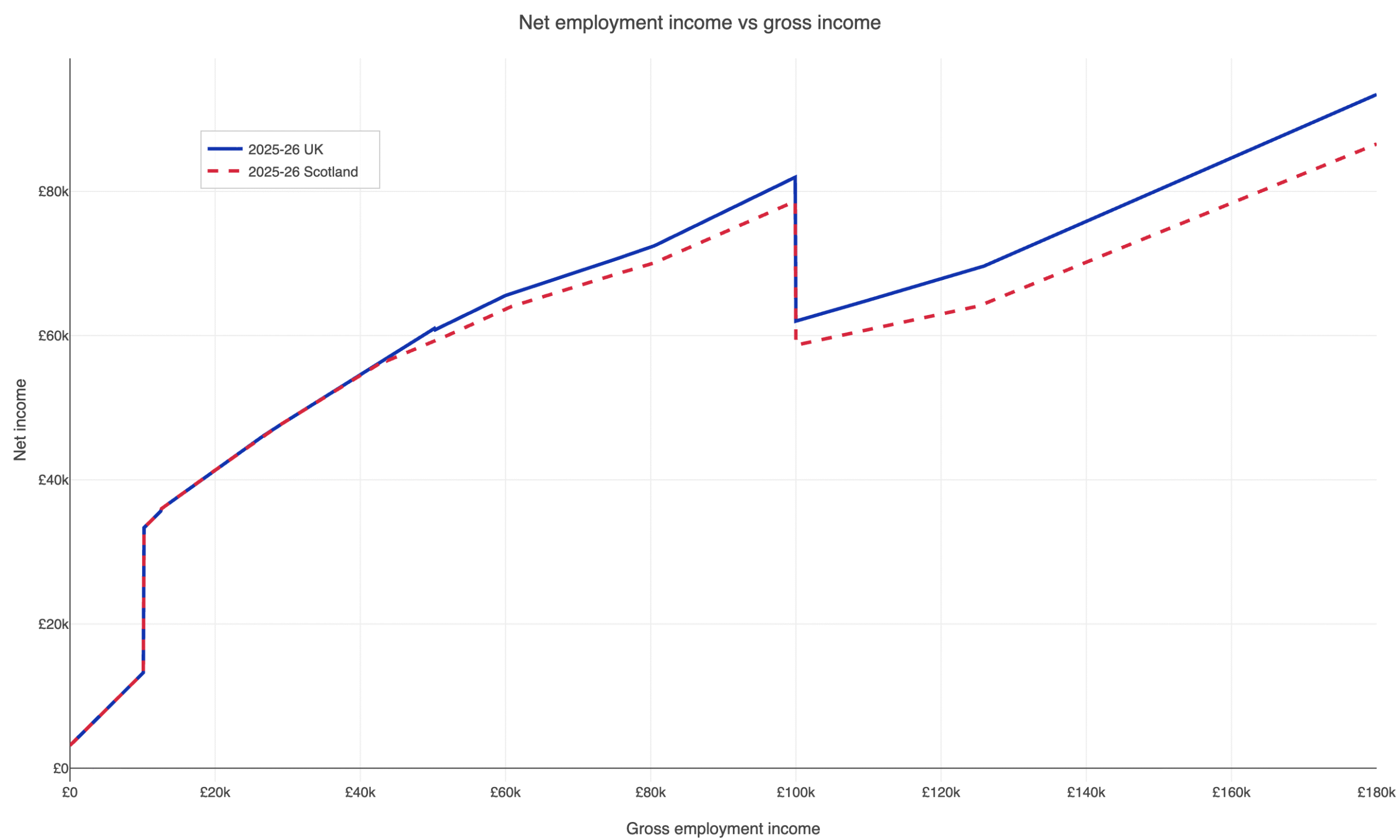

The marginal rate from the marriage allowance and the childcare subsidies is so high that it goes off the above chart. So it’s clearer if we plot net income vs gross income:

The marriage allowance is so small that it’s invisible in this chart (it’s a largely pointless piece of complication). The withdrawal of childcare subsidies, however, completely distorts the picture. When you earn £100k, you immediately lose these. So in this chart, with someone receiving £20k-worth of childcare subsidies, they are suddenly £20k worse off when they earn £100k, and their net income doesn’t recover to where it was until their gross income reaches £152k (or, in Scotland, £170k.8)

There are other minor effects which, for simplicity, our calculator does not cover.9

One issue not covered by the calculator is the high marginal rates impacting working people receiving benefits (other than child benefit). This improved significantly after the introduction of universal credit, but problems remain, particularly around the interaction with child benefit. Benefits are outside our expertise and therefore are not covered by this article or our calculator.

What are the real world effects?

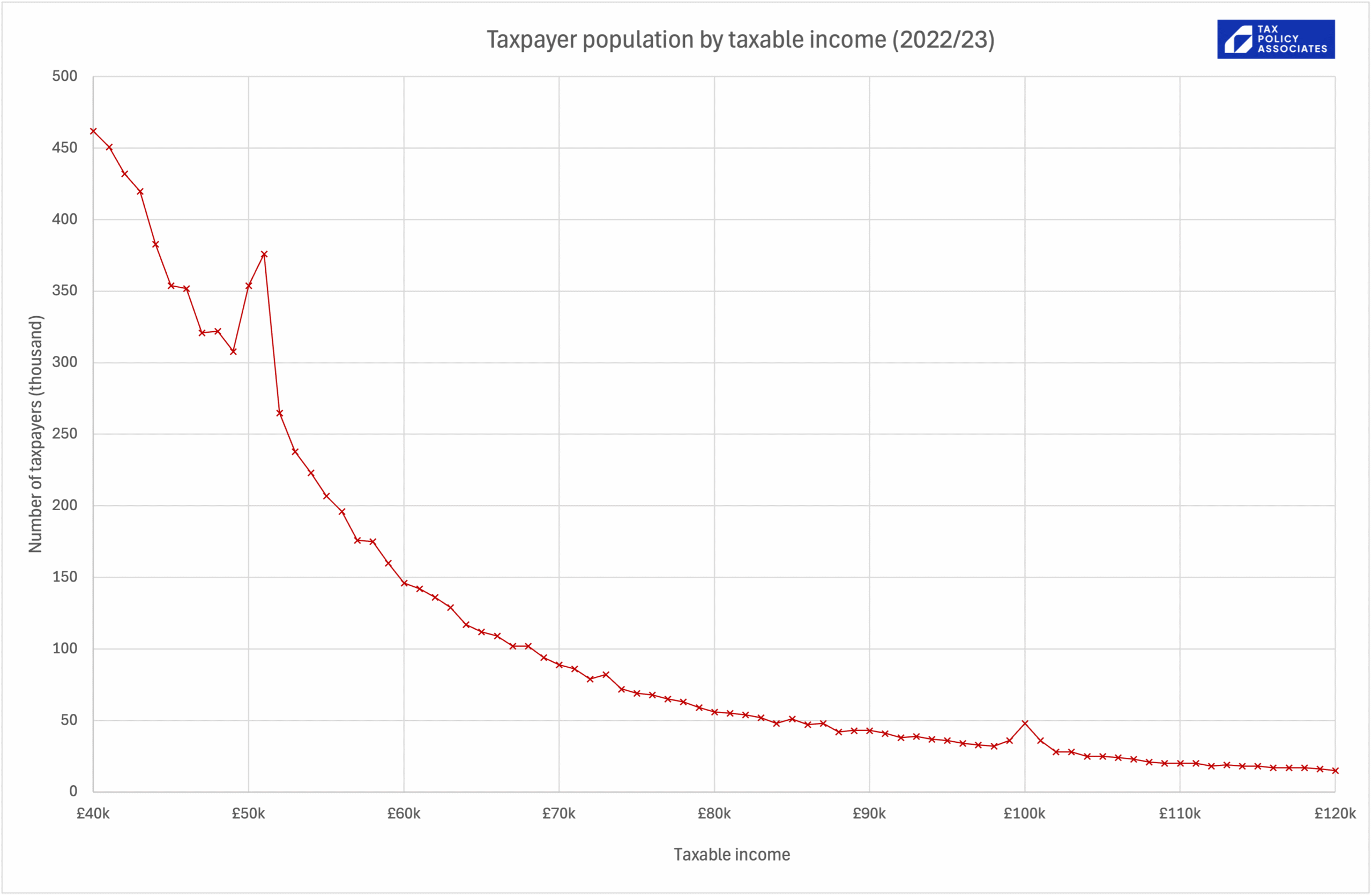

Thanks to a recent series of Freedom of Information Act applications by Tom Whipple at The Times, we can see that large numbers of people take steps to avoid these high marginal rates:

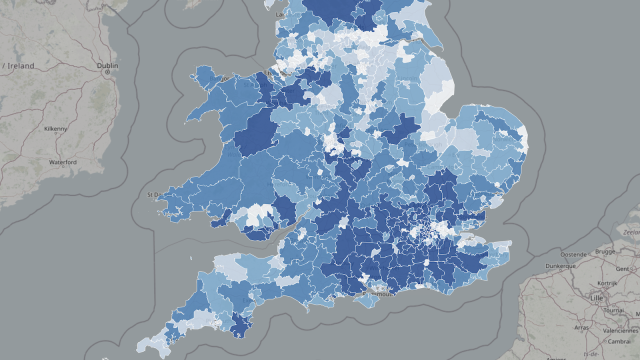

That pronounced “bump” at £100k represents approximately 32,000 taxpayers managing their income so it doesn’t go past £100k. However it’s important to recognise that counting the people in the “bump” gives us a lower bound: there will be others who hold back their income above or below the £100k point, but outside the visible “bump”. There will be others who respond to the incentives by ceasing working altogether or leaving the UK (anecdotally there are large numbers of professionals moving to Dubai; however there’s no hard evidence as to the scale of the effect).

This, however, is nothing compared to the “bump” at £50k – there are 230,000 taxpayers there. Again this is a lower bound.

This is from tax year 2022-23 when the child benefit clawback was at £50k – this will be an important cause of the bump, but we expect there are three others.10

These “bumps” reflect broadly three taxpayers responses:

- No change in economic activity (i.e. working hours) but taking steps to legally reduce taxable income. The most obvious example is making additional pension contributions and/or salary sacrifice. Additional pension contributions are an attractive option to people nearing retirement, but unattractive for people at the start of their careers.

- No change in economic activity but tax evasion – i.e. self-employed people artificially depressing their income by not declaring income over £50k to HMRC.11

- Actually reducing their income – for example self-employed contractors turning away work, or employed staff working fewer hours (or even, in at least three cases we’ve heard of, refusing promotions).

Both outcomes reduce the tax people are paying. However the second outcome has an obvious wider effect – it’s reducing the supply of labour.

We’ve heard anecdotally from managers unable to persuade staff to work more hours, or return to work full time – it’s a particular problem for hospital managers, as junior consultants’ pay is within the £100k “trap”.

But it’s important not to just focus on the impact on jobs that we might think are of particular societal importance.

It’s also problematic if an accountant or estate agent turns away work because of high marginal rates – it represents lost economic growth and lost tax revenue.12 It also makes people miserable.

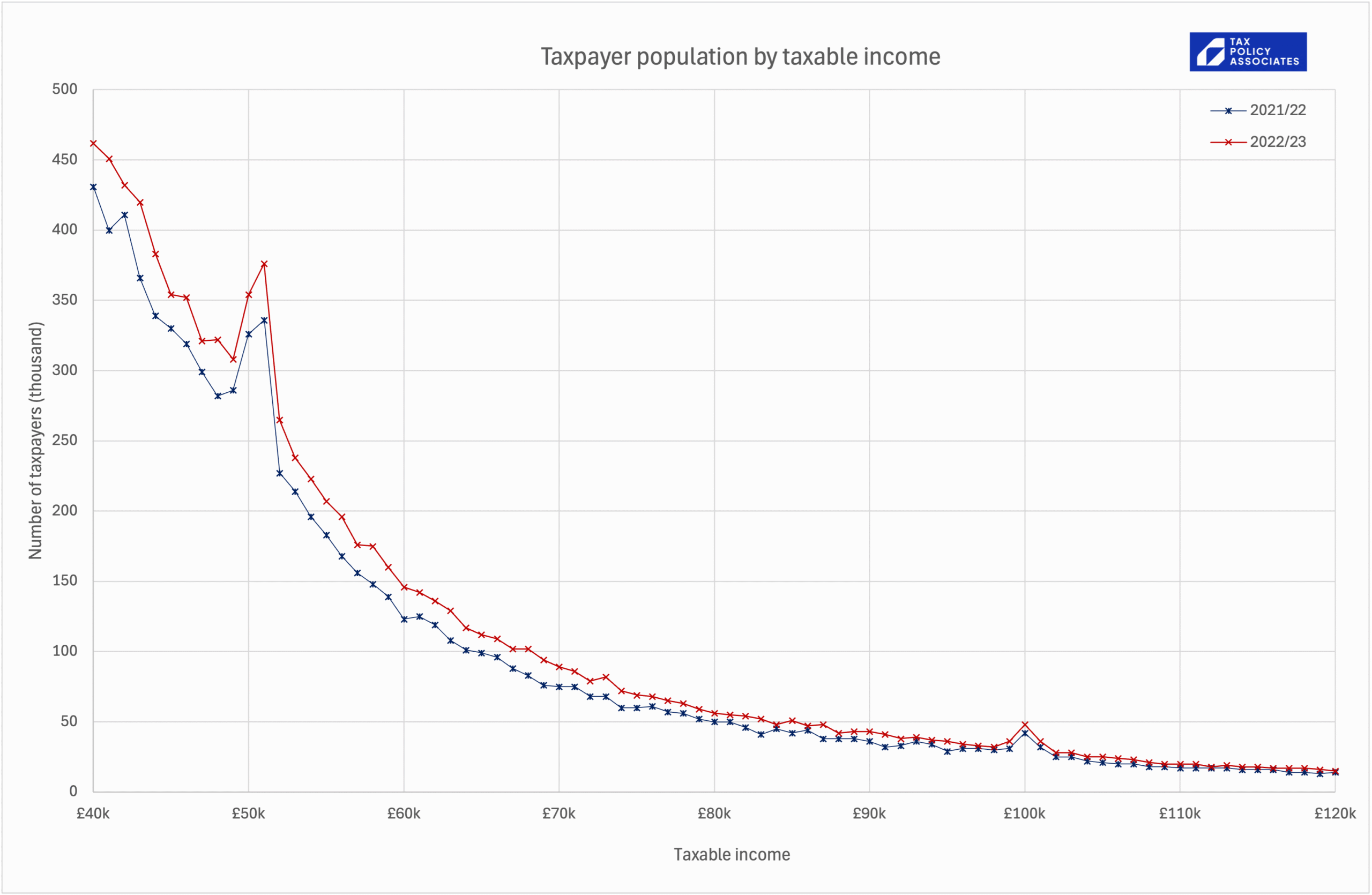

Inflation and frozen thresholds mean the problem is getting worse each year – the data The Times obtained shows much larger “bumps” in 2022/23 compared to 2021/22. So 2025/26 will be considerably worse:

What’s the solution?

These problems are getting worse over time, as fiscal drag takes more and more people into the thresholds that trigger these high marginal rates.

When Gordon Brown introduced the personal allowance taper in 2009, only 2% of taxpayers earned £100,000; by 2026/27 about 6% of taxpayers will. When George Osborne introduced child benefit clawback a year later, only 8% of taxpayers earned £50,000; by 2026/27 about 17% of taxpayers will earn £60,000.13

This creates a double problem. First, the economic distortions created by the high marginal rates start to impact into mainstream occupations (doctors, teachers). Second, the revenues raised by the marginal rates are now so great that they become hard to repeal.

Ending the high marginal rates in one Budget is, therefore, not realistic – particularly in the current fiscal environment. The cost of making child benefit, the personal allowance, and childcare subsidies universal, would be expensive (somewhere between £5-10bn, depending on your assumptions). The obvious way of funding this – increasing income tax on high earners, appears to have been ruled out.

We would suggest five modest steps:

- An acknowledgment that the top marginal rates are damagingly high, and that the Government will take steps to reduce them when economic circumstances permit.

- Some immediate easing of the worst effects, at minimal cost to the Exchequer, for example by smoothing out the personal allowance taper over a longer stretch of income, therefore reducing the top marginal rate, and slightly increasing the additional rate so that the measure is revenue-neutral overall.

- A commitment to uprate the thresholds for clawback of child benefit, personal allowance and childcare subsidy in line with earnings growth or inflation.

- A commitment that no steps will be taken to make the high marginal rates worse, or create new ones.

- A new rule that Budgets will be accompanied by an OBR scoring of the highest income tax marginal rates before and after the Budget.

There’s a coherent political case for people on high incomes paying higher tax (whether we agree with it or not). There is no coherent case for people earning £60k, or £100k, to pay a higher marginal rate than someone earning £1m. It’s inequitable and economically damaging. Ms Reeves should call time on high marginal rates.

Code

The code for the calculator is available here. If you want to experiment with different rates you can download all the files and run “index.html” locally. You can then edit “UK_marginal_tax_datasets.json” and add different scenarios.

The data showing the “bumps” is available here. Many thanks to The Times for sharing it with us, and letting us publish it.

Footnotes

Please note that the calculator is intended to illustrate tax policy. It is not designed to actually calculate your tax for your tax return, and should not be used for that purpose. ↩︎

Note there is no limit on how many children you can have for child benefit purposes – and that produces some extremely high marginal rates if you select e.g. six children. ↩︎

The way the childcare free hours schemes work is complex and varies considerably from individual-to-individual – the calculator doesn’t attempt to provide a detailed analysis but simply lets you enter the amount of overall subsidy. ↩︎

Which provides up to 1140 hours of free childcare. This isn’t means-tested. However the tax-free childcare scheme is means tested, even in Scotland. ↩︎

It can be expressed as 2,000,000% if we look at the loss of income for someone with £20k of free childcare who was earning £100k but receives a £1 pay rise. However in reality the concept of a marginal tax rate has little meaning in such circumstances. ↩︎

Noting of course that Scottish students don’t have to pay tuition when studying at Scottish universities, so their student loans will be much lower. The full rate is really only relevant to graduates who studied elsewhere in the UK and then move to Scotland. ↩︎

The calculator calculates your marginal rate over £100 rather than £1. That’s necessary because the personal allowance taper reduces the personal allowance by £1 for every £2 of income over £100k. If the marginal rate is calculated over £1 then it produces a different result for even numbers than odd numbers, which doesn’t make sense. The choice of £100 is arbitrary, but has no effect other than to change the (essentially meaningless) childcare subsidy marginal rate. ↩︎

Although the Scottish childcare scheme is less generous and so this problem is usually less extreme in Scotland. ↩︎

The £1,000 personal savings allowance drops to £500 once you hit the higher rate band, and to zero once you hit the additional rate band. The £5,000 starting rate for savings tapers out, but slowly, and so it just somewhat increases the marginal rate – it’s also less relevant for most people. ↩︎

First, people responding to the increased marginal rate of the higher rate tax band – but this effect should be small (when the marginal rate rises from 28% to 42% that means take-home pay on the next pound is reducing by about 20%). Second, people irrationally responding to the higher rate band – we found evidence that a large number of people believe that when you cross the higher rate threshold, you pay a higher rate of tax on all your income. Third, owners of small/micro businesses whose income fluctuates year-by-year managing the profits they take out so they don’t cross the higher rate threshold. It should be possible to definitively establish the impact of child benefit clawback when we obtain data on 2024/25, the first year when the child benefit clawback threshold was moved to £60k. ↩︎

It ought to be possible to check the extent of this by comparing the data for taxpayers on PAYE with other taxpayers, i.e. because tax evasion is not generally practicable for people on PAYE. A more sophisticated analysis🔒 would look at the way reported taxable income changes over time, as the income increases and as it decreases. ↩︎

Particularly when the economy is running at very little spare capacity; it would be different if there was high unemployment/plenty of spare capacity, because the work that was turned away would (at least in theory, in the long term) be undertaken by others ↩︎

Data from the HMRC percentile stats, uprated for post-2022 inflation. ↩︎

Leave a Reply