Law firm Axiom Ince failed in October 2023, with £64m of client money missing – losses ultimately covered by the solicitors’ profession. How could the auditors have failed to notice £64m of missing money? The answer is that the company broke the law, and filed unaudited accounts.

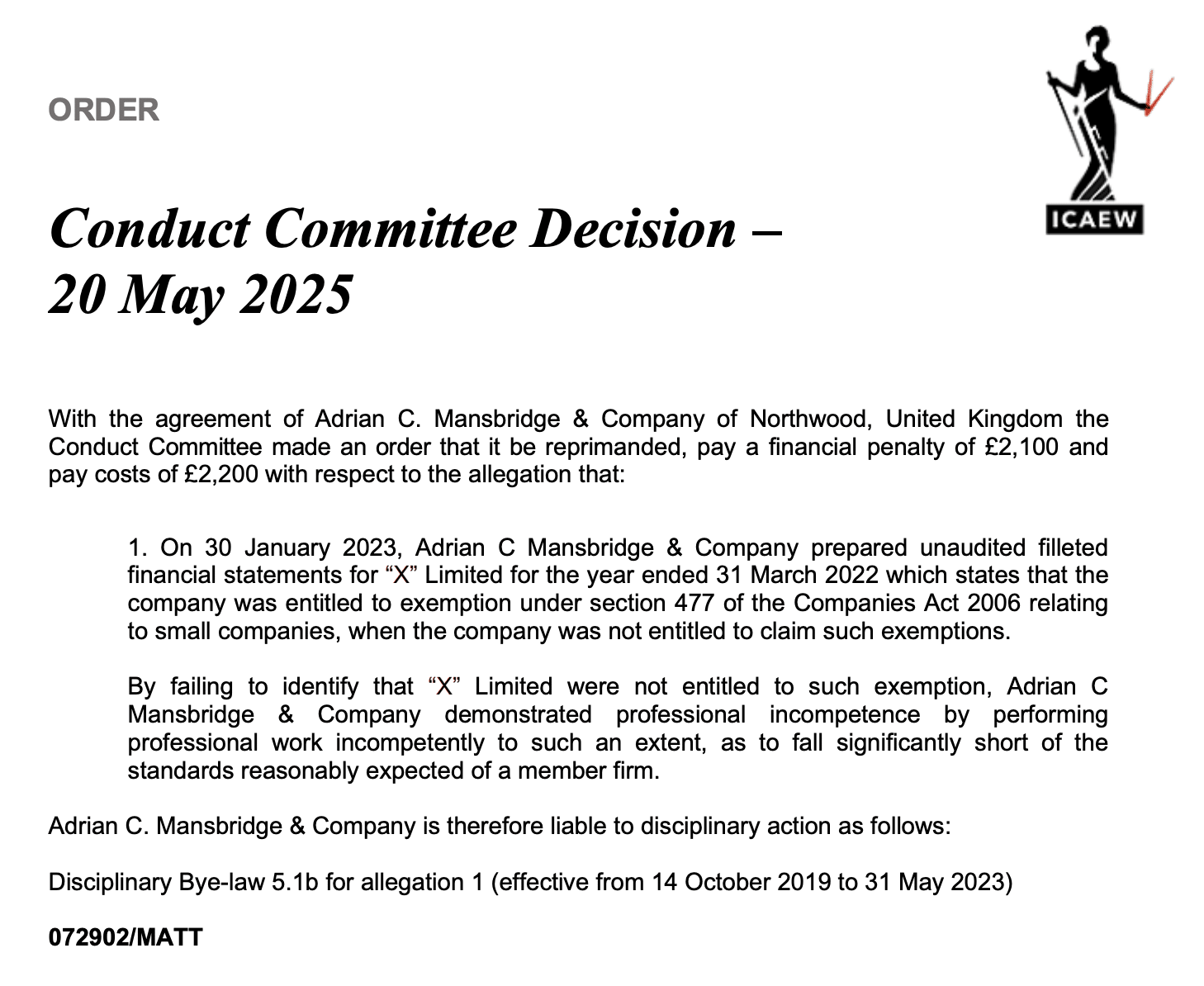

Axiom Ince’s accountants, Adrian C Mansbridge & Co, somehow failed to notice this, and signed off on unaudited accounts. The Institute of Chartered Accountants in England & Wales (ICAEW) described this as “professional incompetence” – and that incompetence will have delayed the moment of reckoning for Axiom Ince, and so increased its losses. The only consequence for Adrian C Mansbridge & Co has been a £4,300 disciplinary penalty.

It’s a double failure of professional regulation. The SRA didn’t spot that a law firm they were already investigating had failed to file audited accounts. The ICAEW gave a “slap on the wrist” for behaviour that realistically merited a suspension or expulsion.

Axiom Ince

Axiom Ince grew rapidly from a series of acquisitions. When the Solicitors Regulation Authority intervened to shut it down, 1,400 people lost their jobs. However, it soon became apparent that this wasn’t a normal law firm failure – £64m of client money was missing. Five men have been charged by the Serious Fraud Office. The Legal Services Board published a report in May identifying a series of failures by the Solicitors Regulation Authority.

The cost of refunding Axion Ince’s clients falls on the SRA Compensation Fund (which is funded by the solicitors’ profession, and compensates clients owed money by a regulated law firm).

There is an excellent timeline of events in this article in Law Society Gazette.

Adrian C Mansbridge & Co and the accounts

Axiom Ince’s accountants were Adrian C Mansbridge & Co1, a firm of chartered accountants and registered auditors, regulated by the ICAEW and ACCA. Adrian C Mansbridge himself2 is not an obscure figure – in 2018 he was chairman of the London Society of Chartered Accountants’ taxation committee.

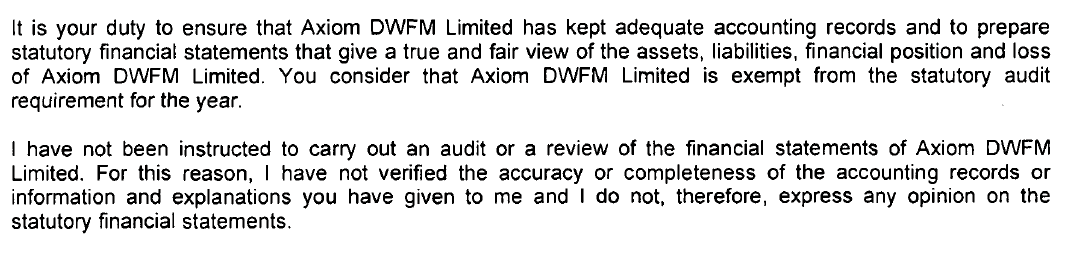

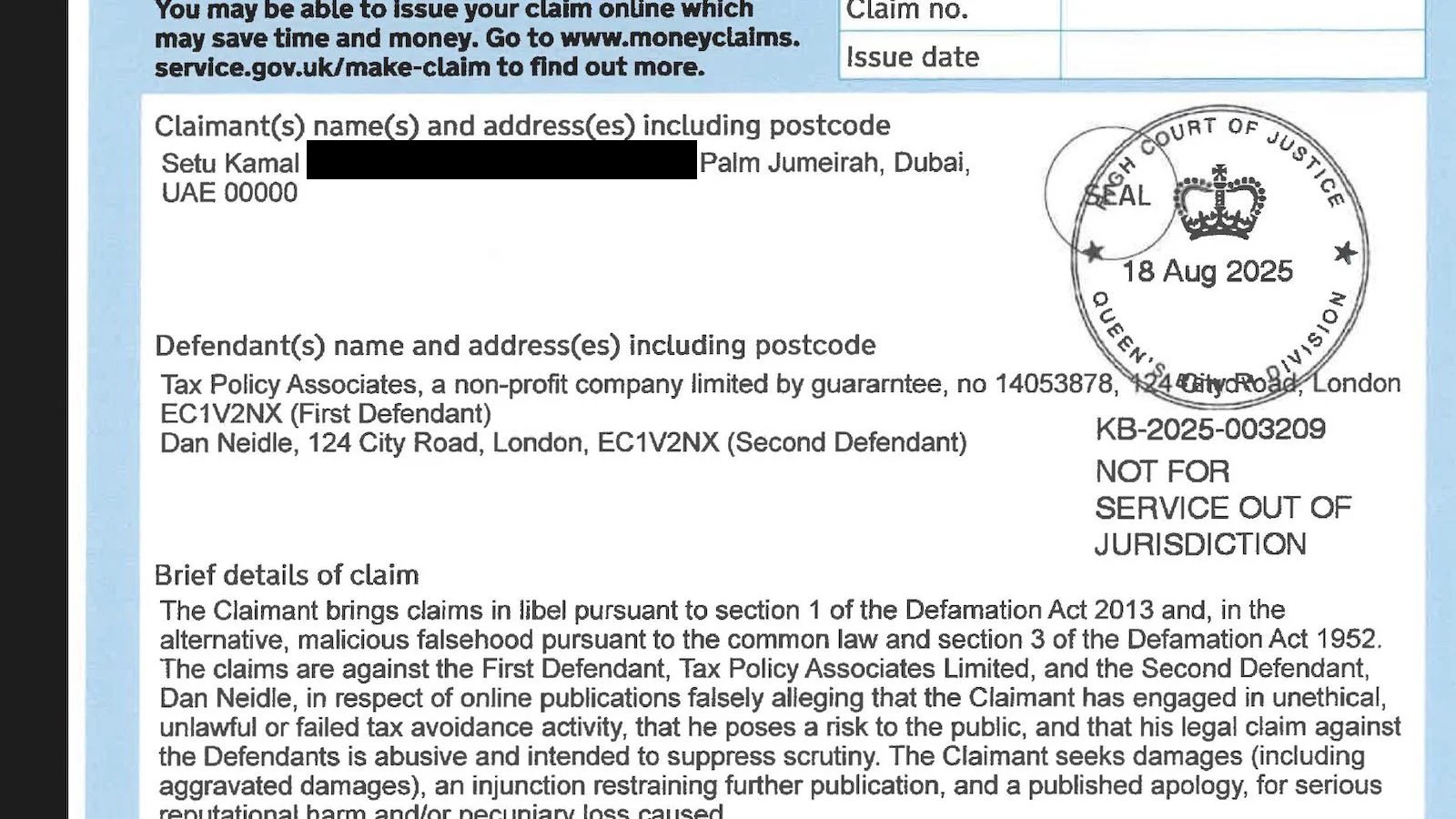

Here’s Axiom Ince’s last set of accounts, filed with Companies House on 7 February 2023:

The company was at that point called Axiom DWFM Limited; it changed its name to Axiom Ince Ltd the following year

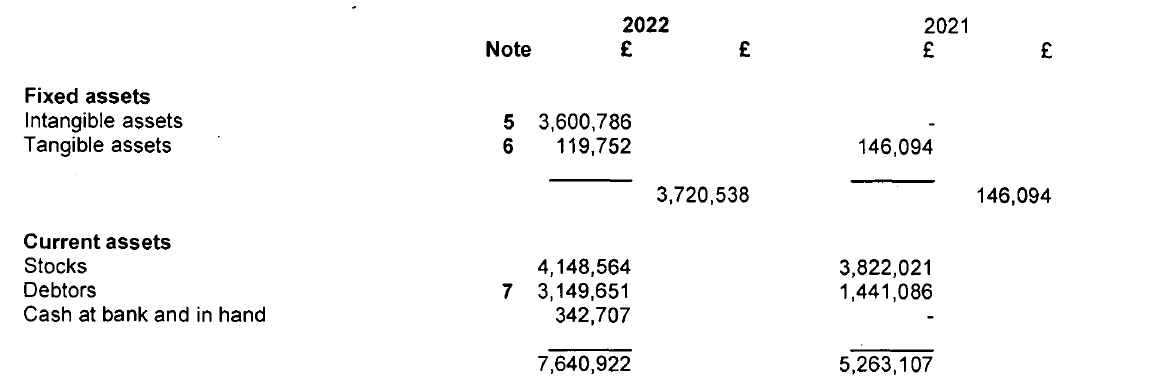

Here’s the key part of the accountants’ report:

Small company audit exemption

Small companies are exempt from audit. The rules at the time said that a company would be small if it satisfied two of these requirements:

- Turnover not more than £10.2m

- Balance sheet not more than £5.1m

- Employees not more than 50.

There is a one year grace period – so a company will only cease to be “small” after two successive years of failing to satisfy the requirements.

Was Axiom Ince a small company?

Axiom Ince’s 2022 accounts showed its total balance sheet assets for 2022 and 2021 :

£5.4m in 2021 and £11.3m in 2022 – so the balance sheet requirement was failed for two successive years.

The accounts also stated the number of employees:

The employee requirement was failed for two successive years.

So the company wasn’t small and the accounts should have been audited. It is surely inconceivable Adrian C Mansbridge & Co was involved in any fraud, but we cannot understand how an experienced accountant could have made such a basic error.

The mistake was very significant because, if an audit had been carried out for the 2022 accounts, it is plausible that the fraud would have been spotted, and the £64m losses to the SRA and the solicitors’ profession limited.

A missed opportunity by the SRA

The SRA were already investigating Axiom Ince in early 2023. That investigation included a forensic investigation of the firm’s accounts3 but it seems there was no check of the firm’s statutory accounts.

The SRA therefore didn’t identify that the firm had failed to file audited accounts – a red flag that would have justified immediate action. Instead, Axiom Ince was permitted to remain in business until October 2023.

The Legal Services Board’s report into Axiom Ince’s failure, written by Carson McDowell, is very critical of the SRA’s investigation, and in particular of the SRA’s insufficiently thorough checks of the firm’s accounts in early 2023. However the report does not mention the SRA’s failure to identify the lack of audited accounts. We infer that Carson McDowell missed this point.

The consequence for Adrian C Mansbridge & Co

At some point, the Institute of Chartered Accountants in England and Wales became aware of the error, and pursued disciplinary proceedings against Adrian Mansbridge & Co.

The result:

This outcome is surprising for two reasons:

First, the company is not named (although we are confident it is Axiom Ince4). The ICAEW’s usual policy is that third parties involved in disciplinary matters should not be named, for their own protection. In this case that makes no sense: Axiom Ince has ceased to exist, and the many affected stakeholders have a strong public interest in knowing what happened. No public interest was served in anonymising this case.

Second, the penalty is extraordinary. The ICAEW finds that Adrian Mansbridge demonstrated “professional incompetence”. The result was that Axiom Ince continued to misapply client funds for another ten months. Yet the only consequence was a reprimand and penalty/costs of £4,300. That seems disproportionately lax. The ICAEW’s own sanctions guidance says that “audit work of a seriously defective nature” should trigger a £20,000 penalty. Failure to identify that an audit is required seems “seriously defective” to us. Indeed financial sanctions seem inadequate; suspension or expulsion seem more appropriate.

We have to wonder if the ICAEW’s Conduct Committee was aware of the wider context around Axiom Ince, or just saw this as a technical breach with no material consequences.

The response from the firms and regulators

Adrian Mansbridge & Co did not reply to two requests for comment.

The ICAEW said they couldn’t comment on a specific case, but that it’s their standard policy to anonymise the names of all third parties.

We asked the SRA, the LSB and Carson McDowell if they were aware that Axiom Ince had unlawfully failed to file audited accounts; they each told us they were unable to comment.

The consequences

It may be that there is potential for the SRA Compensation Fund to recover some of its losses from Adrian Mansbridge & Co’s insurers (although we haven’t analysed the prospects for such a claim).5

The ICAEW should review its disciplinary processes. The way it’s applying its anonymity policy does not make sense, and there is something seriously wrong with the penalty applied in this case.

And Companies House should have automated measures in place to detect companies which unlawfully fail to file audited accounts. We’ll be reporting more on this soon.

Thanks to our researcher K, who found the ICAEW disciplinary decision.

Footnotes

Note that the firm appears to be a trading name of Adrian C Mansbridge himself. Whilst there is a company – Adrian C Mansbridge & Co, Ltd – it is dormant. ↩︎

Not to be confused with the solicitor Adrian Mansbridge. ↩︎

See paragraph 93 onwards of the Legal Services Board’s report, starting at the bottom of page 19. ↩︎

We found the decision by searching against Adrian Mansbridge’s name. The accountant’s report date and balance sheet date match Axiom Ince. The ICAEW would not comment on specifics but did not deny that the reprimand refers to Axiom Ince. Adrian Mansbridge did not reply to our request for comment. ↩︎

The SRA has already taken action against the former owner of Axiom Ince to recover some of its cost, but as far as we are aware no action has been taken against Adrian Mansbridge & Co. ↩︎

Leave a Reply to Acc member FCCA Cancel reply