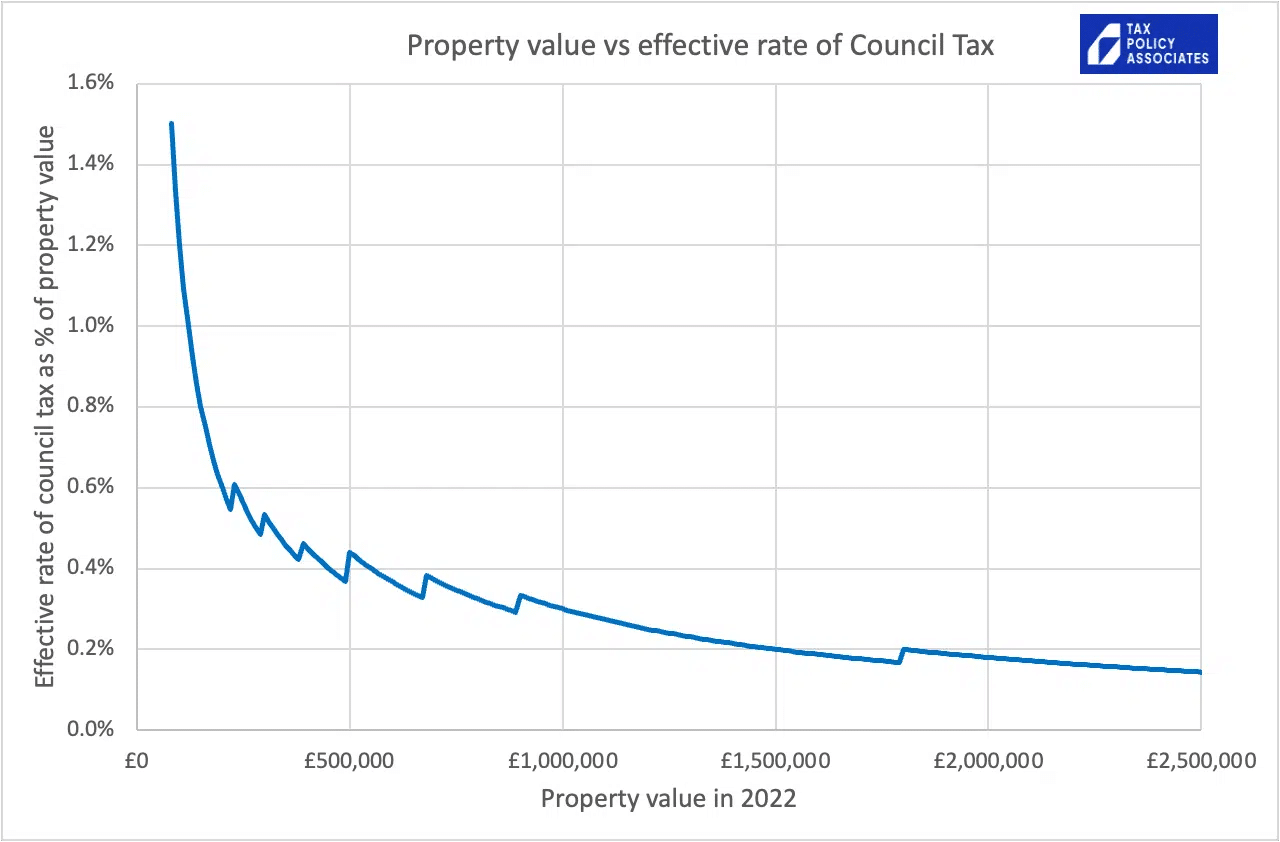

The Government needs money. Council tax is regressive – high-value properties pay a trifling sum in comparison with their value. It must be tempting for Rachel Reeves to solve both problems in one go by raising council tax on high-value properties.

We’ve created an interactive calculator that shows how this could be done, and how much could be raised.

How council tax could be raised

Council tax only slightly varies with the value of properties:

This is because of the way council tax is charged in bands, by reference to 1991 valuations. The middle band, D, is properties worth between £68,001 and £88,000 (in 1991 money). The top band, H, is properties worth more than £320,000 in 1991 (about £1.5m today). By law, band H properties are charged only twice as much council tax as band D properties. The IFS has described all this as “out of date and arbitrary” and said council tax is “ripe for reform”.

So an obvious fix is to split band H into four bands, H1, H2, H3 and H4, with H1 retaining the 2x multiplier that band H currently has, and the others having higher multipliers.

Or something more radical: a proportional property tax could be charged on properties in bands H2, H3 and H4, as a percentage of property value (but only on the value in those bands, so no “cliff-edges”).

How much could be raised?

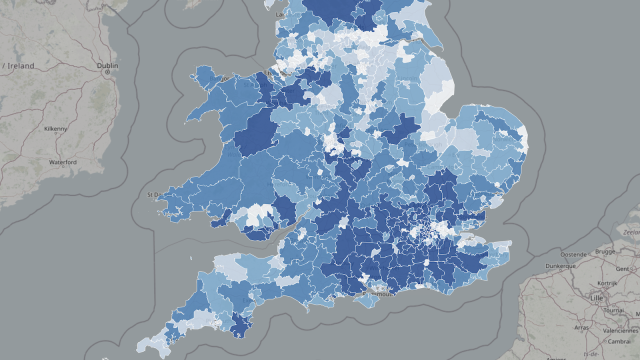

The calculator below lets you experiment with either new multipliers or a percentage tax for high value properties. It shows how much revenue the change would raise across England, and the average council tax bills it would generate.

We split band H in four, and the slider at the top lets you position each of the new bands. Then you can choose between a “multiplier” tax and a “percentage tax” – and the revenue consequence is displayed at the bottom. You can also see the average bill someone in each band will pay (on mobile you have to click the “info” icon for that).

You’ll see that adding a few more bands doesn’t raise much money. For example, a new 3x band at £2m, 4x band at £4m, and 6x band at £8m only raises £270m. Owners of £8m+ properties pay an additional £9,000 of tax each year.

Creating a new percentage tax on top of existing council tax, on the other hand, raises more significant amounts. A flat 0.5% annual tax on all property value above £2m raises about £1bn, with owners of £8m+ properties paying an average of £90,000 more tax each year.

Or make it progressive: 0.5% from £2m to £4m, 0.7% from £4m to £8m and 1.1% for £8m+, and we raise about £1.5bn. Owners of £8m+ properties now pay £120,000 more tax each year.

These figures are just for England; if applied across the whole of the UK, expect overall revenues to be 5-10% higher. And the various approximations and assumptions in our approach mean the real-world revenues would likely be somewhat higher (see the methodology section below).

The obvious conclusion: there is potential for the Government to raise a useful amount of additional tax by taxing high value properties, but the amounts are limited.

Does extending council tax make sense?

The obvious reason to do this is that Government needs to raise tax. Raising it from people who can likely afford it, on property which is currently under-taxed, makes some sense.

There is also an equally obvious moral case for making annual tax on property more progressive. A £100m property in Mayfair currently pays less tax than a terraced house in Bolton. A fairer tax on property feels the right thing to do.

There’s a relatively small economic benefit: an annual tax creates an incentive to use/develop property that may currently be very under-used or even derelict.

There are, however, also some obvious problems:

- A percentage property tax would require somewhat regular valuations. Valuing the c4,500 properties over £10m is relatively straightforward. Valuing all the c80,000 properties over £2m is more difficult, and would require considerable resource (and take time to create). The council tax banding system was designed to avoid such difficulties.

- There will be some people in very valuable properties who don’t have enough income to comfortably afford the new tax – “asset rich, cash poor”. This is often overplayed: someone owning a £3m house usually has numerous ways to raise funds. However any new tax could include a deferral option (e.g., paying the tax as a lien on the property upon sale or death). These kinds of mechanisms are common in other countries with annual property taxes.

- The biggest problem: the tax will be capitalised into property values. The day after the tax is announced, the value of e.g. a £10m property facing (say) an annual £50k bill will fall – in principle by somewhere around £600,000.1 So someone buying the property a week later isn’t really paying the new tax – it’s paid by the person owning the property at the point of announcement (because they’re getting a lower purchase price). In the real world things tend to be not quite so tidy, but there is nevertheless an unfairness that most of the economic burden will fall on current owners – it’s like a one-off property wealth tax. There is no way to solve this problem – land tax proponents often regard it as a form of rough justice. Others may be less sanguine.

- So we can expect some people will sell to escape the tax; but that will be mostly a one-off effect, as new buyers economically are much less exposed.

- Unlike a proper land value tax, a percentage property tax somewhat disincentivises improving properties. Once you’re into the range of (say) a 0.5% property tax, then every £100k you spend improving the property triggers an additional £500 of property tax each year – in principle reducing the value of the property by about £6,000. So you’re paying £100k but receiving a net benefit of £94,000.

- Some would add another disadvantage: if (as would be wise) a percentage tax is charged on the landowner, landlords would simply pass on any additional tax to tenants. That’s widely believed, but mostly not correct: rents are primarily determined by location value and demand, not by the landlord’s costs. More tricky would be an increase in council tax multipliers; the bill would go to tenants. In the medium term rents should adjust so that most of the cost is borne by landlords, but in the short term it would be a tax on tenants in high value properties.

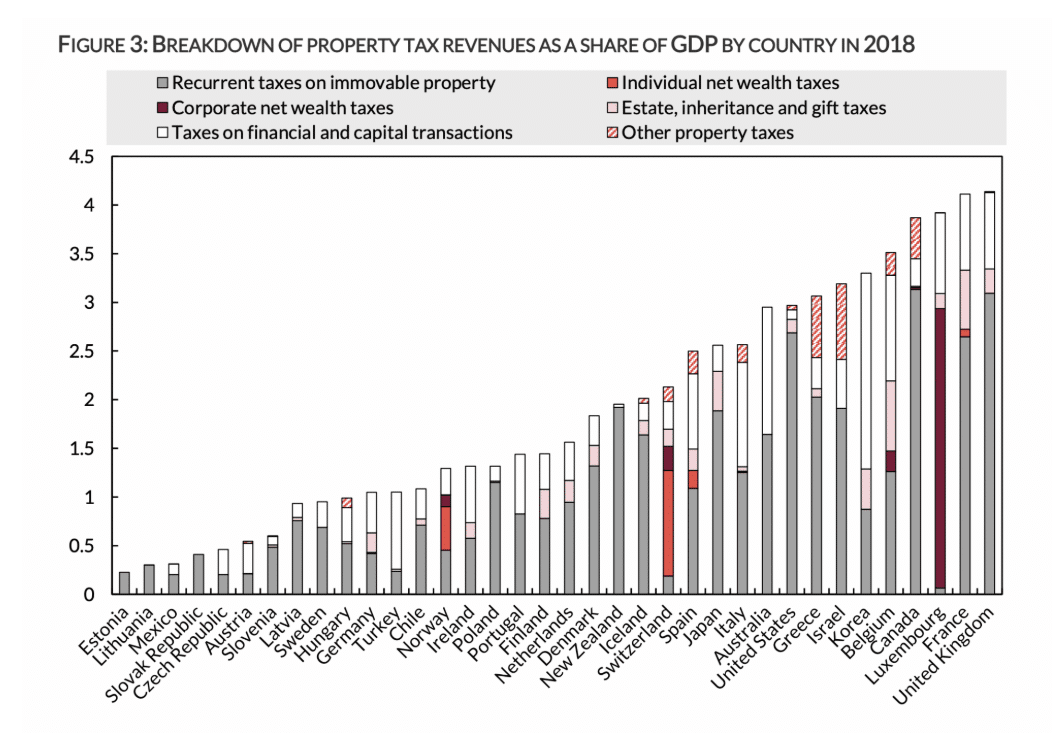

If we look at all taxation of wealth and property, the UK has higher tax as a percentage of GDP than any other OECD country:2

The reason is simple: council tax (it’s most of that grey bar – a “recurrent tax on immovable property”). And that’s council tax paid by most people, not council tax paid by the very wealthy. We under-tax high value property ownership compared to most of the world, at the same time as we overtax purchases.

My view is that there is a strong case for adding more multiplier-based council tax bands. I’m less convinced that a percentage tax makes sense given the administrative/valuation issues and the horizontal equity problem.

The balance changes once we’re looking at wholesale reform: replacing all of council tax, business rates and stamp duty with land value tax. The boost that such a reform would give to growth and homebuilding in my view more than counters the downsides. But bolting on a miniature version of such a tax as a pure revenue-raiser looks less attractive.

Methodology

The calculator works as follows:

- First, it estimates the number of properties in a given band. We weren’t able to find any reliable data on the number of high-value properties in the UK, so we estimate this using three data sources:

- The council tax data shows 154,000 properties in Band H, which (on average) means they’re worth about £1.5m today. We use £1.5m as our starting point for the new bands, and 154,000 as the “true” figure for the population of £1.5m+ properties.

- HMRC stamp duty statistics give us figures for the number of residential property transactions in six bands above £1.5m – the highest is £10m+. We use this to estimate the number of properties in England between any two values, interpolating for values below £10m and using a Pareto distribution above that. We then cap the top-end estimate, fixing the most valuable residential property in the UK at £210m (the reported value of the UK’s most expensive property).

- Some property is held in UK or foreign companies or trusts. It isn’t normally sold, and so doesn’t appear in stamp duty returns. But such properties have to pay an annual tax, ATED, and data on such “enveloped” properties is published by HMRC, in bands up to £20m. We use this data to estimate the number of properties; again interpolating when within the published bands, and using a Pareto distribution beyond that. We add the output of this estimate to the stamp duty estimate (it increases the result by 5-10%).

- When in “multiplier” mode, we apply council tax discounts (e.g. single person) and premiums (e.g. second homes) using the current data for band H. We don’t discount/premium when in the percentage mode.

This is all very approximate:

- Our assumption that annual stamp duty statistics are representative of the housing stock is clearly wrong. A flow is not always representative of a stock. Some very large estates are rarely if ever sold (think “old money”). We will therefore likely be under-counting very valuable properties, and therefore potential revenue, but we weren’t able to quantify this effect.

- There will be some double-counting (likely limited) between the ATED and stamp duty datasets, e.g. where a property paid ATED in 2023/24 and was sold that same year.

- Our analysis is for England only, but 1% of the ATED properties are in Scotland – this creates a small over-statement of our estimate. We didn’t just deduct 1% from the ATED estimates, because we expect that the Scottish properties are lower in value, and that would therefore potentially add more error than it removes.

- We apply band H data for discounts and premiums across all four of our new bands H1 to H4. It is plausible that the most valuable properties are less likely to qualify for discounts (e.g. single owners) and more likely to have premiums (e.g. second homes). Again this suggests we may be under-counting revenue.

- We assume that all properties have risen in value to 495% of their 1991 valuations. This likely over-values properties outside London and under-values property in London. It may therefore mean we significantly under-estimate values, and therefore potential revenue, at the top end. A more sophisticated analysis could account for this to some extent.

- We apply tax to the bands at the band averages; slice integration would have been more accurate – but only very marginally changed the results, and that didn’t justify the added complexity.

The code is available on our GitHub here.

Photo by Jakub Żerdzicki on Unsplash

Thanks to C for help with the modelling.

Footnotes

i.e. that’s the NPV of the stream of payments, assuming an 8% discount rate and ignoring inflation/house price rises. ↩︎

This is from the Wealth Tax Commission report – the data is a little old but it’s unlikely the overall picture has changed. ↩︎

Leave a Reply