A firm called Arka Wealth have widely promoted a tax scheme which they claim avoids all corporate tax, income tax, capital gains tax and inheritance tax – not just in the UK but across Europe. They work with a barrister called Setu Kamal, who they say is “one of Europe’s leading tax barristers”.

Arka Wealth’s claims on TikTok and elsewhere are nonsense. Mr Kamal’s arguments have been repeatedly rejected by the courts. In our view, anyone using the scheme will fail to save tax and instead incur large up-front tax liabilities. Nobody should be going near this scheme, and nobody should hire unqualified and unregulated firms like Arka Wealth and their related company Benedictus Global.

We believe closing down schemes like this should be a policy imperative, to protect the public purse – but also to protect the public from buying hopeless tax schemes.

We make specific policy proposals at the end of this report:

- The law should change to make life much more difficult for the promoters profiting from the schemes. That means imposing personal civil liability and – in some cases – criminal liability.

- The schemes are enabled by a small number of barristers. Chartered accountants, chartered tax advisers and solicitors are prohibited from facilitating abusive tax avoidance schemes. Barristers are not. The Bar Standards Board should bring the Bar in line with the ethical standards of the rest of the legal profession.

Arka Wealth’s promises

Here’s one of the almost 200 videos promoting the scheme (originally found on TikTok:1

The scheme is explained in more detail on their website2 and in this webinar (with a transcript3 here).

The idea is:

- Your company transfers all its intellectual property to a Cyprus trust.

- When your company trades, it’s using the trust’s intellectual property, so it pays over the company’s profits over to the trust.

- Your company is therefore “broke on paper” and has no taxable profits. You are, they claim, now “working for your trust⚠️“.

- Or you can put other assets – your house, cryptocurrency, etc – into the trust, leaving you personally “broke on paper”.

- When you want to purchase a sizeable asset (house, car, etc) the trust buys it for you and lets you use it.

- For everyday living expenses you take a loan or investment from the trust.

- The trust is then exempt from all tax, and you and your company don’t own anything, so aren’t taxed.

They promise 0% corporation tax, income tax, capital gains tax and inheritance tax.4 And they say their legal protection acts as an insurance policy, so you are fully legally protected.

The webinar makes a succession of other outlandish claims – including that Angela Merkel has an offshore trust5

The structure is widely promoted across social media: LinkedIn, Facebook, YouTube and Instagram, as well as TikTok (where they have made an impact, and have over 220,000 followers).

The UK tax reality

We discussed the structure with our usual panel of experts, and several other leading tax lawyers. The immediate response of James Quarmby, one of the UK’s leading private client tax and trusts lawyers, was: “it’s nuts”. A tax KC with expertise in trusts taxation told us that the claims made were “legally illiterate”. Another senior tax/trusts barrister told us simply: “it stinks”.

It’s hard to know where to start, but here’s our incomplete list of the technical problems with the structure:

- There are rules requiring people selling tax tax avoidance schemes to disclose them to HMRC. We understand this scheme wasn’t disclosed. Arka Wealth will likely have incurred penalties of up to £1m.6 And a very bad consequence for their clients: the usual HMRC time limits are extended, so HMRC has 20 years in which to pursue the tax.

- Arka Wealth says that a UK trust is subject to inheritance tax, but a Cypriot trust is not.7 That’s incorrect: there is an immediate 20% “chargeable lifetime transfer” if a UK domiciled individual puts property into an offshore trust8, and then an ongoing 6% charge every ten years or on exit. So the transfer of the intellectual property into the trust will create an immediate inheritance tax charge.

- Arka Wealth say the trust is not subject to capital gains tax.9 That’s incorrect: if you put property into an offshore trust then you are personally taxed on the trust’s capital gains.

- Arka Wealth also believe that, unlike UK trusts, Cypriot trusts don’t pay income tax.10 That’s again incorrect. The trust will be taxed at 45% on its UK source income. The client will also be directly taxed on the trust’s income under the “settlements” rules or the “transfer of assets abroad” rules.11

- The claim is that the client will “own nothing, control everything”12. It therefore may not even be a trust from a UK tax perspective.13 This is likely the best outcome for a user of the scheme because, whilst they’d fail to obtain any tax benefit, they’d also probably escape up-front tax liabilities caused by the structure.

- The company’s payments to the trust for the use of the IP will be subject to 20% royalty withholding tax.14

- The company will likely not be able to deduct the royalty payment to the trust.15

- The company will likely be subject to corporation tax on the capital gain from its disposal of the intellectual property into the trust, with the sale price deemed to be its market value.

- There are potential additional problems, and complex interactions, with the benefits in kind and disguised remuneration rules, plus the potential for a market value stamp duty land tax charge and ATED on any real estate moved into the trust.

- The claim that a barrister’s insurance provides clients with full protection is often made by tax avoidance scheme promoters. The problem is that the barrister may be insured, but that’s for his protection, not his clients. If his advice is negligent, you will have to sue him and/or Arka Wealth – and win. The insurers will then typically take over the defence; only if you win do they pay out. And the cover could be as low as £500,000.

This is a tax disaster.16 Like other schemes we’ve investigated, it won’t just fail to obtain any tax benefit for the clients. It will likely trigger large up-front tax liabilities.

The courts have struck down almost every17 tax avoidance scheme they’ve seen in the last 25 years. A sign of the consistent failure of such schemes is that a “general anti-abuse rule” was created in 2013 to counter avoidance schemes. The courts haven’t needed to use it even once; all the schemes considered since it was enacted have failed under normal taxation principles. No reputable adviser would let their client go near a scheme like this.

However the non-tax consequences could be worse. The scheme results in all of a client’s assets moving into a complex Cypriot trust arrangement. Arka Wealth assure clients everything remains under their control but, given their poor understanding of tax law, it would be optimistic to assume their understanding of Cypriot trust law is any better. One scenario is that assets are trapped in an expensive structure (as has happened🔒 with other trust structures). The worst-case scenario is that the assets become stranded, or even disappear.

The European reality

Arka Wealth claim the structure works in 30 European countries as well as the UK.18

This is an implausible claim on its face: even the most innocuous commercial structure will usually have different tax consequences in different countries. A tax avoidance scheme is an extreme case.

We spoke to French, German and Italian tax lawyers, none of whom thought the scheme would work, and all of whom thought it would likely result in a criminal investigation.19 We also spoke to a Polish tax adviser, who said the structure looked like a sham but, if not, would be countered by the Polish GAAR. The structure will also likely be disclosable to many tax authorities across the EU under the rules often called “DAC 6“.20

Who is behind Arka Wealth?

Arka Wealth is an Estonian company.21 – its CEO of Arka Wealth is James Verite-Shephard; the Chief Operating Officer and “Wealth Specialist” is Jeremy Vaughan. Mr Verite-Shephard also owns the company. Neither appears to have any legal, tax or accounting qualifications, or indeed any experience with trusts or the private wealth sector.

The same two individuals are also CEO and COO⚠️ and owners of another unregulated wealth manager called Benedictus Global.

Given that Benedictus Global and Arka Wealth appear to be run by people with no qualifications or experience, and who make transparently false claims, we would suggest that anyone looking for tax advice goes elsewhere.

We put our criticisms to Arka Wealth and asked them for comment. They didn’t respond to any of our specific points, but said they would now be conducting a review of their materials and how they presented their marketing. We responded that the priority should be to comply with UK and EU tax avoidance scheme disclosure laws. We didn’t hear back. The email thread is here.

Messrs Verite-Shephard, Vaughan and two junior employees of Arka Wealth are members of a UK limited liability partnership called Fair Share Legal LLP. The other member is a barrister called Setu Kamal, who also controls that LLP.

Mr Kamal is listed as the legal adviser for Arka Wealth and Benedictus Global⚠️ as their “legal adviser”.22

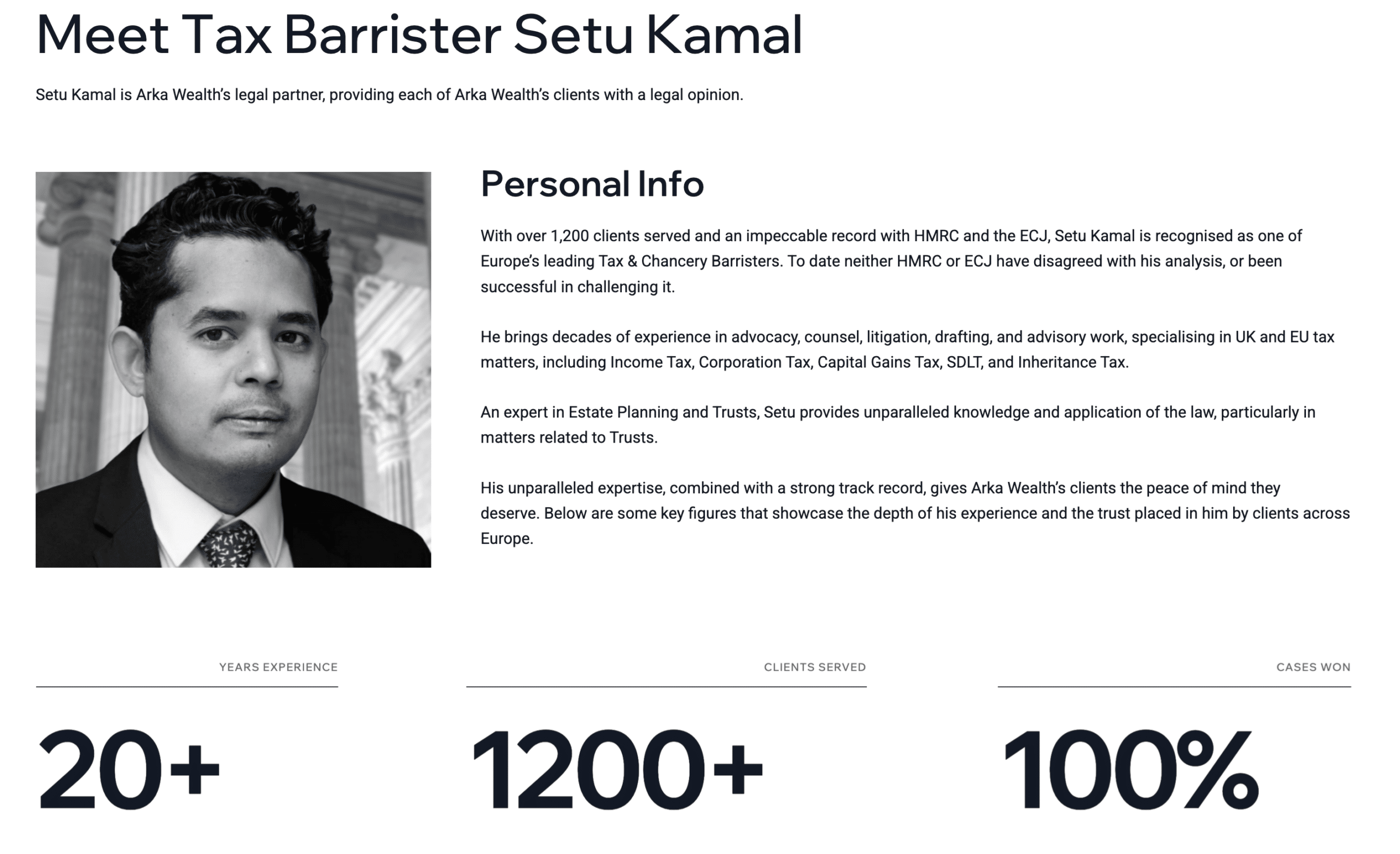

Setu Kamal

Arka Wealth refer extensively to their reliance on the advice of tax barrister Setu Kamal. They host videos in which Mr Kamal recommends that business owners set up a trust, and says that every Arka Wealth client receives a legal opinion from him.

Mr Kamal tells us that his opinions for non-UK clients are based on arguments that EU law prevents the structure being taxed.23 He says he doesn’t use this argument for UK clients post-2023.

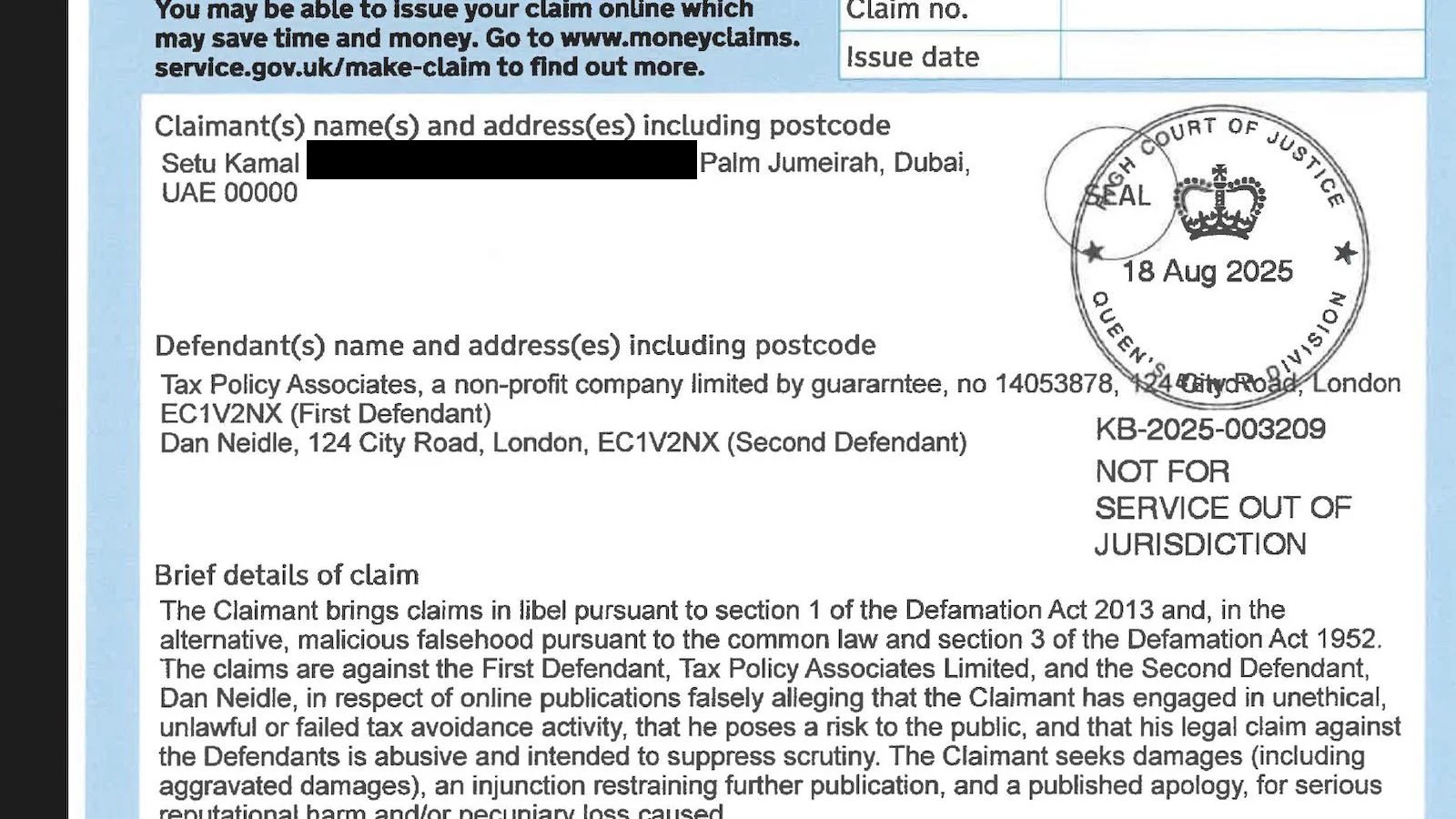

Mr Kamal was promoted on Arka Wealth’s website as having a 100% win record, with the claim that “neither HMRC or ECJ have disagreed with his analysis, or been successful in challenging it.”:

Mr Kamal’s actual win rate is closer to 20%, and probably 0% on substantive tax points.2425 As far as we are aware, Mr Kamal has never appeared before the CJEU.26. We pointed this out to Arka Wealth – they didn’t change their website. Update 27 March: one month after we published our report, we reminded Arka Wealth that they were making false claims. They then corrected this page.

A barrister’s win rate is a crude measure of their ability, because some excellent barristers take on very difficult cases. However in Mr Kamal’s case, we believe that most of the cases relate to tax avoidance schemes that he helped devise. His win rate is an accurate reflection of the success of these structures (indeed it flatters it, because his wins were on valuation and procedural points; we don’t believe he’s ever won a substantive tax point before a court or tribunal).

Whilst the Arka Wealth scheme is targeted at wealthy individuals, many of the other schemes Mr Kamal has advised on are “contractor schemes”, targeted at people on modest or low earnings. They think they are signing up for normal agency work, but (thanks to complex documents they are asked to sign without advice) end up participating in complex and contrived tax avoidance schemes. Scheme users typically have no idea of the nature of the scheme they are signing up to, and often end up with large tax liabilities as a result. The risks are very high, but rarely if ever disclosed. There’s a good Computer Weekly article on these schemes here.

Three of the contractor schemes that we believe were created with Mr Kamal’s help have been listed by HMRC as tax avoidance schemes and, we expect, will in due course either lose in front of a tribunal, or vanish before HMRC can pursue them. The Advertising Standards Agency ruled that the same three schemes⚠️ misled people.

In defending these and other schemes in court, Mr Kamal has a history of pursuing arguments that we regard as hopeless. This culminated in him being referred by the High Court to the Bar Standards Board for a disciplinary hearing.

A short summary:

- In June 2023, Mr Kamal acted for two tax avoidance schemes called Vision HR and Veqta. HMRC planned to list the schemes on its website; the promoters sought judicial review to stop that. Mr Kamal ran the surprising argument that EU law overrode domestic UK law even after Brexit. The court described this as “unarguable” – we believe almost all EU law and constitutional law advisers would agree. Three other of his arguments were held to be “unarguable”. Mr Kamal also failed to answer the Judge’s questions as to how the scheme worked (although, having devised the scheme, we expect that he knew the answers). The promoters were found to have breached the “duty of candour”. Judicial review was refused.

- A month later, Mr Kamal acted for another tax avoidance scheme, Apricot, on very similar facts; and Mr Kamal made almost identical legal arguments. His application referred to another similar legal challenge “underway in the case of Veqta“. However he failed to disclose that the Veqta challenge had failed, and his arguments had been rejected. The Judge said this prima facie constituted a breach of a barrister’s duty to the court, and made a “Hamid” referral to the High Court to consider whether Bar disciplinary proceedings should be brought against Mr Kamal.

- The Hamid referral was heard by the High Court in March 2024. The judgment indicates that Mr Kamal made no apology for his omissions, nor any acknowledgment that he failed to comply with his obligations to the court (although he said he had been “flustered“). He failed to attend the hearing, initially claiming he had made an application to attend remotely, but then admitting he hadn’t done so. The Court found that Mr Kamal had breached his duty to the court, and referred the matter to the Bar Standards Board. Mr Kamal has told us that the investigation by the Bar Standards Board concluded on 5 March 2025, he was fined £650, and no further disciplinary action was taken against him, but he has so far refused to provide evidence that the BSB did in fact reach this conclusion.

- Soon after the Hamid hearing, in April 2024, Mr Kamal acted in another judicial review, Oculus, against HMRC’s decision to force disclosure a promoter who hadn’t disclosed their avoidance scheme under DOTAS. He again ran EU law, GDPR and ECHR arguments which the court found to be “unarguable”.

- In August 2024, Mr Kamal acted on a failed attempt to challenge the loan charge as contrary to EU law (very far-fetched, particularly post-Brexit) and contrary to the ECHR (which the Court of Appeal had already ruled against). Mr Kamal made an application in which he claimed that two judges were biased and there was an appearance of “institutional corruption”. The court rejected the application, saying it was “frankly scurrilous” and “lacking in any merit”. 2728

Mr Kamal appears to honestly believe the eccentric legal positions which he takes. Arka Wealth’s staff probably don’t understand them. We expect, however, that may other promoters know these arguments will fail; their aim is to slow down HMRC, and let the promoters extract more money from their clients/victims before their schemes are (inevitably) closed down. In the case of Oculus, that meant that workers continued for a further year before being notified that they were participating in a tax avoidance scheme (we expect they were low-paid and had no idea what was going on) .

Despite the claim in the webinar (at 00:31:29) that Arka Wealth “use the foremost tax chambers within the UK”, Mr Kamal is no longer a member of a Chambers.

We wrote to Mr Kamal giving him an opportunity to comment on the Arka Wealth structure. He declined to respond unless we gave him “access to our subscriber base” – when we said this didn’t make sense, he stopped responding. The email thread is here (read from the bottom up):

We had previously written to Mr Kamal last year, following his referral to the Bar Standards Board. For reasons which aren’t clear, he copied his response into two twitter posts. In short he accused us of a “medieval witchhunt”, and provided more detail of his legal positions (which we regard as highly eccentric).

The policy implications

HMRC should investigate and close down Arka Wealth.29

However, Arka Wealth are just one small player in a sizeable industry of tax avoidance scheme promoters. Government action is required.

1. DOTAS needs to be strengthened, with civil and criminal penalties for the people promoting undisclosed schemes

Every tax avoidance scheme we’ve investigated has two things in common. It should have been reported to HMRC under DOTAS, the rules requiring up-front disclosure of tax avoidance schemes. But it wasn’t.

Arka Wealth’s scheme follows the same pattern.

The reason is simple: having to market a scheme that’s been disclosed to HMRC as a tax avoidance scheme is hard.30

So DOTAS is widely ignored. Often, promoters obtain an opinion from a tax barrister which takes implausible, but highly convenient, positions. An example of such an opinion, and a tribunal’s dismissive attitude to it, can be found in the recent Asset House case. Nevertheless, it’s often the case that the fact an opinion was obtained means that penalties can’t be charged (and Setu Kamal has advocated for precisely this result).

We suggest two responses.

- DOTAS penalties should be increased31 and a promoter’s directors/owners should always be joint and severally liable for the penalties. Right now it’s too easy for them to walk away from their company.32

- Breach of DOTAS should be a criminal offence for the individuals responsible33 with strong protections to prevent innocent mistakes being penalised.34

2. It should be an offence for an unregulated person to advise on or promote a tax avoidance scheme

The last Government consulted on regulating the tax profession, but only for advisers who act as agents for taxpayers in their dealings with HMRC. Most tax avoidance scheme promoters do not do this – they provide advice behind the scenes.

We are therefore pleased to see that the present Government’s response to the consultation states that there will be proposals issued soon dealing specifically with cases where an adviser facilitates a taxpayer’s non-compliance.

We would suggest this brings within the scope of regulation anyone who provides tax advice for an arrangement which has a main benefit of obtaining a tax advantage.

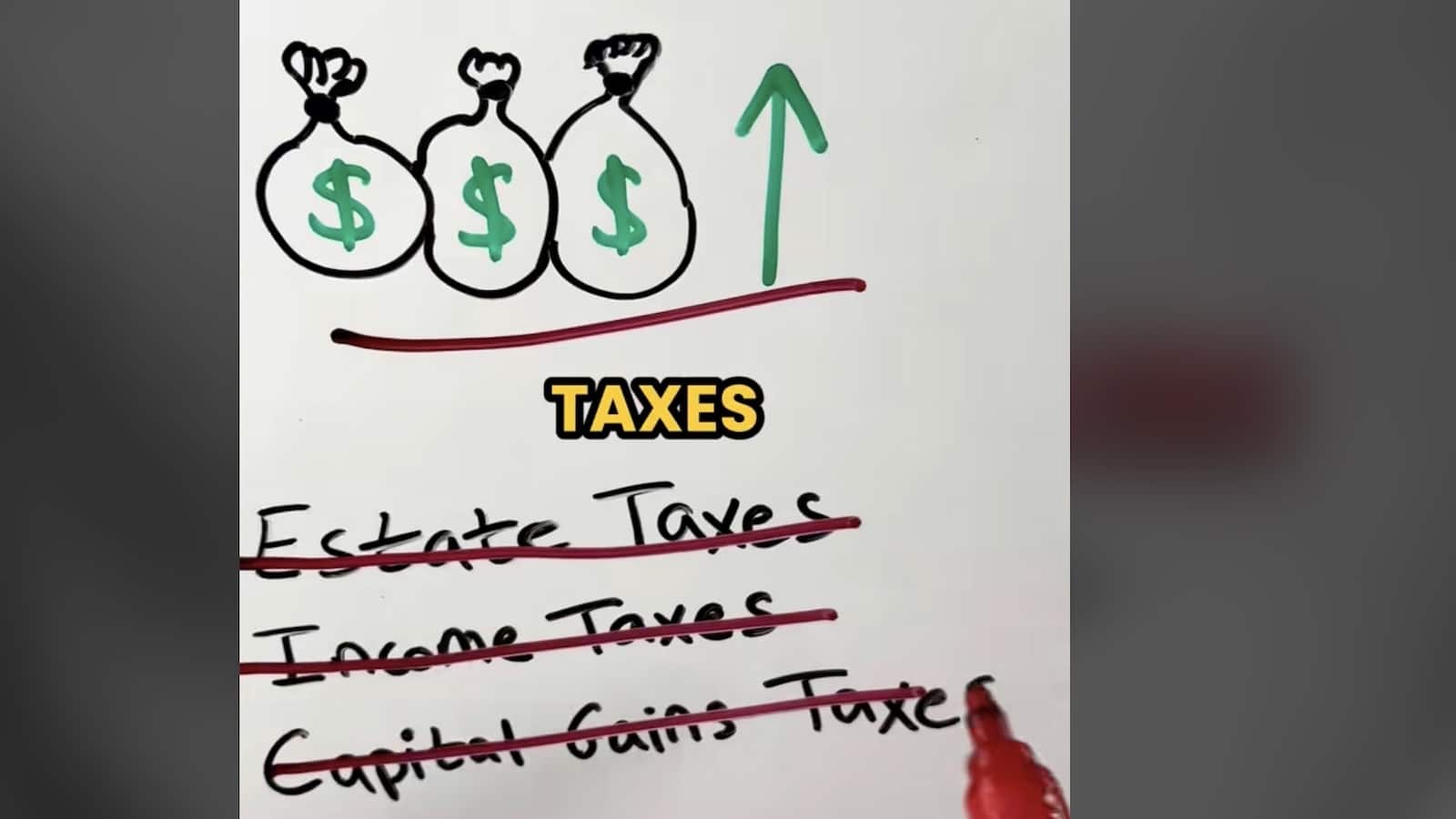

3. The Bar Standards Board should bring barristers up to the same standards as solicitors and accountants

A solicitor, chartered accountant or chartered tax adviser is bound by the rules of the Professional Conduct in Relation to Taxation (PCIRT). These rules include:

This protects the public, because any tax structures falling within this paragraph are very unlikely to work.

However there is no such restriction on barristers – they are free to create and promote aggressive and abusive tax avoidance schemes which have no realistic prospect of their success. What’s worse is that such barristers usually act for scheme promoters, not the end-users of the scheme. So when – inevitably – the scheme goes wrong, the end-users were not the client, and will not be able to sue the barrister for negligence.

This is nothing to do with the “cab rank” rule, which obliges a barrister to take on any appropriate case with a paying client. It would be unfair and unreasonable to criticise a barrister for (for example) defending a person accused of tax avoidance or tax evasion. However that is very different from the case where a barrister devises and/or promotes an aggressive tax avoidance scheme. That was the barrister’s choice and, in our view, an indefensible one.

Thanks to the PCIRT, few of the schemes we have investigated involve a solicitor or accountant; but many of them have involved barristers. A small number of barristers are actively damaging the integrity of the tax system – and everyone in the tax world knows who those barristers are.

It is over ten years since Jolyon Maugham wrote an article about the problems caused by barristers issuing impossible opinions without consequence. Nothing has changed.

We will be asking the Bar Standards Board to reconsider its position, and make the PCIRT binding on barristers.

Thanks to James Quarmby, C, K, T and L for their UK tax technical input, to P, J, D and H for the French, German, Italian and Polish tax commentary, and to T and G for the international arbitration advice. Thanks, most of all, to A for the original tip.

Videos and other content are © Arka Wealth and reproduced here in the public interest and for purposes of criticism and review.

Footnotes

We have also archived a copy of Arka Wealth’s TikTok channel, which as at 25 February contained 186 videos. If the channel goes down, please get in touch if you would like access to them. ↩︎

The website went offline in sometime around August 2025 ↩︎

AI generated, so not necessarily accurate ↩︎

See 00:28:43. The whole video is well worth watching. Amongst the other claims: that European Union company law is based on trust law (00:40:10), that you can avoid rental withholding tax using a UK holding company (01:13:50), that they work with barristers in the “EU” (00:17:18). For fairness, we should add that a minority of our panel agreed with the claim (at 00:29:33) that “a barrister is always considered an expert in law where a lawyer or a solicitor is not”. And their many other videos make other wild claims, including that billionaires use this structure (we would be surprised if any do; billionaires are generally (but not always) very well advised). ↩︎

Because the main benefits of the structure include obtaining a tax advantage, Arka Wealth is making it available for implementation, and the scheme will (we expect) use standardised documentation. We also expect there will be a premium fee. The references in the webinar to not wanting to disclose their “secret sauce” suggests the confidentiality hallmark applies as well. ↩︎

Or a non-dom settles UK situs assets. In either case, only to the extent the property exceeds the nil rate band ↩︎

With a credit for income tax paid by the trust. ↩︎

Either on general principles (it’s just not a trust) or under the sham doctrine (see e.g. paragraphs 72 and 73 of the Northwood case) ↩︎

Arka Wealth seem to think the UK/Cyprus treaty🔒 will help. They’re wrong: a non-taxable trust can’t be resident in Cyprus for treaty purposes (and the trust in practice is probably resident in the UK anyway). The trustee may be a company resident in Cyprus, but a trustee isn’t the beneficial owner of the trust property. Even if the trust were taxable in Cyprus, treaty relief likely still wouldn’t be available. ↩︎

Either on the basis that it is not “wholly and exclusively” for the purposes of the company’s trade, or on the basis that it was undertaken solely for fiscal purposes and so has been “denatured“. Note that the likely clients are small companies, and so transfer pricing and the diverted profits tax probably won’t apply. ↩︎

We of course do not know the details of how the structure works. The webinar refers to Arka Wealth’s “secret sauce”, which we expect means likely additional steps designed to disguise the nature of the arrangement (see 01:05:17). We discussed these kinds of structures in our previous article on the Minerva structure. However, all of the trust tax specialists we spoke to regarded the claims made as essentially impossible to achieve. It’s been a long time since artificially inserted steps were able to save a tax avoidance scheme. ↩︎

The exceptions: the SHIPS 2 case, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction, and D’Arcy, where two anti-avoidance rules accidentally created a loophole. The GAAR was in large part created to prevent cases like SHIPS 2. ↩︎

The full list is: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the UK. ↩︎

The Italian tax authorities tend to treat all tax avoidance, and even many technical tax disputes, as criminal tax evasion – so this response will not surprise many tax practitioners. The French and German responses are less usual. ↩︎

i.e. under the A2 tax-geared fee, A3 standardised documentation or C1 deductible/non-taxable payment hallmarks. ↩︎

As an aside, the Estonian company registry is in our view the best in the world in its openness, and user interface. ↩︎

Mr Kamal says he is advising the “BW Network” and notorious tax avoidance scheme promoter Paul Baxendale-Walker. The similarity between the Arka Wealth structure and the Baxendale-Walker🔒/Minerva structures may not be a coincidence. ↩︎

We believe this is incorrect. EU law never protected wholly artificial⚠️ tax avoidance structures like those promoted by Arka Wealth (even before the recent CJEU movement towards applying a much weaker standard than “wholly artificial”). ↩︎

We conducted a quick review of decided tax cases where Mr Kamal acted for the taxpayer. We found 14 tax judgments – of which he won one (Bower, a valuation case), won in part in another (Elphysic, losing on the main point), and lost the remaining 12 (Apricot, Cajdler, Conegate, England, Kondrat-Wilk, Labeikis, Oculus, Opus Bestpay, Phizackerley⚠️, Rapid Brickwork, Veqta/Vision HR, Whight). Mr Kamal also won a tax-related insolvency case⚠️. ↩︎

The Telegraph suggested Mr Kamal was involved in SDLT avoidance schemes. These schemes have a dismal record of failure in the courts, but we are unaware of any specific reported cases where Mr Kamal acted. ↩︎

The name changed from “European Court of Justice” to “Court of Justice of the European Union” in 2009, following the Lisbon Treaty. ↩︎

Mr Kamal now says⚠️ he’s seeking ways of challenging the loan charge via an international arbitration. None of the international arbitration lawyers we spoke to believed such a challenge would be possible. ↩︎

Mr Kamal acted for similar claimants in a parallel judicial review, which appears to be unreported, but is mentioned in passing in the Labeikis case. One of the claimants is the Trustees of the Setu Kamal Action Man Trust 2022, so it appears Mr Kamal has himself used a loan/trust tax avoidance structure of some kind. ↩︎

Likely a stop notice can be issued because the scheme is similar in form and effect to others which have been the subject of DOTAS disclosure, and it is more likely than not that Arka Wealth’s structure will not provide the promised tax advantage. ↩︎

Promoters have lied about this in the past; some claiming that DOTAS is a sign of HMRC approval; others that it was a normal process for investigating novel structures. ↩︎

Currently they are £600 per day or (if that is insufficient), £1m. This is an insufficient deterrent when a promoter can make millions of pounds of fees in a few months. The penalty should instead be geared to the fees received by the promoter (say 200% of fees) or, where a promoter does not adequately disclosure the fees received, such amount as is just and reasonable under the circumstances. ↩︎

i.e. expanding HMRC’s existing powers by removing conditions B and D – HMRC should simply be able to pursue directors/participators as soon as a DOTAS penalty is issued. ↩︎

This should be a different test from the usual “directors, shadow directors and participators” formulation, so that directors with no knowledge of the activity are not liable, but an employee who was directing the activity is responsible. ↩︎

We would adopt the approach in the GAAR: the offence should only apply if the failure to comply with DOTAS cannot reasonably be regarded as a reasonable course of action. Merely obtaining legal advice should not be sufficient for a person to taken to be acting reasonably; we’ve seen in Asset House and other cases that some barristers take unreasonable positions. Everyone in the tax world knows who these barristers are. A consequence of criminalising DOTAS is that a rational person looking to protect their position will instruct a barrister whose opinions haven’t repeatedly been contradicted by courts and tribunals. ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply