In the last few years, HMRC charged 420,000 people with £100 late filing penalties when they earned too little to pay tax. People earning under £6k received twice as many penalties as people earning more than £83k.

Rachel Reeves should reform the penalties system.

Our previous reporting on the impact of HMRC penalties on people on low incomes is here. As the Observer reported on Sunday, we now have better data, and the first data on the impact of the £300 penalties for filing one year late. It’s as concerning as our previous data on the impact of the £100 penalties.

We’ve been presenting a series of tax reform proposals in the run-up to the Budget. This is the seventh – you can see the complete set here.

The impact of penalties on the poor

This chart shows the percentage of taxpayers in each income decile who were charged a £100 fixed late filing penalty:1

The green bars show where penalties were assessed but successfully appealed. The red bars show where the penalty was charged. The black vertical line shows the personal allowance, below which nobody should have any tax liability.

- There are 420,000 penalties to the left of the black line. That means 420,000 £100 late filing penalties were assessed on people who earned too little to pay tax. Another 150,000 were charged with penalties but successfully appealed.

- More than twice as many £100 penalties were charged on people in the lowest earning decile (earning less than £6k) than in the highest earning decile (earning more than £83k2).

There’s an even more extreme pattern in the £300 penalties for filing a year late: three times as many penalties in the lowest earning decile than the highest earning.

Every penalty issued to the left of the “personal allowance line” is a policy failure. Those penalties should never have been issued.

The full dataset and bar chart code is here, and there’s more detail on the technical background here.

Why are people on such low incomes being asked to complete a self assessment return?

We don’t know, but likely some mixture of:

- People with self-employment income (which always requires self assessment),

- People who had higher income the previous year, and

- HMRC mistake.

The human impact

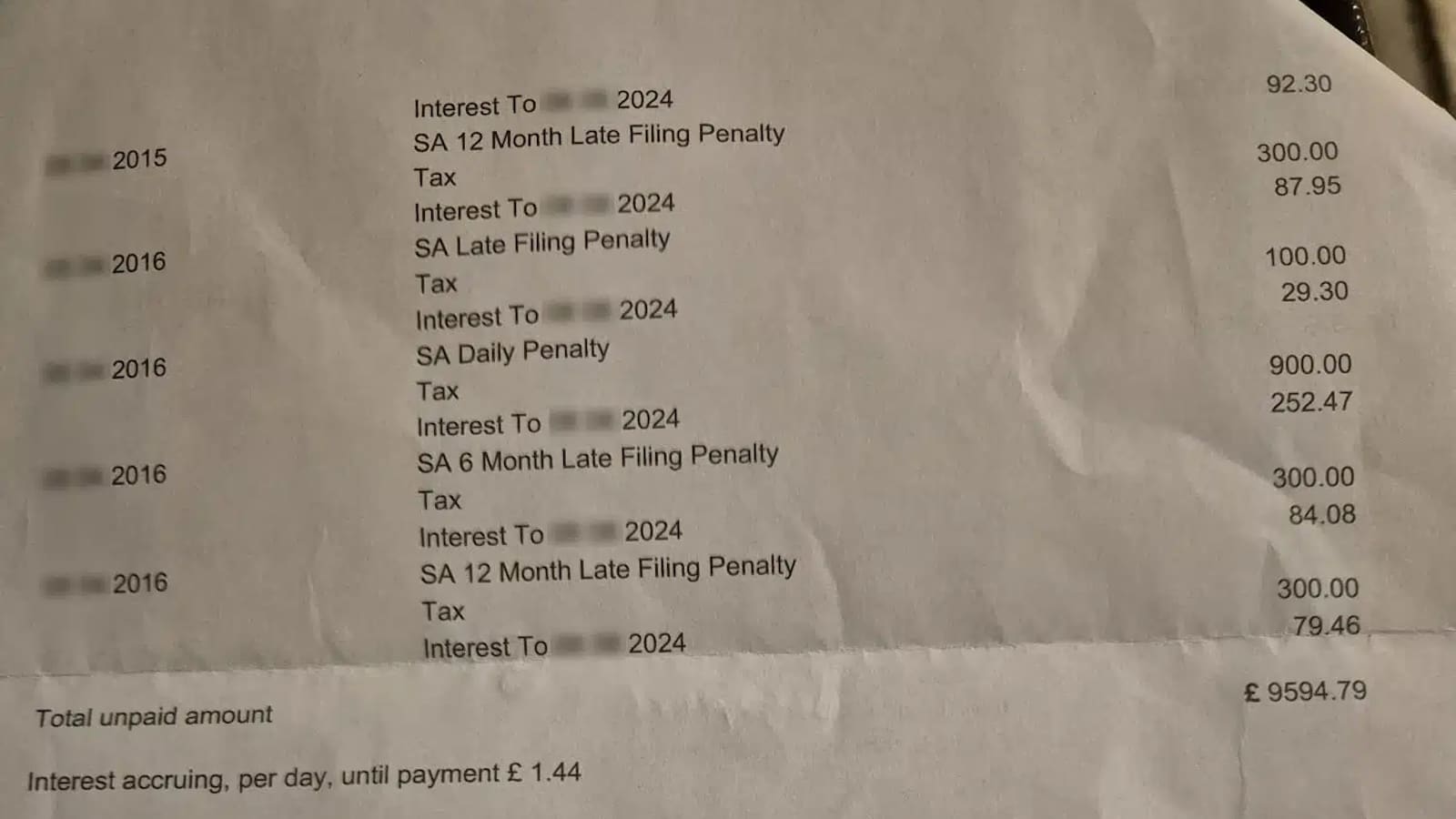

Several years of penalties can add up to thousands of pounds – here’s a typical example that was sent to us (digits obscured to preserve privacy):

People are falling into debt, and in one case we’re aware of, actually becoming homeless, as a result of HMRC penalties.

Even just the lowest penalty of £100 is a large proportion of the weekly income of someone on a low income (indeed over 100% of the weekly income for someone in the lowest income decile):

A respected retired tax tribunal judge has described the current UK penalties regime as the most punitive in the world for people on low incomes.3

Since publishing our initial reports, we’ve been inundated with stories from people on low incomes affected by penalties when they had no tax to pay.

These are vulnerable people, at a low point in their lives – and the same difficulties which meant they missed the filing deadline mean they often won’t lodge an appeal, and may take months before they pay the penalties (racking up additional penalties in the meantime). A successful appeal is not a success – it means that someone with limited time and resources has had to navigate what is to many a complex and difficult administrative system.

Here are just two of the many responses we received:

What should change

Until 2010, nobody could be charged a penalty which exceeded the tax due. If you were issued a late filing penalty, and then submitted a return showing no tax was due, the penalty was cancelled.

The data provides compelling evidence that the law should go back to how it was. We have more detailed recommendations here.

This is one tax reform that should be easy for any Labour Chancellor. The cost is likely negligible; but there would be a real benefit to some of the poorest and most vulnerable in society.

Many thanks to HMRC for their detailed and open response to our FOIA requests on penalties and income levels. And thanks to all the tax professionals who alerted me to this issue – otherwise I never would have been aware of it.

All the data and code for these charts is here.

Leave a Reply to Prof SB Cancel reply