HMRC has designated two structures used by the adviser ‘Property118’ as “tax avoidance schemes”. Property118 are appealing to a tax tribunal, and have asked their clients to provide witness statements. That’s perfectly normal. But what’s not normal at all is that Property118 are directing the content of the witness statements.

It would be serious professional misconduct for a solicitor or barrister to coach a witness in this manner, and the witness statements may now be inadmissible.

The background to the Property118 tax appeal can be found in our previous reports here.

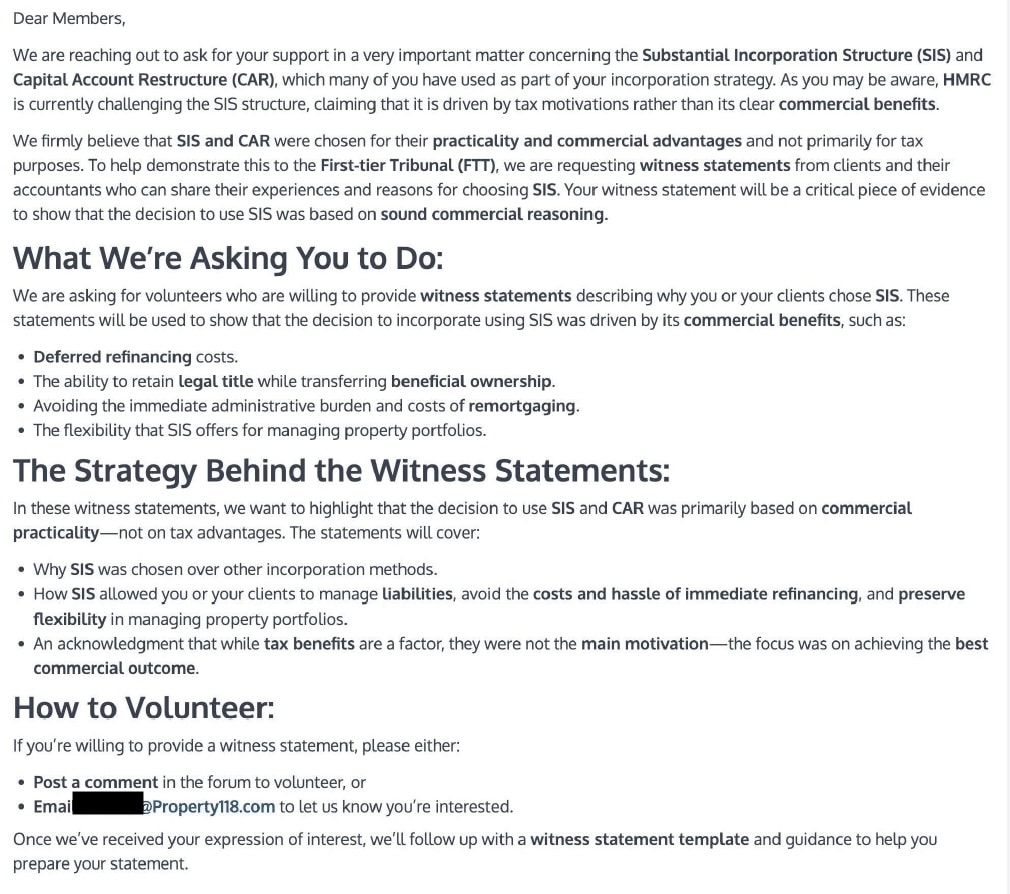

The request for witness statements

It’s usual for a party to a dispute to ask interested third parties to provide witness statements. Court rules require that witness statements from a person should be made in their own words.

That’s not the approach Property118 took in a message they sent their clients on 18 September:

This is not merely asking for witness statements; it’s directing what they should say: “In these witness statements, we want to highlight that the decision to use [the structure] was primarily based on commercial practicality – not on tax advantages”.

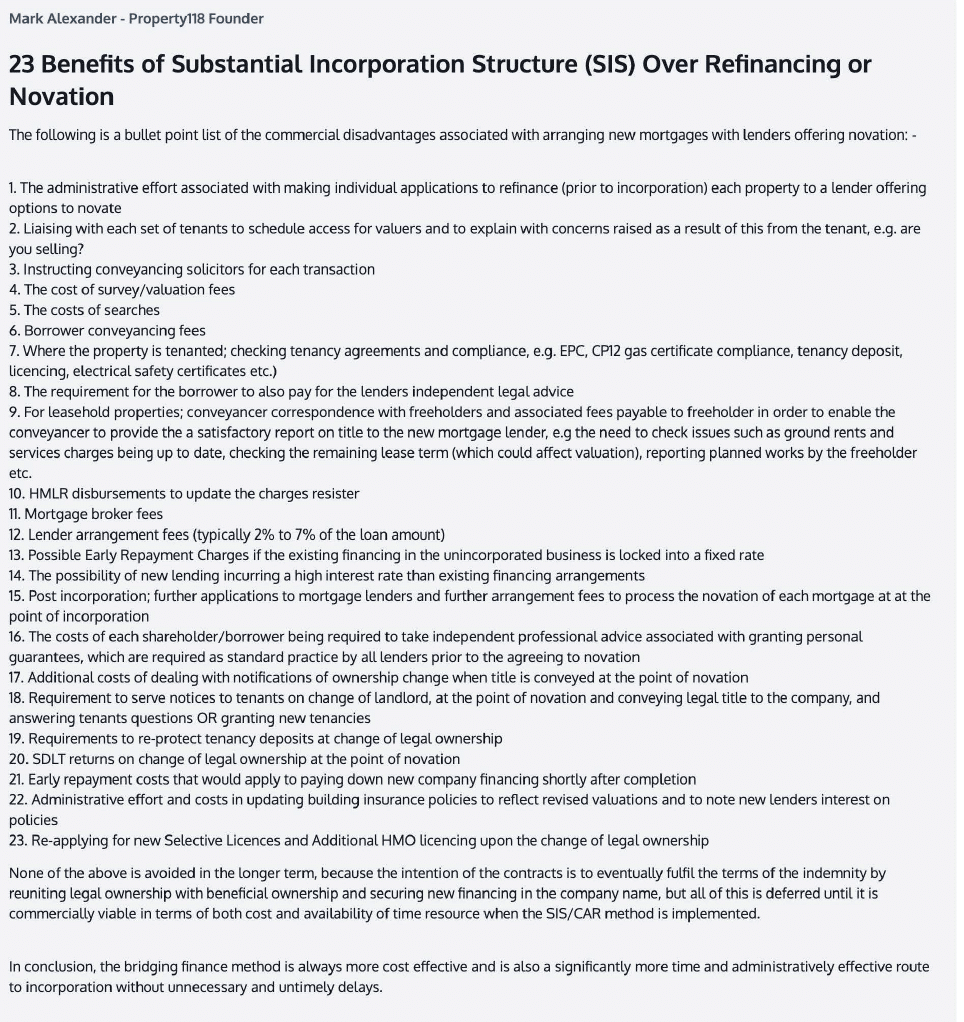

Mark Alexander, the founder of Property118, then provided his clients with a list of points to add into their witness statements:

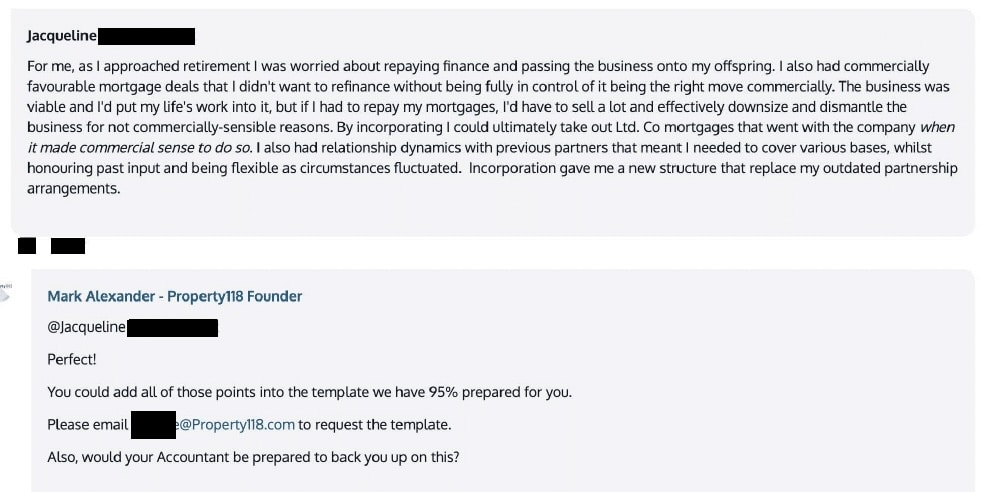

And Property118 have a template they have “95% prepared”:

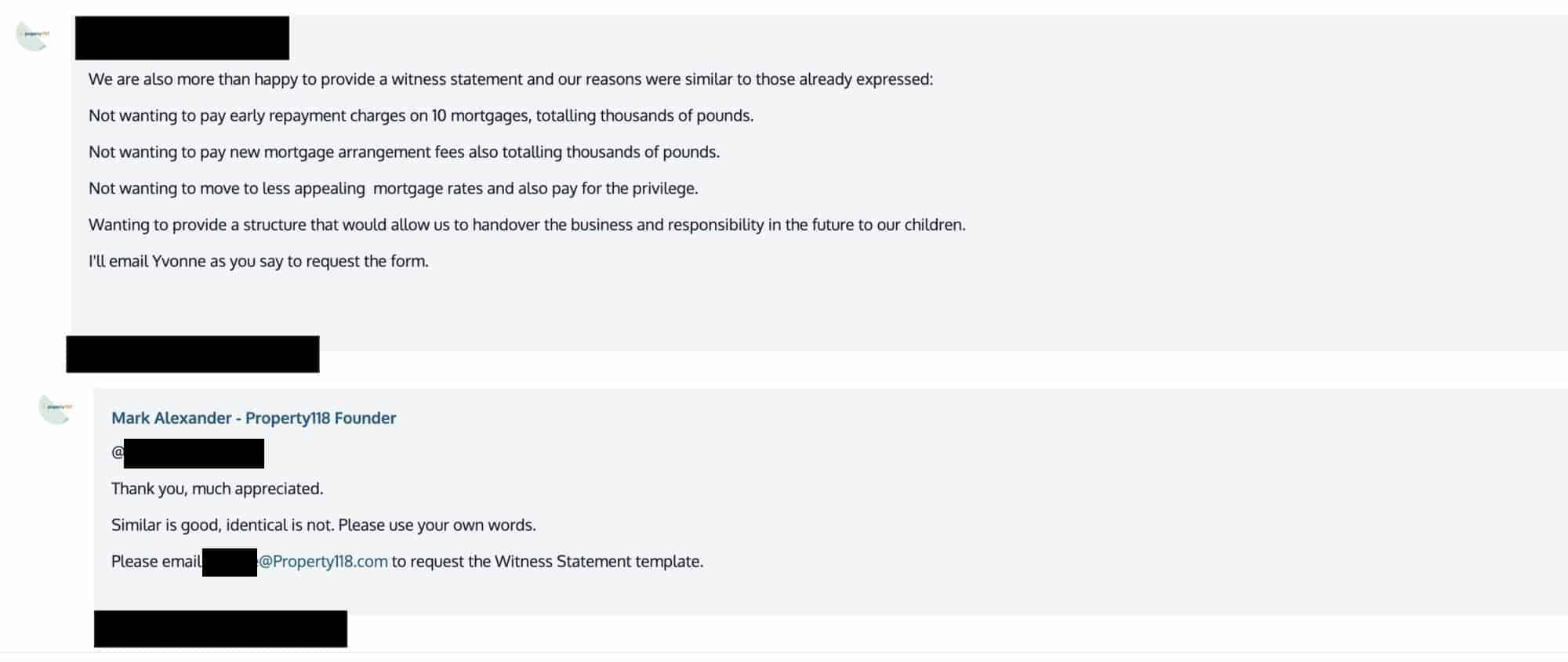

There seems to be some awareness that it is improper to template witness statements – “similar is good, identical is not”:

The messages above come from Property118’s client forum. Two Property118 clients were so alarmed at what they were being asked to do that they (independently) spoke to lawyers, who contacted us with their clients’ permission.

The consequences

We discussed the likely consequences of Property118’s approach with two tax KCs and two solicitors specialising in tax litigation.

Solicitors and barristers have a duty not to mislead a court or tribunal. It would be serious professional misconduct for a solicitor or barrister to coach a witness or seek to influence the content of a witness statement. The courts have been very unhappy when presented with witness statements which were in reality written by a legal team, not the witness.

We and the lawyers we spoke to thought it was highly unlikely that Property118’s legal team had agreed to this approach. It was much more likely that Property118 were obtaining the witness statements behind the backs of their legal team.

That, however, presents a problem. When and if Property118’s legal team becomes aware of how the witness statements were obtained, it is unclear how they will be able to present them to the tribunal.

Witness statements drafted in this way would probably not be admissible in a civil court1. Tax tribunals have more flexibility2, but we would expect a barrister to be required to, at the least, draw the tribunal’s attention to the fact that a witness statement was, to a significant degree, prepared by Property118 and not the witness. That would then likely undermine the weight the Tribunal gave to the witness statement.

The substance of the issue

The difficulty Property118 are having reflects a common problem faced by promoters of tax avoidance schemes. A judge will expect an answer to the question: “why did you enter into this transaction?” The real answer is: to avoid tax. But if the promoter gives that answer, they’ll likely lose. So they struggle to find some other answer – anything, other than tax. Property118’s attempt to construct witness statements should be seen in this context.

Property118 marketed a structure for landlords. The structure involved the landlords declaring a trust in favour of a company. This supposedly enabled landlords to achieve all the benefits of incorporating their business – lower tax rate, full deduction for mortgage interest, and capital gains tax and potentially inheritance tax advantages. But it avoided all the messy disadvantages of incorporation: needing a new mortgage, having to tell tenants, and moving all the contracts associated with the business.

None of that actually worked as a technical matter. But even if it had, there’s a basic problem with the proposition. The trust structure has no benefit other than tax.

If you incorporate a business in the usual way, that will have a large number of legal and commercial implications. Some are desirable; some are not. But the many changes that flow from the incorporation mean that you can’t usually look at someone incorporating a business and say “this is mainly being done for tax reasons”. There’s too much going on.

Property118’s trust structure had only one benefit: a tax advantage.

Property118 are trying to coach their witnesses into answering the question: “why did you use the Property118 structure instead of incorporating?” That’s the wrong question. The correct question is “why did you use this structure instead of keeping things as they were?”

The only answer to that is: tax.

The main benefit, and perhaps sole benefit, of the structure was tax, and that’s why Property118’s appeal will likely fail.

Photo by Scott Graham on Unsplash

Many thanks to K, H, D, V and T for their help with this article.

Footnotes

See e.g. paragraph 18.1 of Practice Direction 32 of the CPR: “The witness statement must, if practicable, be in the intended witness’s own words and must in any event be drafted in their own language”. The recent MacKenzie v Rosenblatt case (also linked above) shows how courts can be expected to react when a legal team prepares witness statements. ↩︎

See rule 15 of the First-Tier Tribunal Rules⚠️ ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply