Recent events have highlighted R&D tax credit fraud. However we believe the scale of the problem is much higher than previously reported. We’ve a new analysis suggesting that the total cost of fraudulent and mistaken claims could be £10bn, or even higher. The mystery is how this went on for so long, when plenty of people were warning about it, and why it wasn’t until August 2023 that the rules were significantly tightened.

The consequence is that we as taxpayers have lost a huge sum of money that could have been spent on public services or tax cuts. And many businesses have been misled into making large claims which they will now have to repay.

The history

The modern small business R&D tax relief was created in 2000, with the laudable aim of incentivising R&D investment. The scheme changed a few times over the following years. Then something dramatic happened to R&D tax claims by “small and medium-sized enterprises” (SMEs) in the 2010s.

Here’s the number of claims:1

And here’s the value of the claims (i.e. the tax benefit to business, and the cost to us/HMRC):

We’d expect to see a step change around 2014/15, as the rules became more generous at that point. And we see that, for both SMEs and large business. However SME claims just keep growing, and growing – and that can’t be explained by changes in the rules.2

HMRC’s analysis of 2020/21 claims (published in July 2023) found that half of all claims were incorrect in at least some respect. One quarter of claims were fully disallowed. Another 10% were fraudulent (5% by value). For SMEs, HMRC estimated that 25.8% of all claims by value were wrong or fraudulent. For large companies, 4.6%.

This is a very high rate of error and fraud. For comparison, across the tax system as a whole, the fraud rate is around 1% and the error rate around 3%.

HMRC’s accounts for 2022/233 and 2023/24 4 included estimates of the total cost of R&D fraud and errors from 2020/21 to 2023/24. That’s been widely reported as suggesting a total of £4.1bn of wrong and fraudulent claims. However, HMRC only started to systematically analyse R&D claims from tax year 2020/21 – and so the £4.1bn figures does not include fraud and error prior to 2020/21.

Our analysis

We’ve made a very cautious estimate of the total fraud and error from 2013/14 by assuming (prudently) that there was no fraud/error in that year, and that the level of fraud/error then ramped up linearly until it reached the 25.8%/4.6% level in 2020/21.

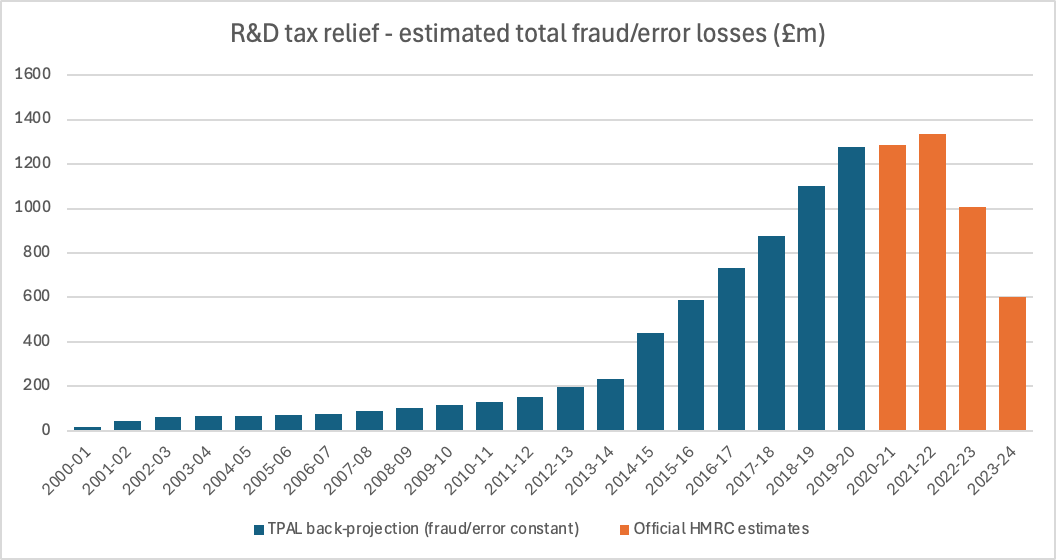

That results in total fraud/error losses looking like this:

The total over this period is then £7bn.

But what if the level of fraud/error in 2020/21 had always been there in the past, it’s just that the number and value of claims were smaller? If we apply the 2020/21 figures to earlier years we get this:

And total losses of £10bn.

It could be worse still. A large proportion of the “new” claims after 2014/15 could be bad, with HMRC’s estimate for 2020/21 having undercounted them.

The evidence for undercounting

There are two reasons to believe that HMRC may have been undercounting fraud and mistake.

The first is anecdotal. A large number of unqualified and unregulated businesses have carried on for years, making a good living from R&D tax relief claims. In the last few years their claims have been systematically challenged by HMRC; they weren’t before that. This implies that, historically, dubious claims were missed.

The second reason lies in the HMRC analysis for 2020/21, which includes a table showing fraud and mistake by sector:

It’s important to note that some of these sectors saw many more claims than others:

Looking just at the more significant sectors, the R&D tax reliefs specialists we spoke to were surprised that 58% of the claims in wholesale/retail trade were found by HMRC to be compliant. It would be unusual for a wholesaler or retailer to have any qualifying R&D expenditure. Similarly, the 60% figure for construction looks very high.

Three possibilities:

- We’re wrong, and there really has been a significant amount of qualifying R&D expenditure in wholesale/retail and construction.

- HMRC has misclassified businesses.5

- HMRC has missed a significant amount of non-compliance, whether it be from fraud or mistake.

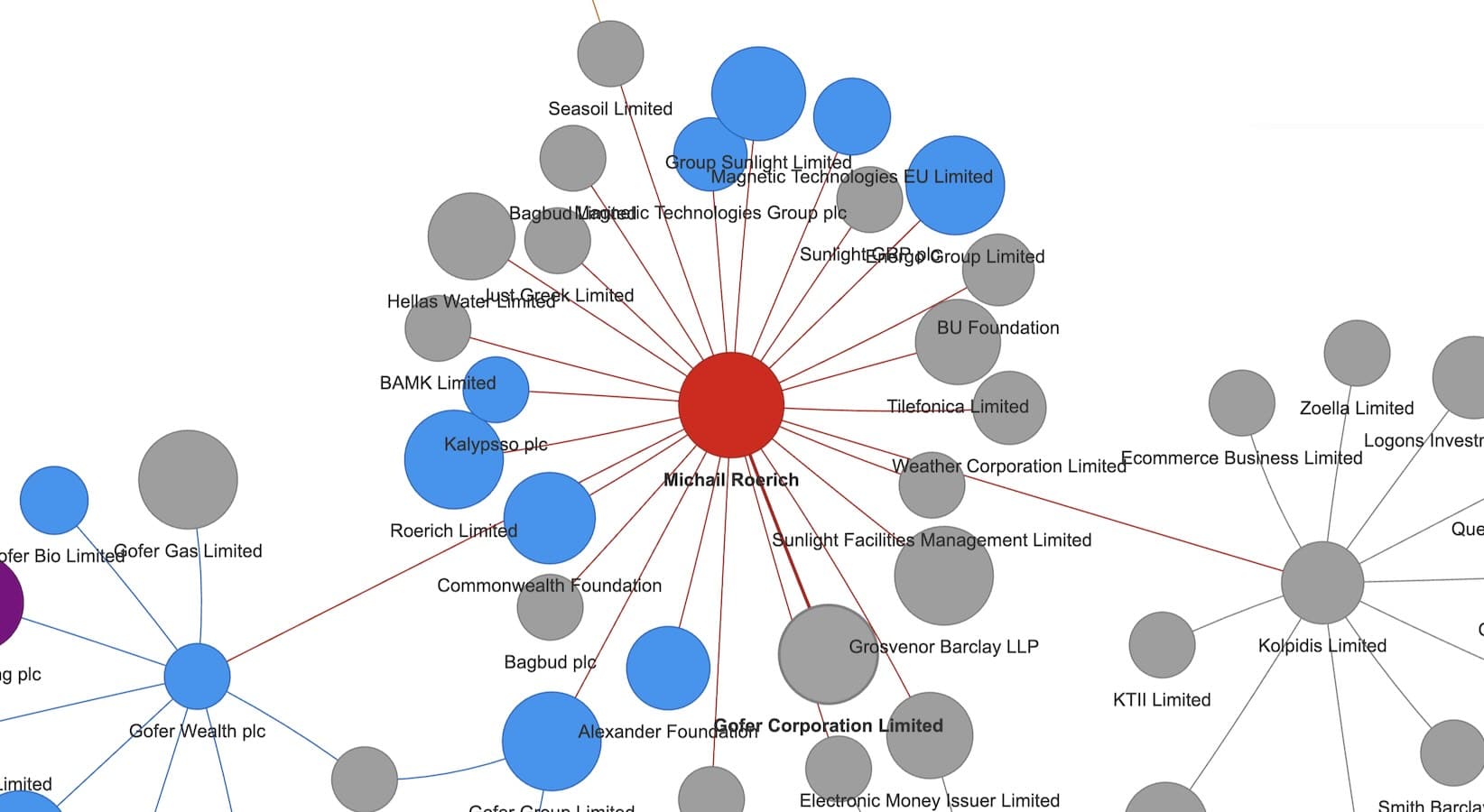

We fear that the anecdotes and the data lead to a conclusion that the true cost to the UK is more than the £7-10bn estimated above. The soaring number of claims from 2015/16 did not reflect more people making claims of much the same quality as before. It reflected many new unqualified firms setting up as R&D tax advisers and making claims of significantly poorer quality than previous claims. The majority of these new claims – which by 2020/21 represented half of all claims by value – may have been non-compliant.

We shared these estimates with HMRC and they didn’t provide any specific comment, but said:

“Our recent published estimates are data driven and use a significantly improved methodology. Clearly, the level of non-compliance we have seen is unacceptable and taxpayers rightly expect us to scrutinise claims. That is why we have increased compliance activity. We do that thoroughly and fairly, and the overwhelming majority of valid claims are paid on time.“

The scandal

Tax professionals have been of aware of incompetent and fraudulent R&D tax relief claims for years. HMRC must have been aware of the claims too. And HMRC and HM Treasury must have noticed the spiralling number of claims from small business, the increasing number of unregulated firms in the market, and the suspicious sectors for which claims were being made.

So why wasn’t anything done? There was a fraud prosecution for a one-off entirely fake R&D transaction, but there appears to have been little action on what became widespread fraud and error.

Philip Hammond, Chancellor between 2016 and 2019, told The Times that the Treasury and HMRC were well aware of the problem:

“We were certainly on it. It was top of the HMRC agenda issue with me. This is probably the single biggest area in percentage terms of fraud and error in the tax system at the moment.”

However nothing much seems to have happened until 2022. It was then that The Times reported that people were treating R&D tax credits as “free money” and making clearly non-compliant claims for, most notoriously, vegan menus. HMRC then conducted its detailed analysis of claims for 2020/21, but it was a year more (August 2023) before more stringent procedures were introduced to discourage frivolous/fraudulent claims.

Why?

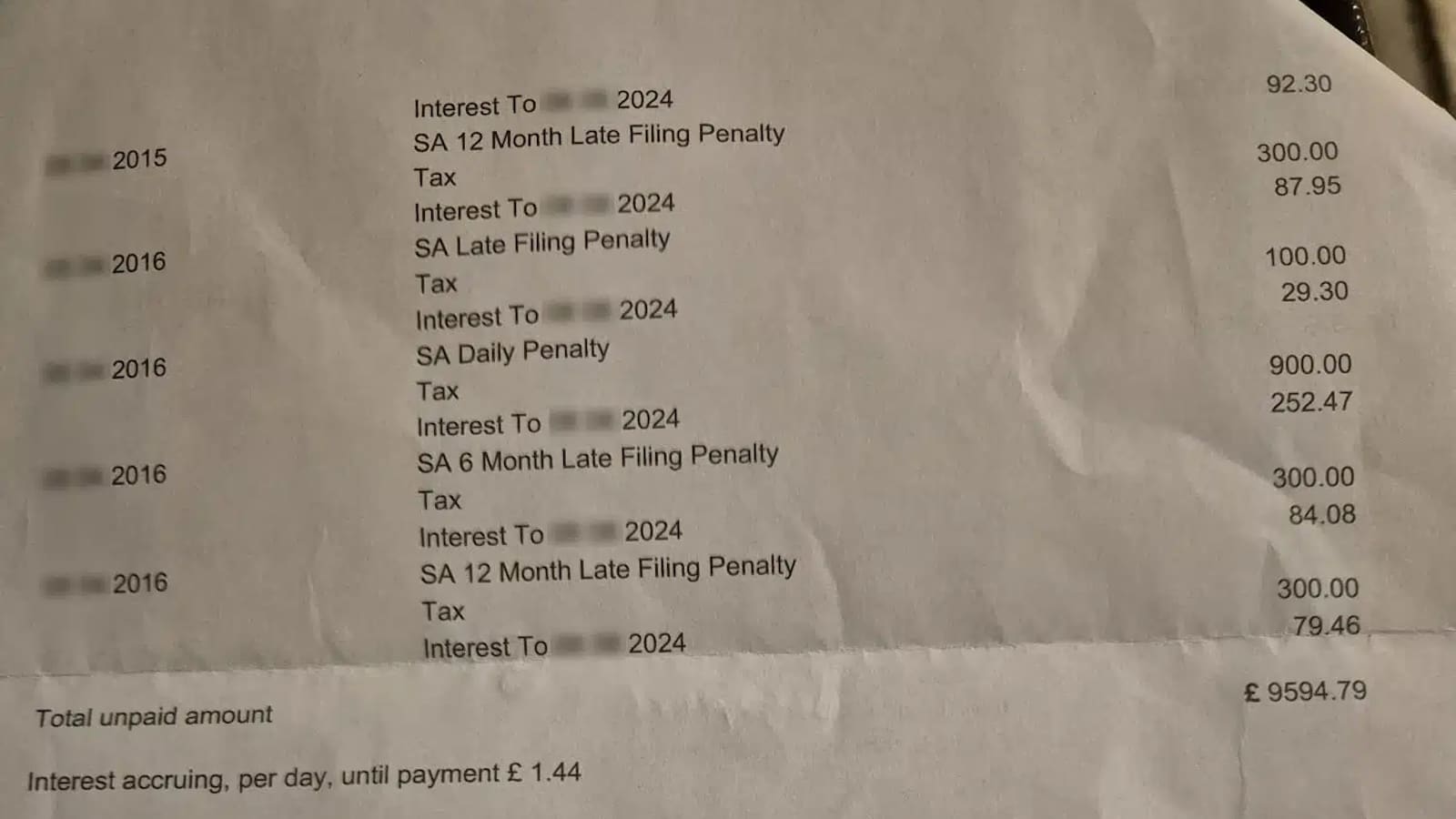

We don’t know. But we believe it’s a scandal. We as taxpayers have lost up to £10bn, little of which is likely to be recovered. Many small businesses that made more recent claims will find them challenged by HMRC, and will find themselves out of pocket (with the fees they paid their R&D advisers hard to recover).

It’s been described as the “next PPI scandal” given the number of businesses affected and the large liabilities they have. However, at least with the PPI scandal, the banks ended up compensating the people they’d sold useless insurance. In the case of the R&D tax scandal, most of the small businesses affected won’t receive compensation from anyone. Likely almost all of that £7-10bn is lost to the Exchequer for good. Much of that went as a chaotic and uncontrolled subsidy to small businesses. Some 20-30% of it went as fees to questionable and even fraudulent advisers.

There is now an equally depressing coda: businesses undertaking real R&D projects have had their claims delayed, putting some startups in financial jeopardy.

Who will be held accountable for this?

Thanks to Paul Rosser and T, O and A for their R&D tax credits expertise.

Footnotes

All data from official statistics available here. ↩︎

There were further small changes, but too marginal to drive changes of this magnitude. ↩︎

See section 5.1.5 starting on page 256. ↩︎

See section 4.1.5 starting on page 241. ↩︎

A business’ “sector” is determined here by a company’s Standard Industrial Classification (SIC) code, and this coding is often subjective or inaccurate. For example, Tax Policy Associates Ltd is a “tax consultancy”. It’s also unclear how HMRC allocated businesses which listed multiple different SIC codes. ↩︎

Leave a Reply to Alistair Sloan Cancel reply