It’s very hard for normal people to understand tax legislation, and it’s often equally hard for tax lawyers, unless they have a deep familiarity with the rules.

Here’s an example, promoted by the Angela Rayner CGT controversy (although I don’t believe this point has any bearing on her position).1For completeness, there are two ways it could in theory be relevant. First, Angela Rayner could have been wrongly advised that the fact she and Mark Rayner lived in separate houses meant that they were not “living together” and they each had a separate main residence exemption. That seems unlikely, but is not impossible if she was advised by a non-specialist. Second, it could be that there are personal circumstances we are unaware of that mean that Angela and Mark Rayner really were separated well in advance of the 2020 date that they announced their separation – but there’s no reason to think that’s the case. A couple who are not living together in reality can, nevertheless, be “living together” for tax purposes.

An individual is exempt from capital gains tax on their main residence. But spouses who are married and “living together”, can only have one main residence between them.2That’s not the only CGT consequence of being married. Transfers of assets between spouses aren’t subject to CGT (the original acquisition cost of the asset is “inherited” by the receiving spouse). Again, this is only if they are “living together”.

So imagine a couple, with no children, who are married, but keep separate houses and live separate lifestyles (as if they’re dating, but they’re actually married). They are not, in the normal meaning of the term, “living together”. Does that mean they can each have a CGT-exempt main residence?

The legislation

HMRC guidance on divorce and separation says what HMRC think “living together” means. But it’s unclear whether this is just HMRC’s view (which has no legal status) or reflects the law. So it’s always important to look at the actual legislation (which, unhelpfully but typically, isn’t cited by the HMRC guidance).

The legislation is in section 222 of the Taxation of Chargeable Gains Act 1992:3This and the other excerpts I’ve quoted are from the legislation as it stood in 2015, when Angela Rayner sold her property. Tax legislation changes frequently and one always has to look at the legislation as it stood at the time in question (although in this case the changes aren’t material).

![In the case of an individual living with his spouse or civil partner]—

(a)there can only be one residence or main residence for both, so long as living together and, where a notice under subsection (5)(a) above affects both the individual and his spouse or civil partner], it must be given by both,](https://taxpolicy.org.uk/wp-content/uploads/2024/04/Screenshot-2024-04-12-at-13.20.20-1024x174.png)

There is nothing in this section, or near it, that suggests the phrase “living together” has a different meaning from normal English, and someone reading this (tax specialist or layperson) would be forgiven for thinking that the usual ordinary meaning can be applied.

But TCGA ends with an interpretation provision in section 288, and in subsection 3 we see:

![References in this Act to [an individual living with his spouse or civil partner] shall be construed in accordance with [section 1011 of ITA 2007].](https://taxpolicy.org.uk/wp-content/uploads/2024/04/Screenshot-2024-04-12-at-13.09.42-1024x68.png)

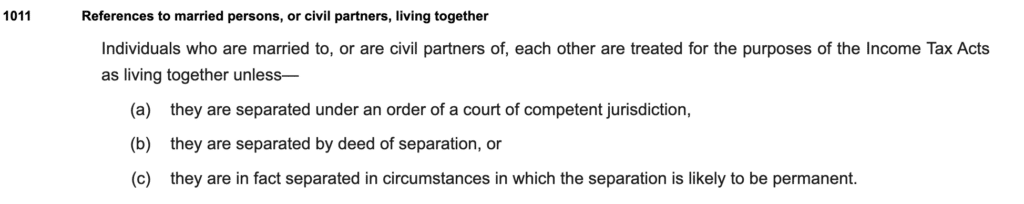

Section 1011 of the Income Tax Act 2007 then says:

So our hypothetical “separate lifestyle” married couple may not be living together in ordinary human terms, but they are almost certainly4I say “almost certainly” because it could be argued that s1011(c) applies to a “separate lifestyle” couple. I would say not – my view is that in context it means the couple have split up, but this point is not beyond doubt. “living together” from a tax perspective, unless they have split up.

They aren’t living together, but they are “living together”. Brilliant.

This is really poor legislative drafting. It’s an area highly relevant to normal people, who often won’t be advised, and yet the way the legislation is drafted is impenetrable; misleading, even. How hard would it have been to add a provision to s222(6) TCGA cross-referencing either to section 288(6), or directly to s1011?

Modern legislation is usually better – there was a “Tax Rewrite Project” in the 2000s which aimed to clarify things, for example by including copious cross-references to defined terms. But in this case it didn’t help – take for example this provision of the ITA 2007 which uses the “living together” term without any hint that it’s defined in s1011.

How could anyone get this point right?

Practitioners working in the area will know this point.

For other practitioners, it is always good practice to check the interpretation provisions at the end of an Act before advising, but it’s easy to forget to do this, particularly when a term doesn’t look like a defined term.5In my first week as a tax trainee, a partner (Richard McIlwee, long retired) gave us a fantastic 30 minute talk on statutory interpretation. The key message was “keep reading”. When you’ve read a clause, read to the end of that section. Then read to the end of the chapter. Then read to the end of the Part. Then read the interpretation provisions of the Act. A non-specialist, particularly one in a hurry, could easily assume “living together” is just a simple factual question, and not check. That’s why it’s so dangerous for a tax adviser to advise outside their area of expertise.

For the layperson, it seems to me almost hopeless. You can’t rely on HMRC guidance, and you can’t dip in and out of tax legislation and hope to find the correct rule. I have no answer to this.

Photo by Taylor Deas-Melesh on Unsplash

- 1For completeness, there are two ways it could in theory be relevant. First, Angela Rayner could have been wrongly advised that the fact she and Mark Rayner lived in separate houses meant that they were not “living together” and they each had a separate main residence exemption. That seems unlikely, but is not impossible if she was advised by a non-specialist. Second, it could be that there are personal circumstances we are unaware of that mean that Angela and Mark Rayner really were separated well in advance of the 2020 date that they announced their separation – but there’s no reason to think that’s the case.

- 2That’s not the only CGT consequence of being married. Transfers of assets between spouses aren’t subject to CGT (the original acquisition cost of the asset is “inherited” by the receiving spouse). Again, this is only if they are “living together”.

- 3This and the other excerpts I’ve quoted are from the legislation as it stood in 2015, when Angela Rayner sold her property. Tax legislation changes frequently and one always has to look at the legislation as it stood at the time in question (although in this case the changes aren’t material).

- 4I say “almost certainly” because it could be argued that s1011(c) applies to a “separate lifestyle” couple. I would say not – my view is that in context it means the couple have split up, but this point is not beyond doubt.

- 5In my first week as a tax trainee, a partner (Richard McIlwee, long retired) gave us a fantastic 30 minute talk on statutory interpretation. The key message was “keep reading”. When you’ve read a clause, read to the end of that section. Then read to the end of the chapter. Then read to the end of the Part. Then read the interpretation provisions of the Act.

19 responses to “Are you living with your spouse? The unreal world of capital gains tax”

This is a fascinating article but I think it is flawed.

The article ignores the fact that TCGA 1992 is a consolidating legislation and as such is not meant to change the law. In particular TCGA 1992 in relation to this only or main residence relief essentially restates the provisions of CGTA 1979.

But looking at the interpretation provisions for TCGA 1992 and CGTA 1979 there is a subtle difference.

CGTA 1979 S155 is similar to TCGA 1992 S288 and states:

“(1) In this Act, unless the context otherwise [my emphasis] requires—

..

“married woman living with her husband”: see subsection (2) below,

…”

“(2) References in this Act to a married woman living with her husband shall be construed in accordance with section [F7282] of [F1the Taxes Act 1988].”

It is clear to me that S222(6) TCGA 1992 and its predecessor S155(6) CGTA 1979 are sections where the context otherwise requires you read these words with their normal everyday meaning rather than a defined meaning. The give away to me is that S222(6) states

“…. in the case of an individual living which his spouse or civil partner ….. .. so long as living together…..”

If Davids intereprestion is correct there would be no need for the words “so long as living together. If one looks at the original CGTA 1992 then this words used are even more striking and it is hard to come down to a conclusion that the words in this instance or meant to refer to their natural meaing rather than look to a definition elsewhere.

So I believe that the legislators meant this restriction to apply where a married couple actually live together in reality.

This does not mean that where the majority of married couples who have two or more residences (for example they own a holiday home) they can claim two resident allowances as most of them are actually likely to be considered to be living together and thus the restriction under S222(6) will apply and they will only get one residence allowance.

However. I believe that where a married couple do not actually live together and each have only one residence then each may have their own relief on their only residence.

Interesting point. But IMO “unless the context otherwise requires” needs a very clear overriding of the usual rule, I would say either a clearly impossible or absurd result, or a different definition. Otherwise it would create a great deal of uncertainty, particularly around terms that are defined in s288 and frequently used e.g. “control”

I’d say “so long as living together” just means so long as “living together” within the legislation.

It seems more than possible that Ms Rayner’s recent professional advice may have been that a gain arose which was not covered by PPR relief, but that since there is no evidence of deliberate failure to file an accurate tax return, HMRC are now, more than six years later, unable to collect the tax, meaning that Ms Rayner’s protestations that she does not owe any tax are the truth. Perhaps not, arguably, quite the whole truth; but enough to serve the purpose.

That seems inconsistent with what her team is briefing the papers – the line is that she had no taxable capital gain.

My instant normal English rendition of a married couple living together would be “not separated”

What if the separate lifestyle couple has one spouse living outside UK? If the UK residence of the UK spouse is deemed the main residence of the couple then only the UK resident spouse can claim PPR it seems

We have this problem and nobody nows the answer it seems.

The same ITA 2007 s1011 definition is used in parts of the stamp duty land tax code. For example it comes into the 3% surcharge for additional properties and the rules about “replacing an only or main residence”.

These rules can help a buyer escape the 3% surcharge, even though they have other property interests, if they meet the conditions for “replacing” their main residence.

There are a set of conditions in FA03/Sch4ZA/para3(6). One of the conditions is that there has been a disposal (usually a sale) of a previous home. That sale would usually be by the person concerned. But the provisions say it could also be by the person’s “spouse or civil partner”.

Looking down to 3(6A) we find that only applies if they were “living together” and para 9(3) directs us to ITA2007 s1011 for the meaning of that.

Dan is being a bit unfair here. The problem is really the lack of signposting, not the definition. The s. 1011 definition arguably gives the provision the scope one would expect it to have.

Interestingly, both Dan’s living in separate houses example and Rebecca’s care home example are dealt with by the Revenue’s gloss that separation in fact occurs only where the marriage has broken down.

Perhaps the real problem is that the Tax Law Rewrite ran out of steam before getting to the Taxation of Chargeable Gains Act 1992, an Act which could certainly have done with a rewrite – for a start, try finding a straightforward statement of the basic rule for calculating a chargeable gain.

thanks! Yes, I agree that the rule itself is fine, but the lack of signposting is a problem. It’s also not ideal to have a term (“living together”) which has a definition which doesn’t mean what the term means.

Dan

Good interpretation/comment on tax legislation.

Mr McIlwee provided very sound advice, which unfortunately not all who provide tax advice follow.

I think whoever provided Ms Rayner with tax advice regarding a possible CGT liability may well be looking carefully at their Professional Indemnity insurance policy.

Good luck to Greater Manchester police in deciding whether or not a criminal offence has been committed by Ms Rayner – I doubt they have the expertise and will likely have to incur incur professional costs.

Mr Ashcroft and Mr Daly appear to have opened a ‘can of worms’ – Hopefully they are both (particularly Mr Ashcroft in connection with tax domicile) confident that their tax affairs are completely in order.

I thought the police were looking into the question of the residence declared for the electoral register. Are they also looking into the tax question?

It would be more logical for HMRC rather than the police to be looking into whatever may or may not have been declared for tax. But so far as I am aware there has been total silence on this.

don’t think so – the police don’t look into tax matters, and there’s no evidence of tax evasion that I’m aware of. Whatever HMRC do will be invisible to the rest of us, given their confidentiality obligations.

Even if there would have been tax to pay, wouldn’t it be too late for HMRC to make a discovery assessment, because it is more than 6 years since the due date?

probably, yes!

One of the really tough areas with this is when one spouse goes into a care home and has sufficient needs that mean they will never be able to return to the marital home. In these cases the separation means that the couple are never likely to live together again (the third leg of the definition). I have not known HMRC to take the case, but technically the law does not recognise this situation. For those with early onset dementia this could be an issue. Fortunately I have not had to deal with a case but it worries me as the absent spouse still has ownership of 50% of the property but could not claim PPR – at least that is a risk.

Why do we accept tax legislation that is difficult for the man and woman on the street to interpret? Even worse when professionals arrive at different answers to the same question. Maybe something the OTS could have tackled instead of recommending greater alignment between income tax rates and CGT rates?

Perhaps a very long view is in order.

One idea of the Protestant Reformation was that people should understand the logic of their religion (be coached rather than dictated to), hence the translations of the bible and holding services in the vernacular.

That ordinary educated people should understand the law, including tax law, followed from that.

But common understanding removes power from specialists, whether lawyers or priests, and specialists are generally the ones who changes the rules, so there is usually a natural bias to add obfuscation.

There is also the fact that from c1990, word-processing vastly reduced the effort required to create complexity in documents.

Note 2 is not completely accurate. When the transfer is made under a court order in the case of a divorcing couple, the transfer is made under the no gain no loss basis as are transfers within 3 years of the end of the year of separation.