There are a surprising number of people still promoting tax avoidance schemes. Of course, they say they’re not tax avoidance schemes, but the giveaway is that they are promising a much better tax result than you’d normally get. Often this makes people nervous. Two lines the promoters use to get round this are “we have an opinion from an independent KC” and “don’t worry, we’re fully insured”.

Here’s why this should make you more, not less, worried.

The problem with KC opinions

A KC avoidance scheme opinion in practice provides you, the client, with zero comfort. In fact it potentially makes your position worse.

1. The opinion is probably wrong

Most KCs are outstanding lawyers with an excellent reputation – they will give the correct legal answer, whether it’s convenient or not. But there are some who, even when faced with dubious tax avoidance schemes, give the answer the client wants. Jolyon Maugham described them as “The Boys Who Won’t Say ‘No’“.

And The Boys usually turn out to be wrong.

The taxpayer has lost almost every single tax avoidance case to come before the courts in the last 25 years. I’m aware of only two cases1 where the taxpayer won, and the response was to enact the general anti-abuse rule (GAAR) so that it wouldn’t happen again.

The Boys provided opinions for many of these, and all of them were wrong.

Mostly we don’t get to see the opinions, or even know which KC issued them, but in some cases we have the details:

- Robert Venables KC provided an opinion that a contractor loan scheme wasn’t disclosable under DOTAS; the tribunal thought it clearly was disclosable.

- Here’s a scheme we wrote about, involving the astonishing step of incorporating thousands of UK companies with Filipino directors to escape HMRC scrutiny. The owner of the business ended up admitting fraud. But there was an opinion from Giles Goodfellow KC that it was fine.

- In one of the many film tax relief avoidance schemes, Andrew Thornhill KC said he “had no doubt” that the entity was trading. It wasn’t.

KC opinions in general are (in my experience) usually sensible and astonishingly right (i.e. they successfully predict the outcome when the point is later tested in court). So why are these opinions so wrong?

The charitable answer is that the KCs are advising on the basis of their instructions from the promoter, which usually puts forward the most favourable possible legal and factual position – very possibly making assumptions of fact which don’t apply to your individual case. And it is not uncommon for the structure that the “KC” approved to be markedly different from the structure the promoters end up implementing.

There are other obvious, but less charitable, answers…

2. You’re not the client

You’re not the KC’s client. The promoter is the KC’s client. So, even if the KC is completely wrong, you can’t sue him.

In that film relief case, even though the taxpayers relied on the KC’s advice, their claim for negligence failed.

3. The opinion makes it harder for you to sue the promoter

If everything goes wrong, the only person you can sue is the promoter.

You’ll sue them for negligence, which means you have to show that no reasonable adviser would have given the advice they gave. That is a harder task if they have a KC opinion, because they can then say they were following the advice of an eminent KC, which (they will argue) must have been a reasonable thing to do.

The KC opinion can make your position worse.

4. Normal people don’t need KC opinions

A KC opinion can be very useful if you’re in a dispute with HMRC, to get an independent view of your prospects of success. And people with complex affairs often have a legitimate reason to seek a KC’s advice (e.g. large companies, very wealthy people with assets all over the world).

But normal people shouldn’t be doing anything so complicated and uncertain that it requires a KC opinion (I’d certainly never put myself in that position).

The best approach to tax is to be boring, stick with the crowd, and do what everyone else is doing. That’s true for taxpayers of all kinds. When I was a practicing lawyer, I advised some of the largest and most sophisticated businesses in the world. If I’d told them I had a unique way to save tax, different and better than everyone else’s approach, they would have fired me on the spot.

The truth about insurance

This is a typical claim from the “Head of Estate Planning” at Less Tax for Landlords, an adviser/promoter we’ll be reporting on soon.2

“You also will be covered by our professional indemnity insurance. Our insurance is designed to return you to the place that you would have been had you never engaged with us. So it just ensures that although it won’t pay for example any tax that you would have paid if you didn’t do this, if any additional tax occurs because you engage with us it would cover that. It would cover any fines, any penalties and any further advice and also it would cover us to help you argue if HMRC ever had any issues and looked into this.”

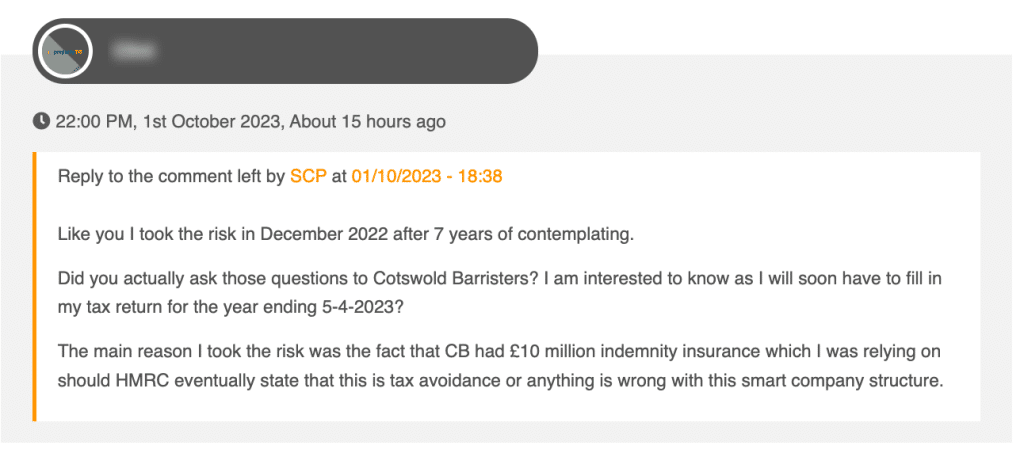

And here’s someone on Property118’s website, who claims to have used the Property118 scheme on the basis of assurances that Cotswold Barristers were insured:

This all suggests that, if HMRC don’t agree with the tax treatment, you’re not out of pocket… you get immediately reimbursed by the friendly insurers.

Here’s what actually happens:

- Initially – nothing. You file the tax return, HMRC’s systems accept it, and you don’t hear anything back.

- Later, likely years later, HMRC tell you they disagree with your tax position, and claim back years of tax, plus interest and potentially penalties.

- You and your advisers have a lengthy exchange of correspondence with HMRC, trying to persuade them to back off.

- HMRC don’t back off – they require you to pay tax on the basis the scheme didn’t work.

- You disagree and file an appeal with the First Tier Tribunal.

- You lose that appeal, and possibly make and lose appeals in higher courts.

- At that point you have to pay up.3

- You then sue the advisor for negligence.

- The adviser then notifies their insurer and the insurer steps in, but not on your side. The insurer will (in most cases) run the advisor’s defence. Remember, you’re not insured – the adviser is.

- (Unless the insurer finds a way to argue that the claim isn’t covered. Insurers are good at this. It is, for example, possible that selling a scheme on the strength of the insurance could itself invalidate it.

- You now have to win the negligence claim (or get a good settlement). This isn’t easy – many professional negligence claims fail. In short, you have to show (1) that the advice was so unreasonable, no reasonable advisor would have given it, (2) that it was reasonable for you to rely on their advice, (3) that you wouldn’t have entered into the arrangement if they’d given you correct advice, and (4) that you took reasonable steps to mitigate your loss.4.

- Clients/victims of the various avoidance schemes of the last 20 years have generally had very little success getting recovery from their advisers.

- There will be lots of arguments about “quantum” – how much you are entitled to recover, and how much tax you would have paid anyway, if you hadn’t entered into the scheme. The best you can hope for is interest, penalties, and additional taxes the scheme created. You’ll never get back the tax you thought you’d saved with the scheme – this is gone for good.

- Once you win, the insurer then pays out. Even in this happy scenario, you’ve still been out of pocket for the (likely) years it took to pursue the negligence claim.

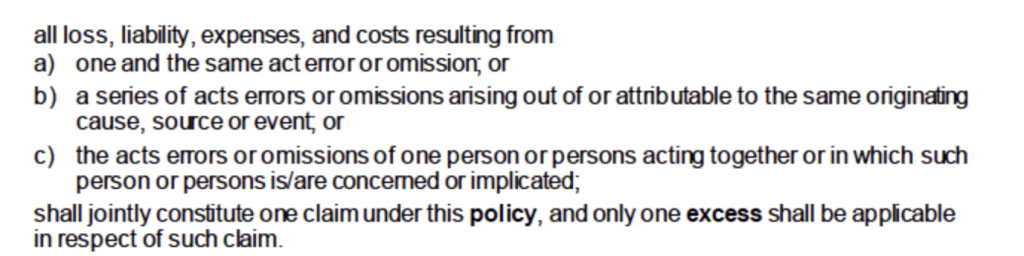

And it could be worse than this. Promoters often say they are covered for £2m (or more) “per claim”. But that is very different from “per client”. Imagine a promoter sells 500 basically identical schemes, and the same point goes wrong on all of them. The insurance may well contain wording like this:

In which case the insurer won’t be liable for 500 x £2m, but only a maximum of £2m total, across all 500 schemes. £4,000 each.

Finally, professional liability insurance often has this exclusion:

Which would could deny the claim entirely.

Even in a best case scenario, the only benefit of the insurance for a client is that it protects you against the adviser going bust or disappearing (if it’s “run-off” insurance, which it may not be). That’s not nothing… but it absolutely doesn’t make it easier for you to recover any tax you have to pay to HMRC.

When I was in practice, I never assured a client that they didn’t need to worry, because we had insurance. We certainly had insurance – a very serious policy with a very large amount of coverage. But my clients knew that the insurance is primarily there to protect the advisers, not the client. Insurance is not a guarantee that the adviser is correct.

My advice

You should expect your adviser to explain and stand behind their own advice. Promoters’ use of KC opinions and insurance is just a sales tactic. You want a competent technician, not a magician5 or a salesman. Remember, tax is supposed to be boring.

Image is © HMRC.

Footnotes

the SHIPS 2 case, essentially because the legislation in question was such a mess that the Court of Appeal didn’t feel able to apply a purposive construction, and D’Arcy, where two anti-avoidance rules accidentally created a loophole. ↩︎

Video is © Less Tax for Landlords Ltd, and excerpted by us as fair dealing for the purposes of criticism and review. ↩︎

At least for income and corporation tax; for some other taxes (e.g. VAT) you have to pay up before you apply for the first appeal. ↩︎

My apologies to any tort lawyers reading this on a horrible over-simplification ↩︎

We’d make an exception for one tax adviser we know who’s a member of the Magic Circle ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply to Michael Richards Cancel reply