Here’s Jacob Rees-Mogg in Wednesday‘s Telegraph:

We hear this a lot. But it’s a terrible argument:

We pay tax on already-taxed assets all the time

Literally every day:

- I just bought a kebab. 20% VAT. I paid for it out of taxed income. Double tax. And this applies to almost everything I spend money on.

- I bought petrol yesterday out of taxed income. I paid fuel duty, and VAT on the fuel duty. Triple tax.

- Same with alcohol – VAT is paid on top of the alcohol duty. Triple tax again.

- I pay the salary for my assistant1 out of my own taxed income. He buys petrol for his car. My income tax, his income tax, his fuel duty, VAT. Quadruple tax.

And so on and so on.2

The point is: there is no principle that we don’t pay tax on already-taxed assets. There never could be such a principle.

In practice, most of the time, the main inherited asset hasn’t been taxed at all

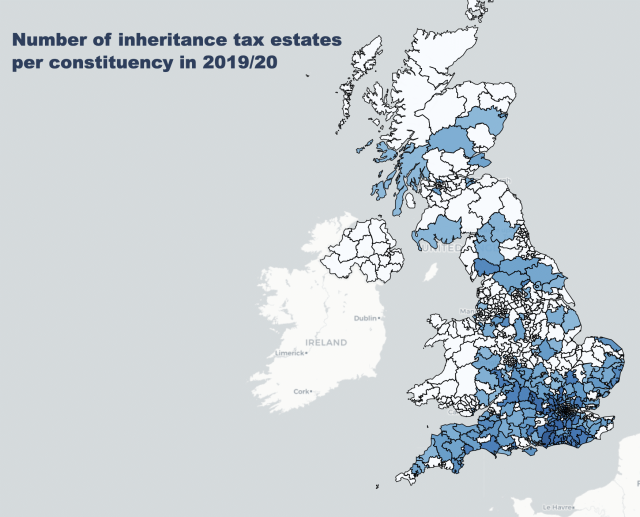

House price growth over the last 40 years means that most of the wealth of the “boomer” generation is in inflated house prices – and that rise in house prices was mostly untaxed.

That’s the same generation whose estates (if over £1m) are going to be paying most of the inheritance tax for the next 20 years.

So likely a majority of the estate value subject to inheritance tax will never have been taxed before. No double tax.

Dead people don’t pay tax

Let’s accept two unlikely premises for the moment. It’s unfair to pay tax twice, and the assets subject to inheritance tax were already taxed.

But the critical point: they were taxed in the hands of someone who just died. The burden of inheritance tax isn’t paid by a dead person – how could it be? – but by whoever is inheriting.3 They get the asset for free, and most certainly didn’t pay tax on the asset before.

So there is no double tax at all, even conceptually.

Tentative conclusion

We double and triple tax all the time. This isn’t an example of double taxation. This is a terrible argument. Please stop making it.

Footnotes

Who does not exist ↩︎

I’d be grateful to anyone who can find an example of quadruple tax involving only one person ↩︎

The estate legally pays, but who legally pays is economically almost irrelevant. The question is: who economically carries the cost of the tax? It can’t be the dead person, because they are dead. The tax reduces the inheritance for the beneficiaries. So obviously it is the beneficiaries, the inheritors of the estate, who bear the economic cost of the tax ↩︎

Leave a Reply to Paul Parkinson Cancel reply