We wrote last week about a school fee tax avoidance scheme, promoted by Signature Tax (the tax boutique owned by the SNP’s new auditors). We’ve since been deluged with reports of other promoters pushing the same scheme. We’ve reported Signature and three other firms to their regulators. More below about who the promoters are, and how they can be stopped.

UPDATE: HMRC have now issued a “Spotlight” stating that HMRC also believe the schemes don’t work, and warning people off them

The rule they’re trying to avoid

An obvious wheeze is for wealthy parents to gift a valuable asset (say, shares) to their children. Then dividends on the shares are taxed at the children’s much lower tax rate – potentially saving ££££. Parents with three children at an expensive private school could save more than £60k of tax per year.

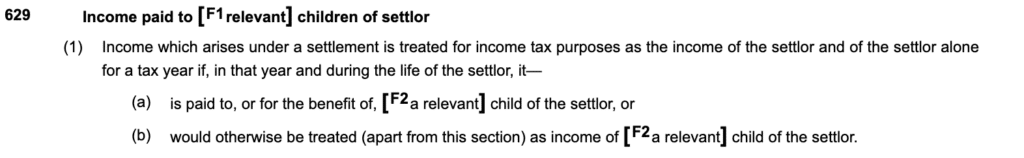

The wheeze is so obvious that there’s a rule stopping it. It’s worth stepping through the legislation, because I think it demonstrates to non-specialists just how straightforward the point is:

“relevant child” is defined to mean a child under 18:

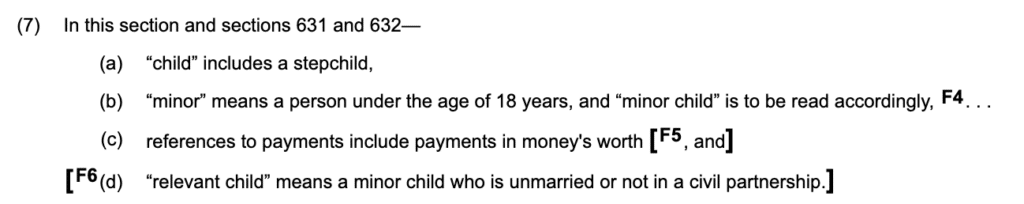

And “settlement” and settlor are defined extremely widely:

Looking at the legislation, here are some things that are fine:

- Grandparent or Aunt gives valuable shares to a child. The child pays tax on the dividends at a much lower rate, and there’s a big tax saving. Permitted by the rules and entirely proper.

- Rather than giving the shares to the child, Grandad/Auntie declares a trust. They may in fact need to do this, because minors can’t hold shares. Permitted by the rules and entirely proper, and if it’s a simple or “bare” trust then the tax result is the same as if the child owned the shares.

- The grandparents have their own company. They issue shares to the children (via a trust) to fund their education. Now you might think this shouldn’t be permitted, but it is – and realistically it’s the same as the previous two examples, just using the grandparents’ own company.

And here are some things that don’t work:

- Parents give valuable shares to their children. That’s a settlement within s620, and the parent is taxed on the income.

- Parents give valuable shares to Granny, and Granny gives the shares to the children. That’s an “indirect” settlement within s620(3)(a) and/or a “reciprocal arrangement” within s620(3)(c). The parent is still taxed on the income. And if those involved hide the connection between the gift to Granny, and her gift to the children, it’s not just failed tax planning – it’s criminal tax evasion.

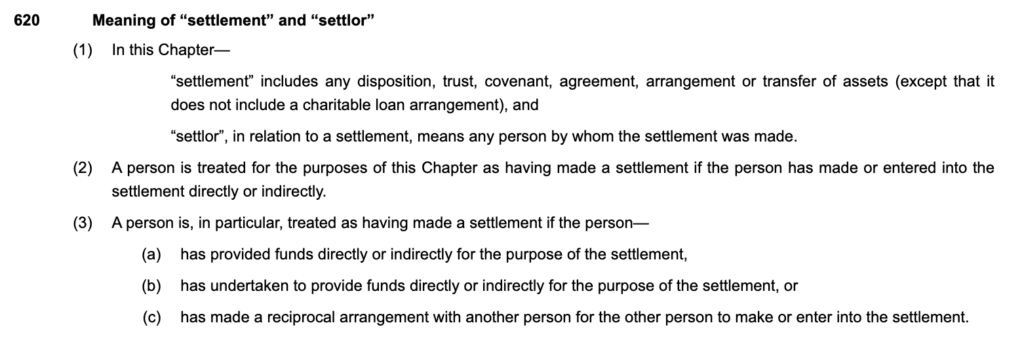

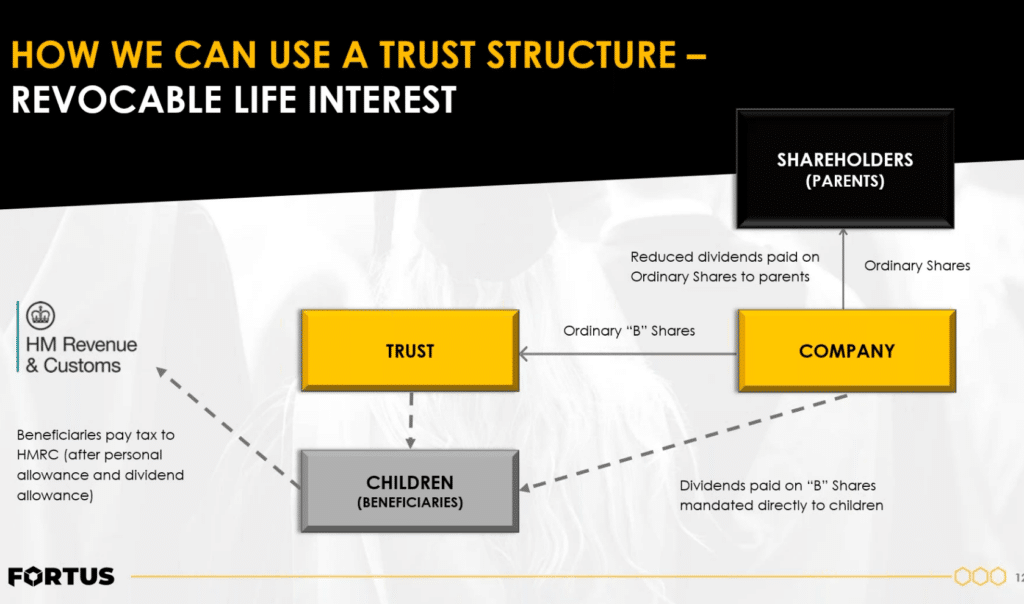

- Parents have their own company. It issues valuable shares to Granny/Uncle/whoever for free (or almost free), and Granny/whoever declares a trust in favour of the children. Well, that’s exactly the same as the previous example. It doesn’t work, and if it’s hidden from HMRC then we’re getting into criminal territory. But that’s the structure that some promoters are pushing.

I think most people (specialists or laypeople) reading the legislation above would see immediately that the scheme doesn’t work. There’s even HMRC guidance almost directly on point:

The Signature scheme

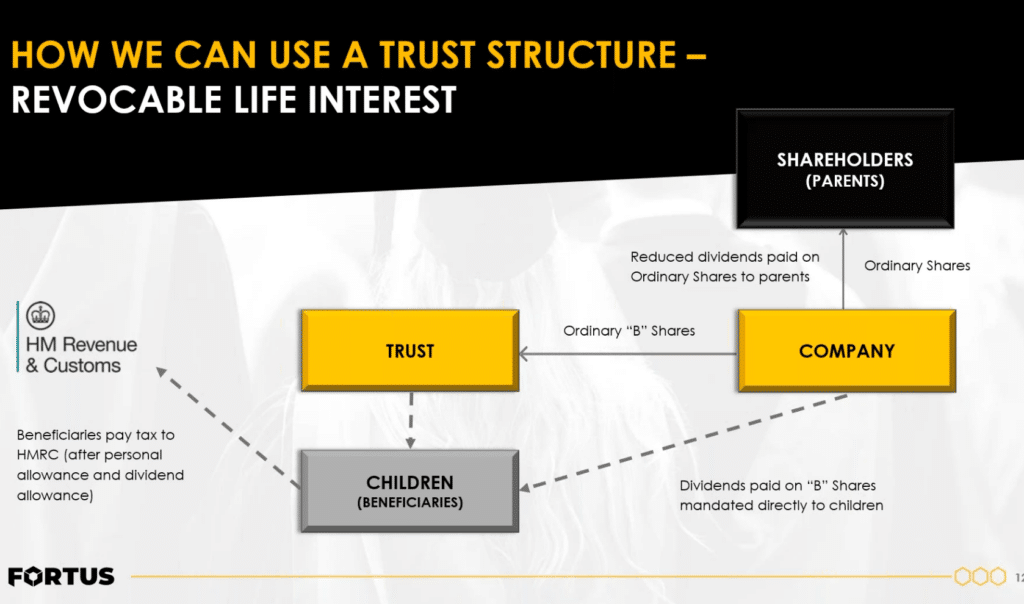

Here’s a presentation kindly provided by an outfit called Fortus, in a webinar on their website1. It’s the same as the Signature scheme. It’s also almost exactly the same as the one that HMRC guidance, and common sense, says doesn’t work:2. (I’m going to call this the “Signature scheme” just because I came across Signature first.)

So how on earth do Fortus/Signature think the scheme works? Here are a few possibilities:

- It’s completely kosher, because the grandparents/trust is paying full value for the B shares, and so there is no “indirect” settlement by the parents. The problem is that this isn’t plausible. If the grandparents had the necessary £££ to hand, they’d just be making a gift3 directly to the children, and wouldn’t need to involve the parents or their company. It would also be a highly inefficient structure, because instead of the grandparents paying £100k/year, they’d be paying a lump sum equal to the present value of many years’ worth of £100k – approaching a seven-figure sum. I don’t think anyone would do that.

- They don’t bother. The nature of the B shares is never disclosed to HMRC, and they’re just chancing HMRC doesn’t spot what’s going on. Probably they’ll get away with it… but make no mistake, that’s criminal tax fraud.

- They claim the B shares are a genuine investment, with the grandparents/trust paying a few £k. They skate over the fact that the actual value is much higher than that. Again, this feels more like tax fraud.

- They run a series of crap valuation arguments, saying that the limited rights attached to the B shares mean their value is low. That is belied by the fact that they expect the B shares to pay enough dividends to cover school fees. However if everything is fully disclosed to HMRC, and the valuation argument presented, then even though if it’s wrong it’s unlikely to reach the level of criminality.

- The trust/grandparents provide full value for the shares, but it’s funded by the parents in the background. Clearly doesn’t work – and if hidden then again we’re in criminal tax fraud territory.

- There is no dishonesty here – the promoters are just clueless.

I asked Signature and Fortus to comment; neither have responded. I’m making a formal complaint about Signature to the Taxation Disciplinary Board4, and to both Signature and Fortus to the Institute of Chartered Accountants in England and Wales (ICAEW).

What are other advisers up to?

Some advisers are promoting arrangements where grandparents gift property, or shares in a family business, to their grandchildren. We can think this is a good or bad thing from a policy perspective. but it’s clearly within the rules. See, for example, theprivateoffice.com, The Money Panel🔒, and RDG Accounting, Henderson Logie and PD Tax Consultants🔒. Each makes clear that it can’t be the parents gifting the property.

But there are other advisers who appear to be either ignorant of the rules, or trying to circumvent the legislation.

Accotax⚠️ fail badly:

… as they appear to be entirely unaware that parents can’t get a tax benefit from gifting shares in their company to their child.

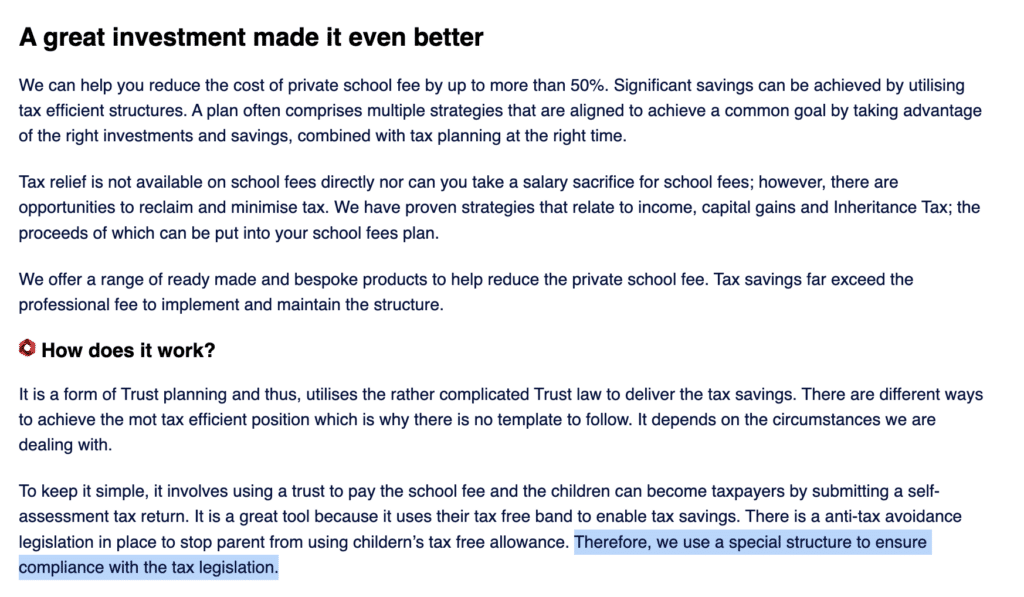

By contrast, TaxQube are aware of the issue, but say they have a “special structure” to fix it:

When I suggested that sounded like the Signature scheme, they responded by amending their website…

… and then making incoherent legal threats, but weirdly failing to explain what their “special structure” was. Absent an explanation, it’s reasonable to assume that their reference to a “special structure” was to the Signature scheme, or something like it.

Walji & Co propose something…

… that looks like the Signature scheme.

SFIA Wealth Management⚠️ seems even worse than Signature…

… they’re either ignorant of the “indirect” rule or promoting tax evasion.

I understand from a source that SFIA charges £1,000 to taxpayers just to provide a report proposing their structure (which I assume is going to be similar to Fortus/Signature), then £7,000 for implementation. Apparently SFIA aren’t too keen on clients taking independent advice – I’d suggest it’s fairly obvious why.

I’ve referred Accotax and Walji & Co to the ICAEW, and will be referring Tax Qube to the ACCA, and SFIA Wealth Management to the FCA. I’ll refer more promoters as further reports come in.

The cost of the schemes

These schemes have two massive costs:

- First, to taxpayers who get caught up in them, and end up being challenged by HMRC, and paying the tax back, plus interest and very possibly penalties.

- Second, to all of us, as tax revenue is lost to the schemes that (inevitably) HMRC miss5.

So its in all of our interests that the schemes are stopped.

Stopping the schemes

I’m referring the advisers involved to HMRC, but this is just scratching the surface. Safe to assume that for every adviser foolish enough to explain their duff scheme on the internet, there are dozens who promote schemes in the shadows.

Ultimately only HMRC can stop this, by publicly calling out the schemes, saying they don’t work, and using its array of new powers to challenge the people who promote them.

Will they?

Footnotes

(c) Fortus, but there is an obvious public interest and fair dealing justification in making a copy publicly available ↩︎

Actually the scheme in HMRC’s example is less terrible, because the company is new and so there is at least an argument the shares have no value when granted. The Fortus and Signature schemes involve pre-existing companies where the shares are clearly valuable ↩︎

or declare a trust ↩︎

Because Signature promote themselves as a member of the Chartered Institute of Taxation ↩︎

Why do they miss schemes? In part because no bureaucracy is perfect. In part because some of the schemes involve non-disclosure to HMRC of key elements, and whilst that doesn’t help the technical analysis – and creates jeopardy of criminal tax evasion – it means that HMRC may not spot what’s going on ↩︎

![To: jeevacation@gmail com[eevacation@gmail com]

From: Peter Mandelson

Sem: Sun 11/7/2010 2 34 57 PM

Subyect: Fwd Rio apartment

Seat to mys bank manager Gratetul tor helpful thoughts trom my chief lite adviser

Sent from ims iPad

Bevin torwarded messave

From: Peter Mander iS

Date: 7 November 2010 [4 29 12 GMI

Subject: Rio apartment

P| ag awe dpeecussed Pan consdernne a purchase of an apartmentin Rion Ttisain](https://taxpolicy.org.uk/wp-content/uploads/2026/01/Screenshot-2026-01-31-at-21.27.15-640x360.png)

Leave a Reply to Andrew Cancel reply