Libel firm Carter-Ruck used the threat of legal action to protect one of the world’s largest financial frauds, OneCoin, which stole $4 billion from investors. Carter-Ruck’s client, Ruja Ignatova, is now one of the FBI’s ten most wanted fugitives.

The Solicitors Regulation Authority is now prosecuting Carter‑Ruck partner Claire Gill for an improper threat of litigation. Carter‑Ruck’s response was to try to cover everything up, applying for anonymity and private hearings.

We led a coalition of NGOs to press for open justice. The Solicitors Disciplinary Tribunal just ruled that Carter-Ruck was instructed to further a fraud and, as a result, the hearings will be open and all filings will be published.

Wider questions remain about Carter-Ruck’s role – and this is not the first time they’ve helped protect a Ponzi fraud.

Carter-Ruck and OneCoin

Carter-Ruck is possibly the UK’s most well-known libel-specialist law firm. At some point in 2016 it decided to act for OneCoin and Ruja Ignatova.

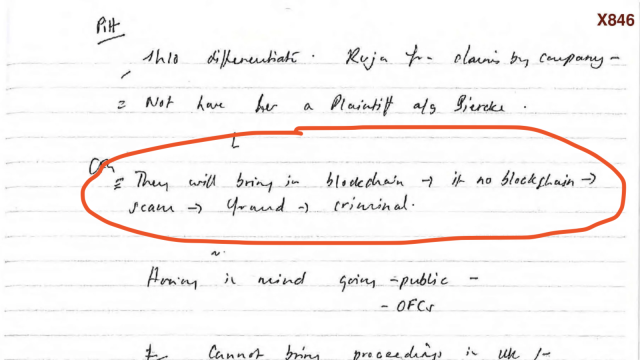

OneCoin1 claimed to be a cryptocurrency like Bitcoin. It wasn’t. There was no “blockchain” – OneCoin just made up prices, took investors’ money, and paid some out to other investors and kept the rest for themselves. It was a Ponzi fraud.

Carter-Ruck should have known OneCoin was a fraud. The signs were obvious at the time. One look at OneCoin’s own publications showed price changes that were impossible for a real traded cryptocurrency:

But Carter-Ruck either didn’t conduct proper due diligence, or didn’t care. They wrote aggressive letters to websites⚠️ and unrepresented individuals threatening them with libel proceedings for making points that were self-evidently true.

In January 2017, OneCoin suspended clients’ withdrawals of money⚠️, but continued to accept new funds. Semper Fortis, an obscure firm which had “audited” OneCoin in 2015 didn’t publish an audit for 2016 or 2017. As at April 2017 its website consisted of one page saying “under construction”.

None of that bothered Carter-Ruck. In July 2017, they then wrote to the Financial Conduct Authority, pushing the FCA to take down its warning notice on OneCoin (which said that the City of London police were investigating). The FCA blinked, and took it down.

This was all at a time when multiple countries had started to pursue criminal or enforcement proceedings against OneCoin:

`; // Long hover tooltip (same content as popup) + click popup m.bindTooltip(richHTML, { permanent: false, direction: ‘top’, offset: [0, -18], className: ‘tpa-tip’, opacity: 0.98, sticky: true, interactive: true }); m.bindPopup(richHTML, { maxWidth: 320 }); }); group.addTo(map); map.fitBounds(group.getBounds(), { padding: [24, 24] }); // Re-fit on resize (e.g., mobile rotation) let resizeTimer; window.addEventListener(‘resize’, () => { clearTimeout(resizeTimer); resizeTimer = setTimeout(() => map.fitBounds(group.getBounds(), { padding: [24, 24] }), 150); }); })();

OneCoin collapsed in 2017, and its executives are all now either in jail or on the run. Around $4bn was stolen from millions of investors, across 125 countries. Carter-Ruck’s client, Ruja Ignatova, is one of the FBI’s ten most wanted fugitives, with a $5m reward for information leading to her arrest.

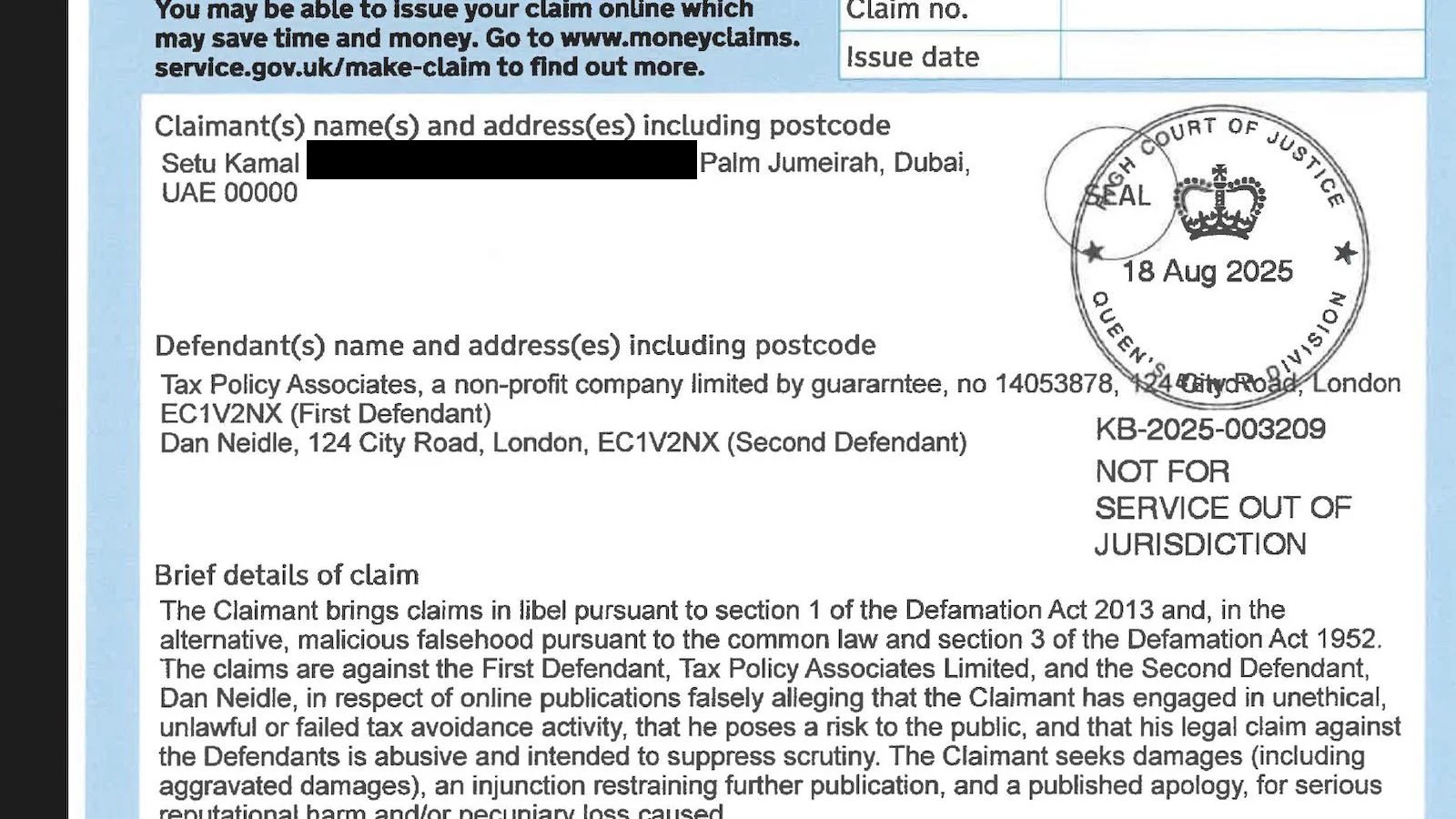

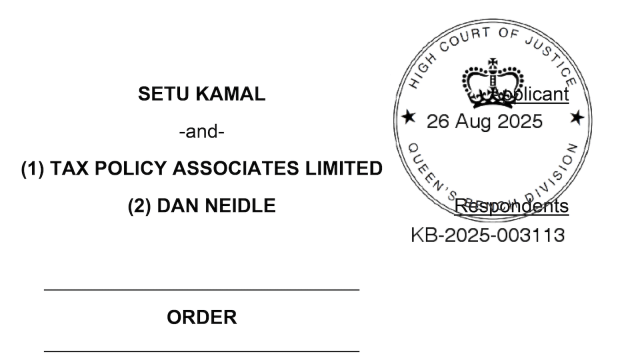

In 2023, The Bureau of Investigative Journalism published a report on Carter-Ruck, with a particular focus on its actions acting for OneCoin. We then compiled a detailed legal analysis of Carter-Ruck’s actions acting for OneCoin, looking at what they did, what they should have known at the time, and how they should have acted. We concluded that Carter-Ruck acted recklessly, should have known OneCoin was a fraud, and had breached the principles governing solicitors.2 We referred Carter-Ruck to the Solicitors Regulation Authority on that basis. On 6 August 2025, the SRA announced that they would be prosecuting the solicitor responsible, Claire Gill, before the Solicitors Disciplinary Tribunal (SDT).

Carter-Ruck might at some point have shown signs of contrition, apologising for what (at best) was a terrible mistake, and promising to take steps to avoid repeating it.

Instead Carter-Ruck tried to cover up their misdeeds.

Carter-Ruck’s anonymity application

Carter-Ruck applied to the SDT to anonymise the case, and requested private hearings. The supposed justification was to protect their clients’ legal privilege – a laughable claim, as legal privilege doesn’t apply where a lawyer is engaged to further a fraud. We expect the real reason was to protect Carter-Ruck’s reputation from being linked to OneCoin and their fugitive ex-client Ruja Ignatova.

In other circumstances, Carter-Ruck might have achieved this without anyone finding out. However we were notified of the upcoming prosecution, because we’d made the original complaint. Representatives of the media were therefore present at the hearing, and were given an opportunity to respond to the anonymity application. There’s a detailed report of the hearing from investigative court reporter Daniel Cloake.

Tax Policy Associates, together with the Bureau of Investigative Journalism, The Foreign Policy Centre, The Free Speech Union, and Spotlight on Corruption, then applied to the SDT for the exact opposite of what Carter-Ruck were asking for.

We sought complete disclosure of everything: the prosecution documents, Carter-Ruck’s defence, and all the supporting documentation.

We believe the public has a right to know how Carter-Ruck ended up helping fraudsters, and had a right to see how they answer that charge. Usually much of that documentation would be legally privileged; in this case we believed none of it would.

We therefore made an application in line with privilege caselaw and the SDT’s disclosure policy.

The Carter-Ruck documents

Here’s Carter-Ruck’s application for the anonymity order:

Here’s our application:

The SDT granted our application, ruling that – on the balance of probabilities – Carter-Ruck was instructed to further a fraud and so legal privilege did not apply. The SDT ordered all materials to be published, with redactions to protect personal information.

The Carter-Ruck/OneCoin SDT materials should be published next week. Carter-Ruck has withdrawn its anonymity application.

Here’s the SDT decision:

Carter-Ruck – zero contrition

Most lawyers would be appalled at the thought that they hadn’t just acted for fraudsters, but had actually helped further the fraud. Carter-Ruck, however, aren’t showing even the slightest sign of contrition.

The filings above reveal that Carter-Ruck are pursuing an aggressive defence which involves trying to obtain internal SRA papers.

![By this application, the Respondent seeks disclosure of the content of the initial recommendation of Dr Sam Jones, the Senior Investigation Officer who was assigned the Respondent’s case and who produced the notice referring the Respondent to the Tribunal. Dr Jones had previously indicated to the Respondent and her firm, by an email dated 12 July 2023, that she had made a recommendation on the outcome of the investigation, and intended to provide an update the following month “to bring this matter to a conclusion” [X1037]. An apparent intervention by senior management prevented the notification of any decision by Dr Jones until 8 February 2024, when she served a very wide-ranging notice of referral [X4-X32], most of the allegations in which have since been abandoned by the Applicant.

5.

The Respondent has inferred that Dr Jones’ original recommendation was to close the investigation and has asked the Applicant to disclose it. The Applicant has refused disclosure and otherwise refused to confirm or deny the inference drawn by the Respondent. Accordingly, the Respondent seeks an order for disclosure.](https://taxpolicy.org.uk/wp-content/uploads/2025/09/Untitled-1.jpg)

This looks like a collateral attack on the SRA – and it seems entirely irrelevant to the question of whether Carter-Ruck acted improperly.

Carter-Ruck and Harlequin

OneCoin wasn’t the first time Carter-Ruck had acted for fraudsters, and sent out libel threats that covered up an international Ponzi scheme.

In the early 2010s, a company called Harlequin sold “below market” plots in the Caribbean to thousands of investors, with the help of endorsements from former sportsmen including Pat Cash and John Barnes.

In 2011, accusations emerged on the “Singing Pig” internet property forum that Harlequin was a Ponzi fraud. Carter-Ruck brought a defamation action and the forum was shut down.

But Harlequin was, in fact, a fraudulent Ponzi scheme. The company had sold far more development plots than it had land to build on, and investors’ 30% deposits were used to pay huge commissions to salesmen, or diverted to the Ames family, who owned the business. The company couldn’t explain where the deposits had gone, and investors ended up losing £398m.

Out of the 9,000 plots sold, only 28 people received a property.

Much of the £400m losses were covered by the Financial Services Compensation Scheme, because many of investors had been persuaded to use SIPPs to invest in the scheme.

The man behind Harlequin, David Ames, was described by the High Court as a “Walter Mitty-type figure who, through an unhappy mixture of dishonesty, naivety and incompetence, has caused irreparable loss to thousands of people”.

In 2022 he was jailed for 12 years for fraud⚠️.

APJ Solicitors have written an excellent summary of Harlequin’s history. There’s also a great write-up from Citywire🔒.

Carter-Ruck missed at least one obvious warning sign. Harlequin was run by David Ames – but as a bankrupt he was banned from being a director. So supposedly his wife and son were the directors, with David Ames pulling the strings as the Chairman. Any lawyer should have seen that as a red flag: Ames was acting as a shadow director and breaking the law.

But Carter-Ruck missed that, just as they missed all the OneCoin warning signs. And just as with OneCoin, Carter-Ruck have never shown any contrition.

Until we published this article, the Carter-Ruck website still boasted about their success with Harlequin, back in 2011, successfully taking down a website that tried to tell the world that their client was a fraudster.3

What happens next?

It is hard to believe that Carter-Ruck knew it was acting for fraudsters.

But a competent firm in Carter-Ruck’s position should have known OneCoin was a fraud. Even acting for OneCoin was a serious professional breach; trying to silence OneCoin’s critics was even more serious than that.

We don’t know enough about Carter-Ruck’s actions acting for Harlequin to say what it knew, or should have known. We hope to publish more on this soon.

We won’t know the conclusion until the substantive SDT hearing in mid-June 2026 . For the moment, we have to hope that Carter-Ruck’s experience before the SDT makes it think more carefully before acting for people credibly accused of fraud.

Many thanks to the Bureau of Investigative Journalism, The Foreign Policy Centre, The Free Speech Union, and Spotlight on Corruption.

Thanks also to The Guardian and Reuters, who were instructing lawyers to challenge Carter-Ruck’s application for the anonymity order (before it was withdrawn).

And thanks to Daniel Cloake for his reporting of the hearing.

Footnotes

The BBC article, podcast and Jamie Bartlett’s book are probably the best sources for the history of OneCoin. The Wikipedia article isn’t very good – it looks like a very old article that’s been occasionally updated. It badly misreads its sources, for example claiming that BBC reporters believe Ruja Ignatova is living in Frankfurt. ↩︎

It’s important to differentiate two scenarios: a solicitor defending someone accused of fraud, and a solicitor assisting a fraud. The first is not just permitted, but essential for the justice system to function (although of course a solicitor must still act within the boundaries of his or her obligations to the rule of law and the court, and for example not mislead a court). The second is not permitted. A libel lawyer instructed to act for a client against accusations of fraud isn’t required to carry out an extensive investigation as to whether the accusations are true. But if the accusations are likely true on their face then it is in our view impermissible for the lawyer to threaten libel threats against people making the accusations. ↩︎

We link to an archived version of the page; the link went dead at some point after 18 September 2025. ↩︎

Leave a Reply