Every Monday morning, we publish an updated list of every PLC in the UK that has failed to file its accounts on time.

Sometimes a company is on the list because of a Companies House delay/error. More often, it’s because the company is troubled, bust, or incompetent. And occasionally it reveals an active fraud.

Despite the real progress made by Companies House, the UK company register remains stuffed full of fraudulent companies.

Here’s a quick example showing how easy it is to find them.

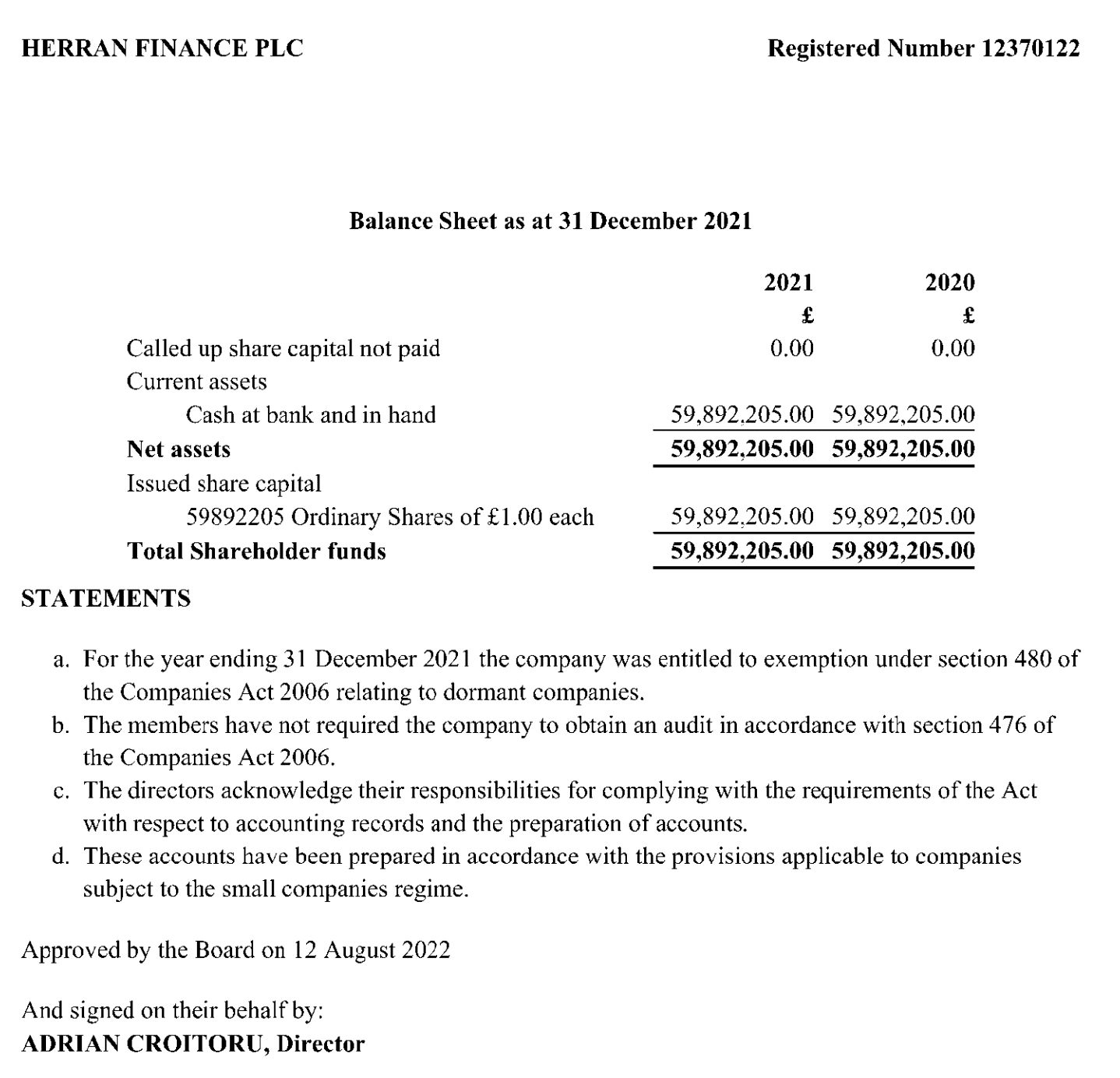

Herran Finance’s fake accounts

Clicking through the list, there’s an interesting sounding company: Herran Finance PLC.

One look at its accounts tells us it’s a fraud:

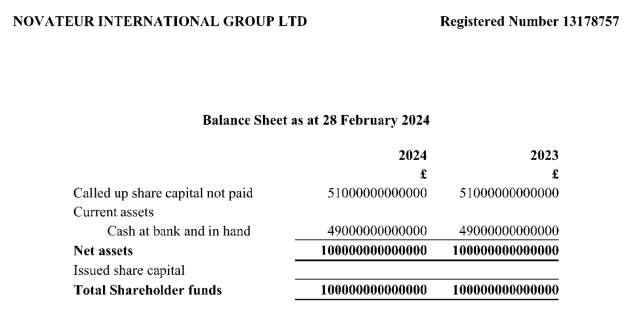

We are supposed to believe that the company had £59,892,205 cash in 2020 and exactly the same in 2021. It made no interest or other return, and had no expenses of any kind, so filed as dormant. This is impossible. The accounts are faked.

Knowingly filing false documents with Companies House is a criminal offence.

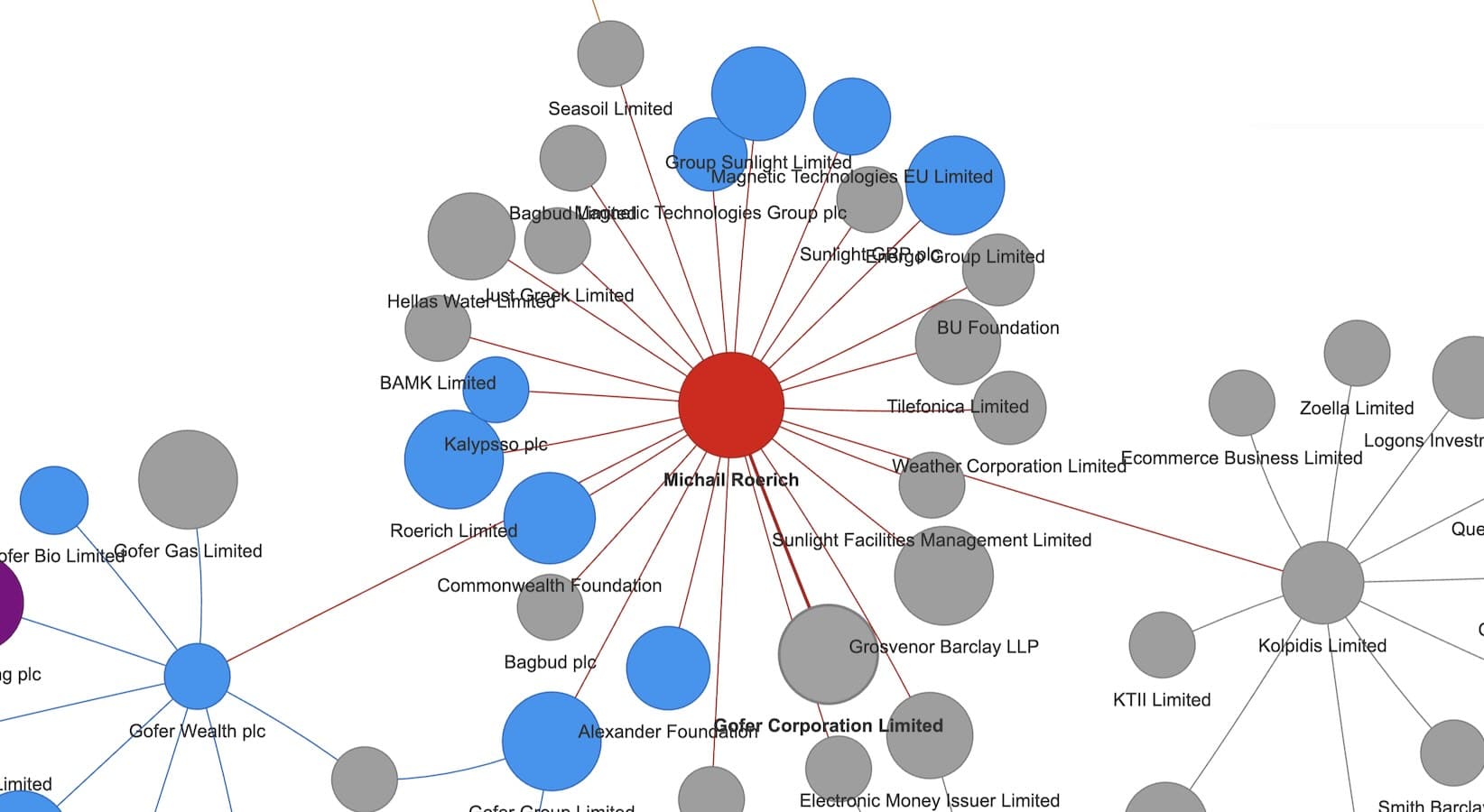

The names listed as directors and shareholders of Herran Finance could be the actual fraudsters, but more likely they are fake names, or names of real people whose identities were stolen.1 One of those names, Adrian Croitoru, is listed as director of five other active companies which all also look fraudulent.

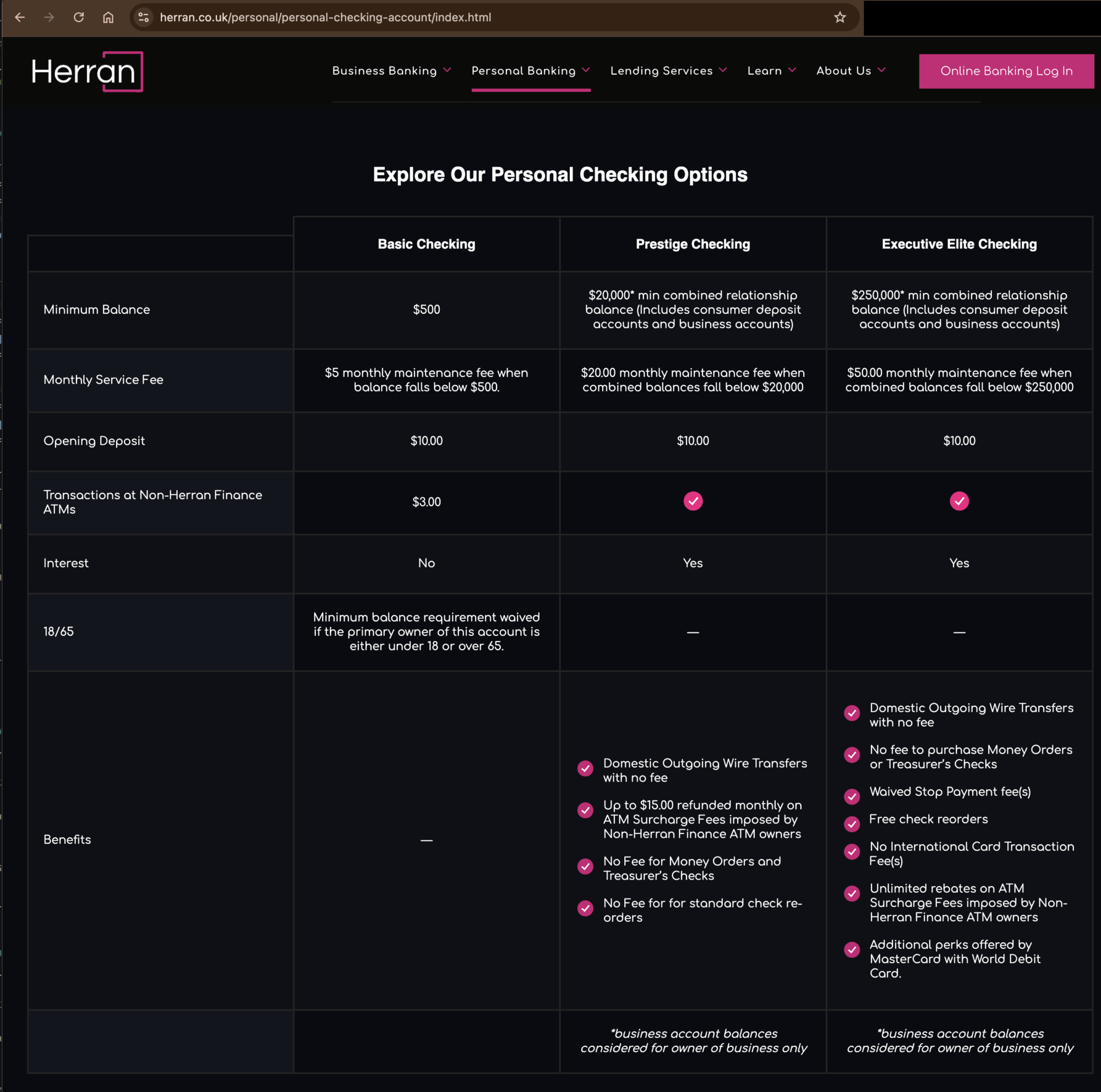

Herran Finance’s fake website

Herran Finance has a superficially plausible website at https://herran.co.uk/:

There are no contact details, no privacy policy, no name of the legal entity, and none of the details one expects on a genuine bank website. Half the links are dead, returning straight back to the homepage. (Please be cautious; we recommend against visiting the website unless you are very confident in your browser security setup.)

The website says Herran Finance is regulated and deposits are fully protected by the FDIC, the US deposit protection scheme. But there’s no Herran Finance authorised by the FCA in the UK or covered by the FDIC.

And why does a bank incorporated in the UK, and with a .co.uk domain, provide US dollar accounts and say it’s regulated in the US?

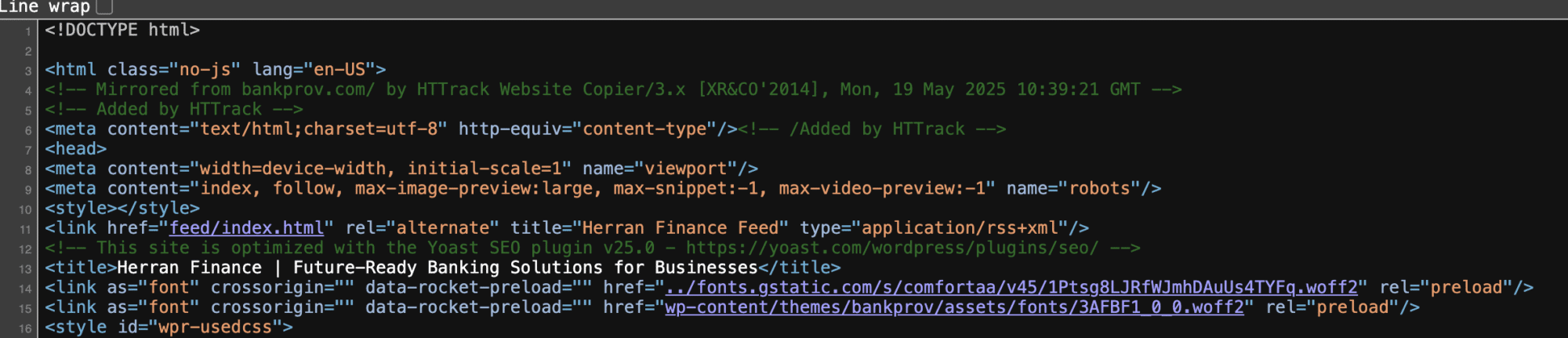

Because the website is a clone of the (real and legitimate) US bank BankProv. The sites look almost identical, and the HTML for Herran Finance shows that they just copied BankProv’s website using the HTTrack tool:

What’s the scam? It could be anything: phishing, money laundering, investor fraud, advance fee fraud, or even immigration fraud2. The company was incorporated back in 2019, but the domain was acquired in May 2025 – so the scam (whatever it is) may be ongoing.

The policy failure

It’s absurdly easy to incorporate a company with an enormous fake share capital and then file dormant accounts – but it shouldn’t be. And large numbers of such companies remain registered.

Companies House should be using its new powers to stop this. It could create a simple automated filter for companies filing dormant accounts with an unchanging large cash balance in its accounts – there’s really no explanation for this other than fraud. The most recent accounts could then be automatically withdrawn, penalties automatically issued for the failure to file correct accounts, and an automated letter sent requiring evidence of the supposedly fully-paid share capital. If the penalties aren’t paid, or the evidence isn’t provided, the company can then be struck off.

A more ambitious approach would be for Companies House to automatically flag and then manually review all incorporations and capital-raisings where shares are being issued for (say) over £10m (ignoring listed companies). These are a vanishingly small percentage of the total number of companies and filings.

Measures of this kind would help stop fraudsters using Companies House to give fake companies financial credibility.

Footnotes

One director, Adrian Croitoru, gives a correspondence address which is a residential property in St. Neots, Cambridgeshire. His name is not on the deeds of that house; very possibly the fraudsters are using an innocent person’s details. ↩︎

i.e. obtaining a work visa on the strength of employment with a company that doesn’t exist. ↩︎

Leave a Reply