Updated to correct my claim that there are few if any prosecutions for failure to file. There are in fact several thousand in most years. That amazed me. So there isn’t a non-prosecution scandal. There’s a scandal of hundreds of thousands of late filings, and serious policy question as to how to fix this.

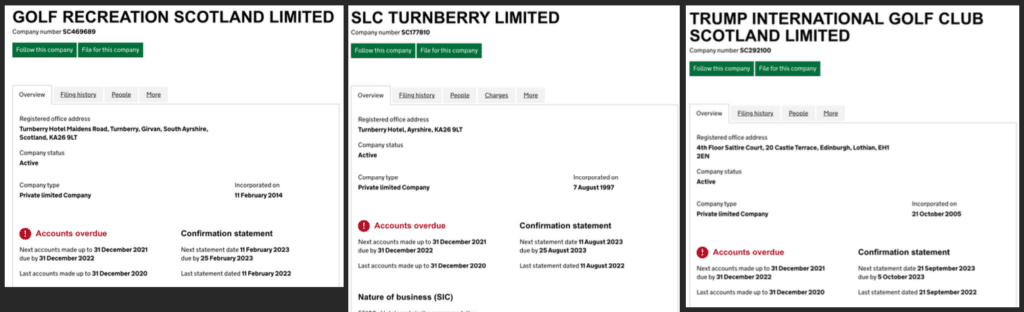

Donald Trump’s Scottish hotel and golf businesses have failed to file their accounts for 2021:

What does this mean?

There’s an automatic late filing penalty of £150. Not much, but more than Trump paid in US Federal income tax in 2020.1

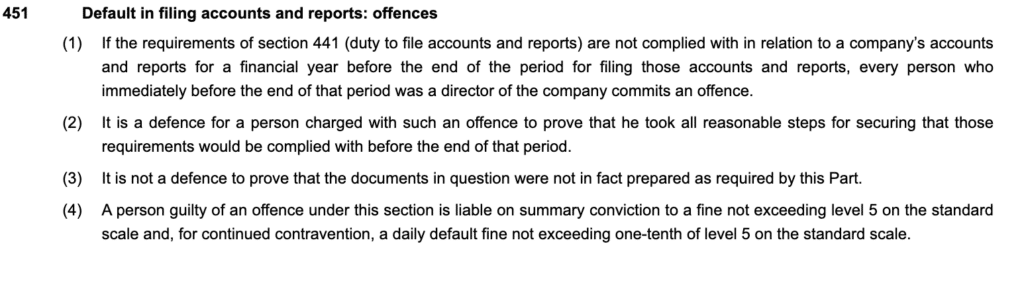

More interestingly, if a company fails to file accounts on time, it’s a criminal offence for the directors, with a potentially unlimited⚠️ fine:

In this case there’s just one director, Eric Trump. Donald Trump stood down as director after he was inaugurated – although if (as must be possible) he is still directing things behind the scenes, then he will be a “shadow director” and also potentially criminally liable.

There’s a defence if the directors can show they “took all reasonable steps” to file. The most common reason – and the one I’m betting is the case here – is simple disorganisation/ineptitude. That will not qualify for the defence. What would? Most often some kind of difficulty getting the auditors to sign off on the accounts. Perhaps because a difficult technical problem has arisen (unlikely with such a relatively simple business as this one). Perhaps – more interestingly – because there is a question whether the business remains a going concern.

It’s pretty common for small companies to miss filing deadlines. Much less common for large businesses – and when I worked on big ticket corporate M&A and financings, these kind of failings were a “tell” that there were financial or governance problems.

We’ve no way of knowing what the reason is for the Trump companies’ delinquency. The tax writer Rebecca Benneyworth spotted that it looks like the Trumps had already extended the filing deadline from 30 September to 31 December. That was probably an automatic three-month Covid extension – but that’s usually a one-off, and wouldn’t explain the late filing now. That could be down to disorganisation or chaos just as much as it could be evidence of a real problem. Chaos seems the safe bet.

Update: thanks to The National for spotting that the Trumps filed their past accounts by post, not online. So it’s possible they posted the 2021 accounts right at the end of the year, but before the deadline, and Companies House just hasn’t gotten round to them yet. And also possible that the postal strikes delayed a filing that was actually posted before the deadline. I’ll withdraw/update this post if either turns out to be the case Further update – initial indications are that this is not the reason. More to follow.

There is one thing we can know for certain. The Trumps won’t be prosecuted. Over 200,000 companies file late, and pay the £150 penalty. I gather in some circles late filing is considered normal, or even tactically advantageous.

Yesterday I wrote this: “But it is almost2 unheard of for a director to be prosecuted. Of course it is more accurate to say: over 200,000 companies file late because it is almost unheard of for a director to be prosecuted.”

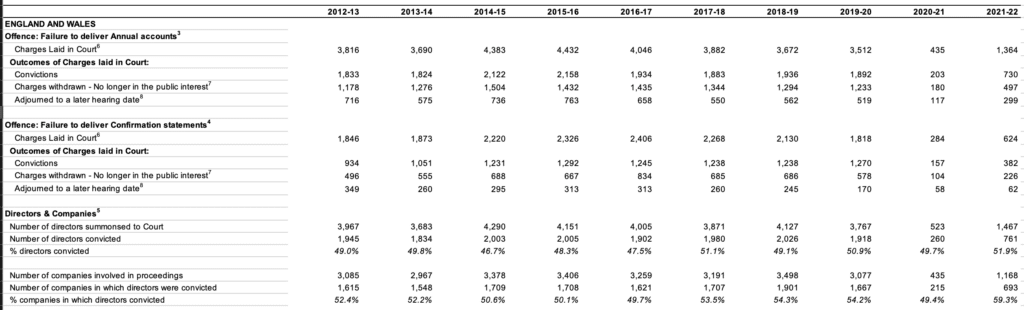

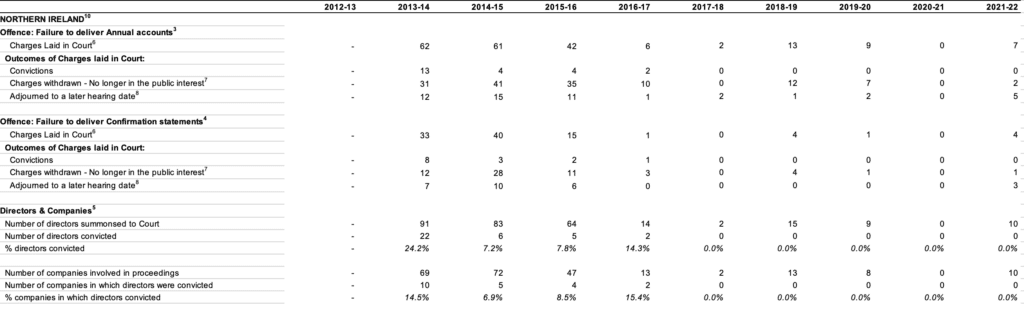

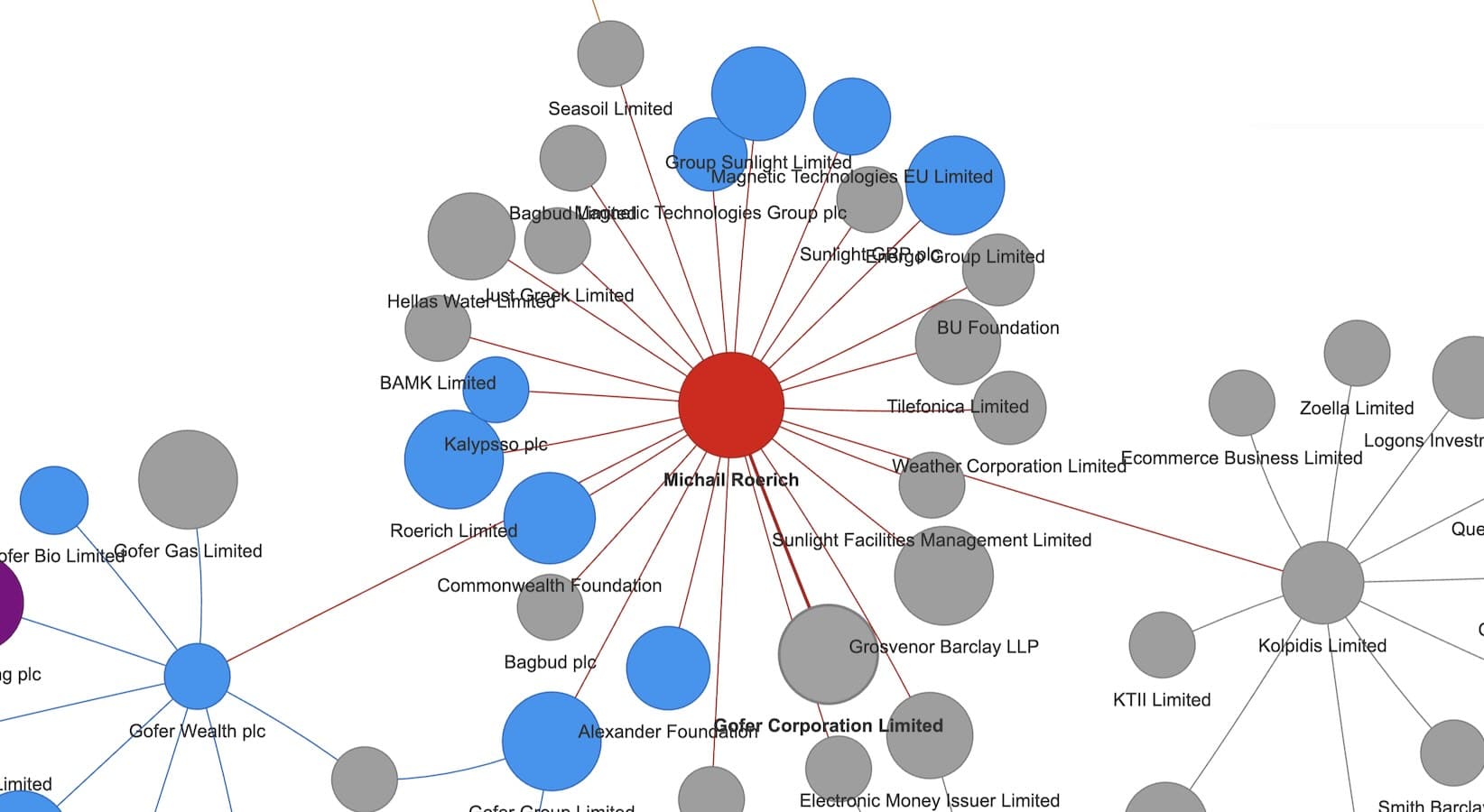

But a lawyer (an old contact of mine) with considerable experience in this area has made clear that I am completely wrong. There are in fact a large number of prosecutions. Companies House publishes the full statistics, but they are hard to find – see Table 6 here. The upshot is that there are several thousand prosecutions in a normal, non-Covid year:

On the surface, it looks like about a 50% conviction rate, but that’s not right – about half the charges are withdrawn… and I understand from my contact, that’s because the accounts have been filed. Account for that and adjournments, and (unless I’m mistaken) the conviction rate looks close to 100%.

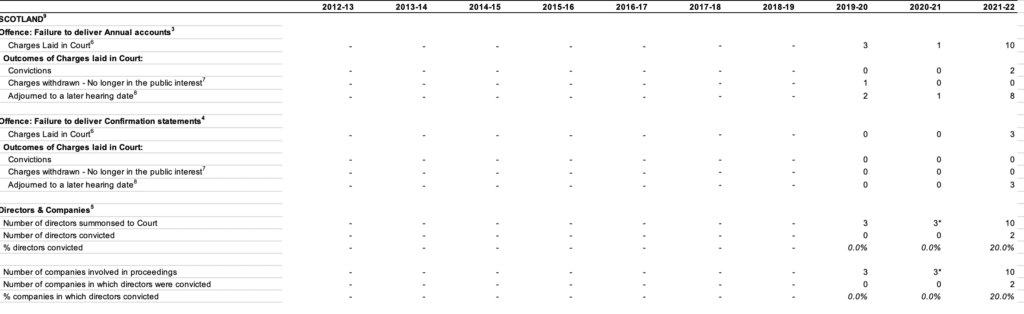

Much less going on in Scotland:

I don’t understand why this is. There are about 20x fewer Scottish companies than in England & Wales (see tab 9 of the linked spreadsheet), but about 100x fewer prosecutions. Northern Ireland has about 1/3 of the number of companies as Scotland, but around the same number of prosecutions.

So my conclusion that the Trumps are likely safe is surely correct, but my reasoning was completely wrong – and I apologise for having unfairly denigrated what looks like a busy and effective Companies House prosecution service (at least in England & Wales).

The mystery

I said there was a scandal of non-enforcement, and it looks like I was dead wrong. Instead we have a mystery – why do so many companies file late when in fact there is a non-zero prospect of prosecution?

- Are the prosecutions not well known? (Possible, given I spoke to six experienced lawyers and only one was aware of them).

- Is it a mistake to drop prosecutions if the directors belatedly file the accounts? The prosecutions are said to be dropped because they are “no longer in the public interest”. That is debatable. I would say the public interest is not just in making a particular director file their own accounts, but in deterring late filed accounts across the board. In essence, the prosecution policy has changed the offence from “failing to file by the due date” into “failing to file”. That does not seem right to me.

- Do these two factors combine so that, rationally, a director can happily file late and accept the low risk of a prosecution, knowing that the prosecution will almost certainly be discontinued once they do file?

I’m not sure what the reason is. But I am sure there’s a problem – because late filing prejudices people dealing with the companies (who often rely on filed accounts to judge creditworthiness) and facilitates financial crime.

Here’s a suggestion for a policy response:

- Does Companies House do enough to make people aware of prosecutions for failure to file accounts? (given my error on this, I would of course say “no”…)

- Investigate late filing in more detail – who is filing late, how late are they filing, and what the reasons are

- Analysis of prosecutions. Who is being prosecuted? Is it really in the public interest that prosecutions are dropped when accounts are belatedly filed?

- Is it correct that Northern Ireland and (particularly) Scotland prosecute fewer offences? If so, why?

- Does the automatic £150 penalty need to be increased for larger companies? It’s tempting to make it a percentage of turnover, but that could easily become disproportionate. 0.1% of turnover for the Trump companies would be a not-so-large £7,000, but for Sainsbury’s (a silly example to make the point) would be a ridiculous £38m

- It’s ridiculous that so many companies still file on paper. That includes giants like HSBC and Tesco. The reason is that (as a number of people have now told me) Companies House’s online submission service only works for very simple cases.3 That’s inconvenient for those companies; it also means that Companies House records are much more difficult to analyse electronically (which is inconvenient for the rest of us).

It would be quite wrong for a small company missing the filing deadline by a day to face prosecution. And it would be equally wrong to selectively prosecute Trump, particularly given that Scotland appears to prosecute basically nobody.

But I remain of the view there is a problem – I’m just much less certain about the solution than I was yesterday.

Photo by Max Goldberg, licensed under the Creative Commons Attribution-Share Alike 4.0 International license

Footnotes

The ultimate sanction⚠️ is for a company to be struck off. If the failure to file continues, then Companies House will send a written warning; then another warning; then they’ll begin the process of striking the company off. ↩︎

I am saying “almost” because it’s possible there have been some prosecutions, but I’m not personally aware of any ↩︎

I should have known this. In my defence, I’ve only ever personally filed for very simple companies… but I should not have extrapolated that to other companies without checking. My bad. ↩︎

Leave a Reply