The independent tax and legal policy think tank

We investigate the real-world impact of the UK tax and legal system, expose avoidance and abuse, and propose practical reforms.

Douglas Barrowman and Michelle Mone may have avoided tax on their £65m PPE profits

During the pandemic, Douglas Barrowman’s company, PPE Medpro, sold £200 million of PPE to the Government. It made £65m profit, which went into trusts benefiting Barrowman and Mone’s families. Most of the PPE was later ruled to breach sterility standards but, rather than repay the money, Barrowman put PPE Medpro into administration. New documents show […]

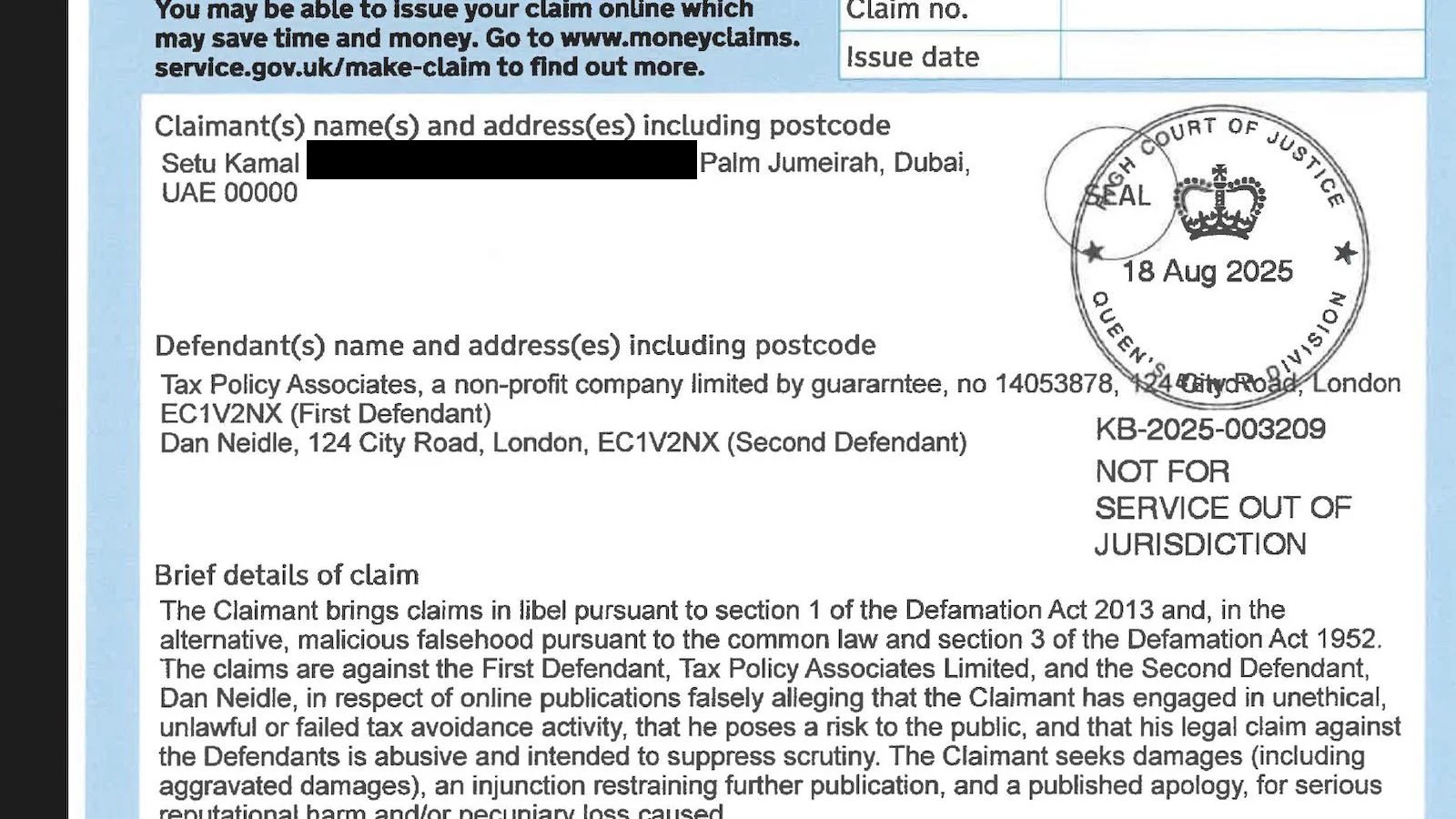

I’m being sued for £8m for a report on tax avoidance

I am being personally sued for more than £8m by a barrister, Setu Kamal. I believe this is one of the largest English libel claims ever made. Mr Kamal objects to a report we published back in February about a firm called Arka Wealth (which appears to have since gone out of business). In September […]

Council tax on ‘expensive homes’ – but most of the money comes from the not-so-rich

The FT has reported that Rachel Reeves is planning a “Budget tax raid on the owners of expensive homes”, expected to raise around £4bn. But less than a 20% of that revenue comes from homes in the top council tax band, while roughly 80% comes from the much larger group of homes in the second-highest […]

Latest reports

Douglas Barrowman and Michelle Mone may have avoided tax on their £65m PPE profits

During the pandemic, Douglas Barrowman’s company, PPE Medpro, sold £200 million of PPE to the Government. It made £65m profit, which went into trusts benefiting Barrowman and Mone’s families. Most of the PPE was later ruled to breach sterility standards but, rather than repay the money, Barrowman put PPE Medpro into administration. New documents show […]

Council tax on ‘expensive homes’ – but most of the money comes from the not-so-rich

The FT has reported that Rachel Reeves is planning a “Budget tax raid on the owners of expensive homes”, expected to raise around £4bn. But less than a 20% of that revenue comes from homes in the top council tax band, while roughly 80% comes from the much larger group of homes in the second-highest […]

I’m being sued for £8m for a report on tax avoidance

I am being personally sued for more than £8m by a barrister, Setu Kamal. I believe this is one of the largest English libel claims ever made. Mr Kamal objects to a report we published back in February about a firm called Arka Wealth (which appears to have since gone out of business). In September […]

The £2bn lawyer tax – should Rachel Reeves tax LLPs?

Doctors, lawyers, accountants, fund managers, and other high earning professionals are often members of partnerships and LLPs. They’re not employees – and so there’s no 15% employer national insurance. This creates a big tax saving. The Times is reporting that Rachel Reeves is considering changing this – and that it could raise £2bn. UPDATE evening […]

Criminalising tax avoidance – I’ve changed my mind

We’ve investigated many tax avoidance schemes. None of them had any technical merit – indeed many were closer to tax evasion than tax avoidance. All of the schemes, without exception, should have been disclosed to HMRC under DOTAS – the rules requiring up-front disclosure of tax avoidance schemes. None of them were. The whole point […]

Carter-Ruck enabled the $4bn OneCoin fraud. Was it a crime?

Carter-Ruck, Britain’s most famous libel firm, threatened whistleblowers, journalists, regulators and even the police on behalf of OneCoin, a $4 billion crypto-fraud. The firm played a key role in helping the fraud to continue. Did Carter-Ruck cross the line, and commit a criminal offence? OneCoin’s founder is now on the FBI’s Ten Most Wanted list; […]

Could we have stopped Revolut’s founder from leaving the UK?

Nik Storonsky, the billionaire founder of Revolut, has reportedly left the UK and become tax resident in Dubai – a move that could save him more than £3 billion in UK capital gains tax. His departure raises a larger question for the UK tax system: could we have stopped him leaving? Either with the carrot […]

The problem with unregulated tax advisers: a scheme from Property118 that could cost clients £100k+

Most of the HMRC losses from tax avoidance aren’t from multinationals or billionaires – they’re from small businesses, who’ve often been sold disastrous schemes by unregulated advisers. It’s a mis-selling problem as much as a tax problem. This report presents one example – but the internet is full of many, many others. The media focus […]

PPE Medpro made £200m but never filed full accounts. The law should change.

PPE Medpro is the company which provided £200m of PPE to the Government in dubious circumstances, of which £122m was faulty. Reports suggest it made £65m profit – but we can’t know for sure. Its finances are a mystery, because it was allowed to file only abridged accounts. Why? Because under UK law, PPE Medpro […]

Popular now

Council tax on ‘expensive homes’ – but most of the money comes from the not-so-rich

The FT has reported that Rachel Reeves is planning a “Budget tax raid on the owners of expensive homes”, expected to raise around £4bn. But less than a 20% of that revenue comes from homes in the top council tax band, while roughly 80% comes from the much larger group of homes in the second-highest […]

Why the Left struggles with tax policy

There’s a problem with a lot of Left-wing tax advocacy: it identifies a political challenge, and proposes a policy aimed at solving it. But the authors believe so strongly in the policy’s righteousness that all of their time and focus is spent on advocacy, and none on analysis.

Douglas Barrowman and Michelle Mone may have avoided tax on their £65m PPE profits

During the pandemic, Douglas Barrowman’s company, PPE Medpro, sold £200 million of PPE to the Government. It made £65m profit, which went into trusts benefiting Barrowman and Mone’s families. Most of the PPE was later ruled to breach sterility standards but, rather than repay the money, Barrowman put PPE Medpro into administration. New documents show […]

For journalists

Find our bios, logos, and the right contact for press enquiries.

About Tax Policy Associates

What we do, who we are, how we are funded – and how to join us.

Stay informed

Get new reports by email

Free to sign up. No spam or advertising. Cancel anytime.